ETF nerds love January, because the Inside ETFs conference brings all the issues in the ETF industry front and center. This year the talk on the big stage was all about “smart beta,” active management, and ESG (Environmental, Social, Governance focus). But talk is not the same as action.

ETF fund flows action for January 2017 showed that only one of the hotly discussed areas is actually hot. Actively managed ETFs had a spectacular month, while “smart beta” and ESG lagged. Meanwhile, the little-discussed vanilla funds continued to gather assets and increased their dominance within the ETF landscape.

The table below shows January 2017 fund flows by investment strategy and compares flows to starting weights for each strategy. A ratio greater than one indicates increasing market share; below one indicates decreasing market share.

| strategy group |

net flows |

net aum as a % of

all U.s. Domiciled Etfs 12/31/16

|

Flows Starting Aum Ratio |

| Active |

2.3% |

1.2% |

2.0 |

| Vanilla |

82.0% |

71.9% |

1.1 |

| Strategic |

14.5% |

22.1% |

0.7 |

| Idiosyncratic |

1.2% |

4.8% |

0.2 |

Active on the Move

January 2017 was great for active management in the ETF space. Inflows to active ETFs reached almost $1 billion: $994,118,875, to be exact. Active fixed income continues to dominate, while active equity and commodity funds also saw inflows. But the gains were concentrated in a few segments – not widely dispersed. Actively managed currency and multi-asset ETFs saw outflows.

Bank loans and Master Limited Partnerships (MLP) accounted for over 50% of the flows to actively managed ETFs. Active flows to MLP funds account for 23% of all MLP flows—a clear gain in a segment where passive management has a strong presence. Bank loans are different, because passive investing is more advanced in the U.S. market than it is globally. In fact, there are no index-tracking global bank loan ETFs. There could be—S&P does publish a global leveraged loan index—but no issuer has launched a global index-tracking leveraged loan ETF. Right now, investors who want to access global bank loans via ETFs must choose active management.

The same is true of the money-market-like ETFs. Index-tracking in the commercial paper market is hardly simple. All cash-substitute ETFs are actively managed. Together with the global bank loans, these non-indexed segments account for half of the flows to actively managed ETFs. Back these out, and what remains is utterly ordinary growth for actively managed ETFs.

It gets worse. On February 1, Alpha Architect, the issuer behind four actively managed value and momentum funds switched away from active management to index-tracking, taking advantage of dual exemptive relief. That’s effectively $162 million of outflows to active strategies to kick off February.

Yum Yum Vanilla

Once again, ETFs that track broad-based, cap-weighted indexes are pulling in assets and increasing their market share. Pity the poor blogger who has to fluff up the story with the headline that reads “boring is hot!” Vanilla funds, representing 72% of total ETF assets at the end of 2016, pulled in 82% of the January flows.

The list of ETFs ranked by inflows has 18 of the top 20 slots filled with cheap, simple ETFs. For the 125 U.S.-domiciled ETFs that saw inflows of $100 million or more in January, the asset-weighted expense ratio came to just 17 basis points. That’s pretty darn cheap. And all these funds track indexes that aim to fully represent their opportunity set. Simple.

Where it gets more complicated is the actual exposures. In contrast to 2016’s focus on funds like SPY-US, 2017 opened with inflows to everything but U.S. large cap equities. U.S. large caps pulled in just one-fifth of the flows that would be expected based on market share alone. The fastest growers among funds that gathered $500 million or more were bonds, led by U.S. Treasuries. Indeed, vanilla bond funds were responsible for all the growth of vanilla market share, pulling in 1.86 times as many dollars as their starting AUMs would suggest.

Not So Hot

With actively managed and vanilla ETFs gaining market share, who lost it? Mostly the oddball idiosyncratic funds, but also the so-called “smart beta” ETFs.

Idiosyncratic funds—ETFs tracking indexes that refer to non-economic principles such as listing on a specific exchange, social responsibility, or equal share weighting—have been losing favor for some time. Last year was rough on most of these, save for ESG funds. And 2017 started out the same way, with one big exception: Dow 20,000 drew lots of assets into price-weighted SPDR Dow Jones Industrial Average ETF Trust (DIA-US).

Exchange-specific funds lost $ 1.02 billion in outflows in January, nearly all of it from PowerShares QQQ Trust (QQQ-US). That’s nothing new, QQQ has been steadily losing assets for years. Indeed QQQ’s losses would have thrown the entire set of idiosyncratic funds into the outflows column, were it not for inflows to DIA.

