As we close the six months starting 2016, a clear picture of a shifting competitive landscape has emerged in the US ETF market: low cost continues to dominate.

The Big Picture

Overall, June was one of the stronger months of the year for ETF asset growth, with some $17 billion in net new money flowing into ETFs, putting year-to-date net flows at almost $65 billion – hardly on track for best year ever, but a substantial continuation of the ETF growth trend we’ve been seeing for the past decade.

From a macro perspective, the big winner for the month of June was fixed income, which, with $5.7 billion in net new assets, has net $47.6 billion in new money in 2016. Specifically, assets continue to flood into plain-vanilla index funds like the iShares Barclays Aggregate, which has almost $7 billion in new money this year, $1.5 billion just in June. That love for vanilla shows up in every corner of the bond market, with cheap, simple exposure to corporates, TIPS, long bonds and even preferred stock continuing to have a great year. Even the emerging markets bond funds have had stellar flows, led by the iShares JP Morgan USD Emerging Markets fund (EMB), which pulled in $423 million last month, and over $2 billion so far this year.

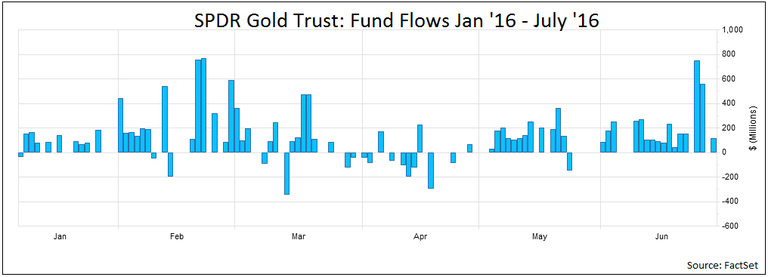

But the biggest story for both June and the year may be the resurgence of commodities. Once the darling of ETF investors, flows had been negative to flat for the past few years, but so far, commodities overall have pulled in almost $16 billion year to date, $14.6 billion of that just in gold funds, like segment leader SPDR Gold Trust, which has raked in over $12 billion year to date, and $3.3 billion in June.

June’s Risk On Trade

While year to date investors haven’t been hot on equities, with net outflows of $4 billion, June was a different story, with almost $5 billion flowing in. That new equity money hasn’t just gone to the steadiest product; it’s actually gone to corners of the market.

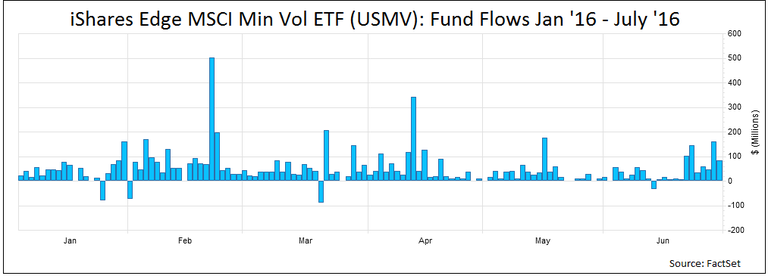

Developed Ex-US investing is back in vogue, pulling in over $11 billion year to date across the segment, led by the Vanguard FTSE Developed ETF (VEA) with almost $5 billion year to date, $1.5 just in June. Elsewhere, smart beta plays in the total US market segment continued to flourish, led by iShares Edge MSCI Min Vol ETF, USMV with over $6 billion year to date, and $780 million in June.

The League Table

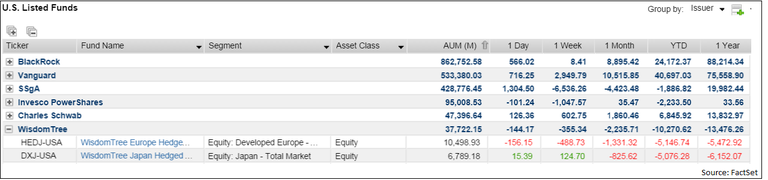

Competitively, we can glean a few things from June’s numbers. The first is that Vanguard and Schwab continue to steadily gain market share with low cost products. Vanguard continues to extend its lead in first place, consistently getting more new money than any other player. That’s just about cost. Even inside the product mix of iShares, lower-cost product like the iShares Core Emerging Markets ETF (IEMG) are outraising their pricier products like the iShares Emerging Markets ETF (EEM). The former has an expense ratio of 16 basis points and raised $2.4 billion so far this year, the latter costs 60 basis points and has pulled in just over $450 million, despite being the hands-down trader’s favorite.

Schwab is now firmly entrenched as the fifth place player in the US, supplanting WisdomTree. Some of this is the steady growth of its products, pulling in $7 billion so far this year, but some of it is also the losses in net assets from WisdomTree’s currency hedged products. Overall WisdomTree has had net outflows of over $10 billion, almost exclusively from their two huge currency hedged products, the WisdomTree Japan Hedged ETF (DXJ) and Europe Hedged ETF (HEDJ), which combined for net outflows of over $10 billion this year and over $2 billion just in June.

Looking Ahead

2016 continues to be a year dominated by uncertainty. Even with Brexit behind us, its actual implementation remains a mystery, and the pending US election won’t help matters either – at least until it’s over. With that backdrop, I’d expect ETF flows to continue their current trends. That means continued flows into low-cost “safety plays” like gold, dividend equities, and fixed income, with a monthly smattering of riskier assets based on the global macro news flow.

Related: Brexit ETF Trading Stays Comfortably Numb

In any case, cost will continue to matter. After all, it’s about the only thing you can control in an uncertain market.