It’s been a little over a month since the people of the UK voted to leave the European Union, and plenty has been said and written on the topic. Even though the dust has settled somewhat, there is still uncertainty, and ripple effects seem to be the topic of the day. On the plus side, our vocabulary is being enriched on a daily basis with creative buzzwords such as Frexit, Retireland, Abortugal, and Quitaly.

Impact on the Europe Union

Vocabulary aside, I thought now would be a good time to see if the lessons of Brexit could help us brace ourselves for a potential Nexit or Grexit. Jeremy Zhou observed that in the build up to Brexit, less domestic oriented companies outperformed those who had more of their revenues outside of the UK. However, I wondered if that effect would reverse in the aftermath of the UK’s EU departure.

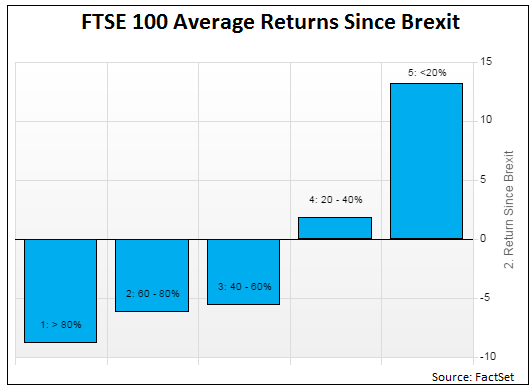

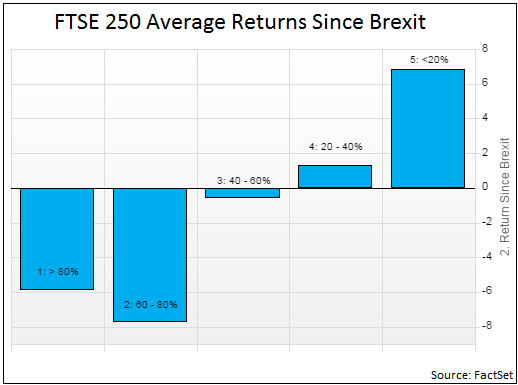

To determine that course, I ran a screen, where I brought back the FTSE 350 and grouped securities by their percent of revenues derived in the UK. I was then able look at the average returns of these groups since Brexit.

| |

GEOREV

% UK

|

RETURN

SINCE BREXIT

|

RETURN

ON BREXIT FRIDAY

|

RETURN

BREXIT FRIDAY TO PRESENT

|

| FTSE 100 |

43.6 |

2.2 |

-6.3 |

8.8 |

| >80% |

96.0 |

-8.8 |

-13.2 |

5.0 |

| 60-80% |

72.9 |

-6.2 |

-11.2 |

5.7 |

| 40-60% |

47.9 |

-5.6 |

-7.8 |

2.1 |

| 20-40% |

29.4 |

1.8 |

-6.7 |

9.0 |

| <20% |

7.3 |

13.2 |

-.3 |

13.5 |

| FTSE 250 |

61.6 |

-1.6 |

-7.9 |

6.6 |

| >80% |

98.1 |

-5.9 |

-9.9 |

4.2 |

| 60-80% |

73.8 |

-7.8 |

-11.1 |

3.7 |

| 40-60% |

49.5 |

-.6 |

-7.2 |

7.1 |

| 20-40% |

30.1 |

1.3 |

-6.6 |

8.5 |

| <20% |

7.7 |

6.8 |

-4.0 |

11.1 |

We can see that FTSE 100 companies have extended their gains compared to the more domestically oriented FTSE 250 by 3.8% (2.2% vs. -1.6%). Interestingly, of that 3.8% only 1.6% was realized on Brexit Friday itself, with the other 2.2% in the weeks that followed. In other words, one could have waited out Brexit Friday and still made a decent return on the spread between the two indices, while enjoying the recovery in markets since then.

Related: In Search of the Brexit Hedge

It gets even more interesting when looking at the buckets within each of the indices.

As we can see in the FTSE 100, companies with less than 20% UK revenue exposure outperformed those with more than 80% exposure, with a spread of more than 20% since Brexit. Of this 20%, roughly 13% was on the Brexit Friday and the remaining 7% in the weeks that followed.

If we look at the more domestically oriented companies in the FTSE 250, we see a very similar pattern of rather monotonic returns. This time we observe a spread in returns of close to 13%, half of which was generated on the day of the vote.