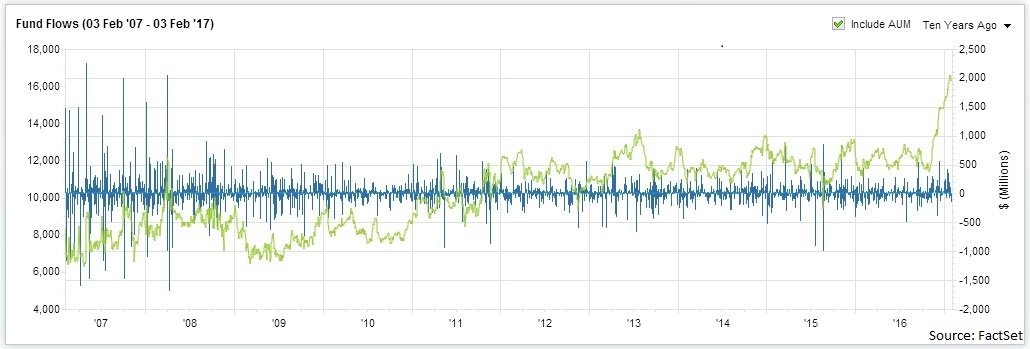

DIA tracks the venerable, but oddly built, Dow Jones Industrial Average, which tracks a single share each of 30 US mega-caps. With the run-up to 20,000, DIA’s share count ran up to levels last seen with any consistency in the summer of 2013. The effect of the cumulative run-up in share count since Election Day shows up in the green AUM line in DIA’s fund flows chart:

Values-Based Investing in Trump’s First Month

Inside ETFs gave plenty of airtime to the industry’s progress in measuring environmental, social, and governance behavior within corporations, and was abuzz with talk of all the new ESG ETF launches. But January didn’t bring much action to these funds, just $13.2 million, or 1/3 of what their December 2016 market share would suggest.

The largest, oldest ESG funds lost assets in January. The gains came in the newer, thematic funds such as iShares MSCI ACWI Low Carbon Target ETF (CRBN-US) and Global X S&P 500 Catholic Values (CATH-US), which each brought in $9 million or more.

“Smarting” Beta

The other industry favorite, strategic or “smart” beta, fared somewhat better, but still lost market share, as strategic funds took in only two-thirds of the dollars that their year-end asset levels would have suggested.

Smart beta strategies that started 2017 with significant market share fared poorly in January, at least in comparison to vanilla and active ETFs. Strategies that had outflows, or anemic inflows, represented 12.3% of starting market share, while strong inflows went to only 9.8% of starting market share.

Here’s how it looks for all strategies with flows over $100 million:

| sTRATEGY |

TOTAL FLOWS ($ mILLIONS) |

% OF jANUARY fLOWS |

% OF sTARTING aum |

flOWS TO eND OF '16 aum |

| Value |

4,185 |

9.9 % |

5.5 % |

1.8 |

| Multi-Factor |

1,597 |

3.8% |

2.1% |

1.8 |

| Fundamental |

1,299 |

3.1% |

2.0% |

1.6 |

| Dividends |

822 |

1.9% |

4.9% |

0.4 |

| High Beta |

214 |

0.5% |

0.0% |

16.8 |

| Technical |

187 |

0.4% |

0.0% |

23.8 |

| Currency Hedged Fundamental |

107 |

0.3% |

0.2% |

-1.4 |

| Momentum |

-121 |

-0.3% |

0.2% |

-1.4 |

| Optimized Commodity |

-129 |

-0.3% |

0.2% |

-1.1 |

| Low Volatility |

-648 |

-1.5% |

1.3% |

-1.1 |

| Growth |

-1,508 |

-3.6% |

4.9% |

-0.7 |

The obvious standouts are the risk-on plays: high beta and technical. Winner funds included PowerShares S&P 500 High Beta Portfolio (SPHB-US), which attracted over $211 million in January, granted $211 million is not a huge monthly inflow. Indeed, 70 U.S.-domiciled ETFs brought in more than that during January. But $211 million was a huge dollar amount for the fledgling high beta strategy. All (both) high beta funds had only $768 million jointly at the close of 2016. High beta commanded little market share before, and after, January’s inflows.

The bigger deal here is the rotation out of growth and into value. A deeper look shows that the losses were confined to large cap growth. Value took in assets across all size buckets.

Also noteworthy was the continued bleeding of low volatility funds. Giants iShares Edge MSCI Min Vol USA ETF (USMV-US), PowerShares S&P 500 Low Volatility Portfolio (SPLV-US), iShares Edge MSCI Min Vol EAFE ETF (EFAV-US), and iShares Edge MSCI Min Vol Emerging Markets ETF (EEMV-US) lost over $867 million. Once again, targeted small and mid-cap low volatility funds went counter to trend, drawing in $175 million.

Where Next?

In all, 2017’s first month fund flows were largely in line with 2016’s, with vanilla funds edging out strategic and idiosyncratic ones. Active management continued to outpace, but often in areas where there is not yet a passive option.

Who knows? Maybe this spells opportunity for any issuer brave enough to launch a well-crafted passive option in the ETF segments with only active management. Believe it or not, there are 29 such segments, with $16.1 billion in combined assets.