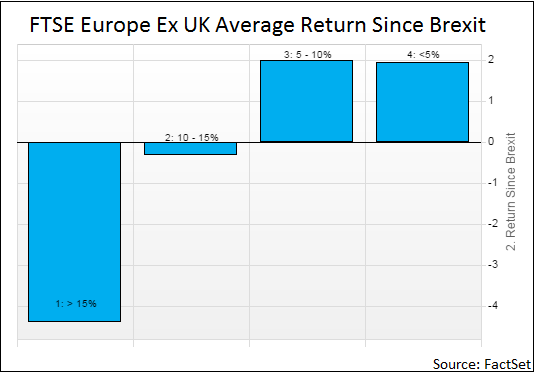

Obviously Brexit wasn’t only felt within the UK. Where UK exporters might benefit from a weakening pound, foreign companies exporting into the UK are likely to suffer. Since the revenue exposure to the UK is far less for companies outside the UK, I’ve used different buckets to keep a meaningful number of companies in each.

Looking at the rest of Europe by means of the FTSE Europe ex-UK, the spread in returns is not as wide, but still about 6.5%. About 3% of the spread happened on the day of the vote, with the remainder in the weeks that followed. It does indeed seem that as markets pick up, companies with revenue dependency in the UK will suffer.

Broadening the Scope

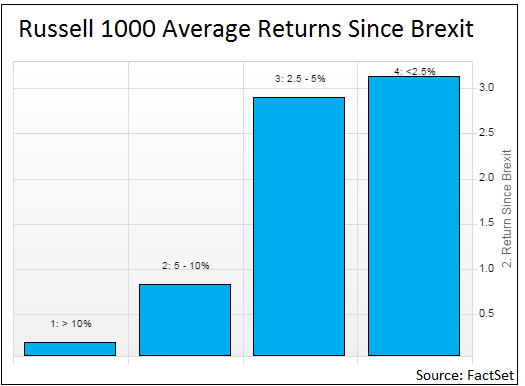

So far the focus has been on the UK and Europe (pun intended), but how did Brexit affect other markets? Turning our attention to the Russell 1000 we see a very similar pattern.

The differences might be less pronounced, but a spread of 3% between the most and least exposed companies still appears, half of which was realized on/after election day.

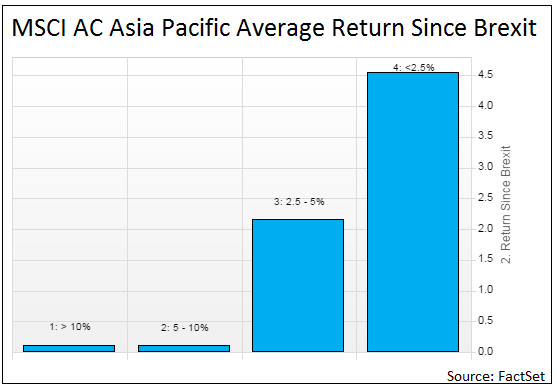

If we look at MSCI Asia Pacific, again we see a similar pattern.

In Asia the spread is around 4.5%, with most realized in the weeks following the event. On Brexit Friday itself although all markets were down, there wasn’t yet a clear pattern. This was likely caused by the panic that dominated the markets that day, unsurprising given that the results were reported towards close for most Asian markets. It was not until Monday and the weeks thereafter companies with exposure to the UK started to lag counterparts with less exposure.

A Positive Look at a Potential Next Exit

So what does this mean? I’m not suggesting that predicting a potential Quitaly or Frexit is straightforward, and clearly the markets hadn’t priced in that Brexit would happen. That said, whether one has a strong conviction or not, it is possible to anticipate and potentially profit from the next exit.

First, if you lack conviction, it might be advisable to stay away from any form of excessive exposure. In other words it would be unwise to tilt towards companies with either very high domestic or very high foreign exposure, preferable instead to stay closer to the benchmark.

Before Brexit, we did see that some uncertainty around the outcome was priced into the market. However, the results show that profit is not contingent on it being in the market beforehand. One can wait, not just until the day of the event, but even until a day after, and still make a return by tilting towards companies with less exposure to the event.

If on the other hand, you do have strong conviction, you might want to start preparing; as we have seen with the Brexit, betting on the right companies could pay off handsomely!