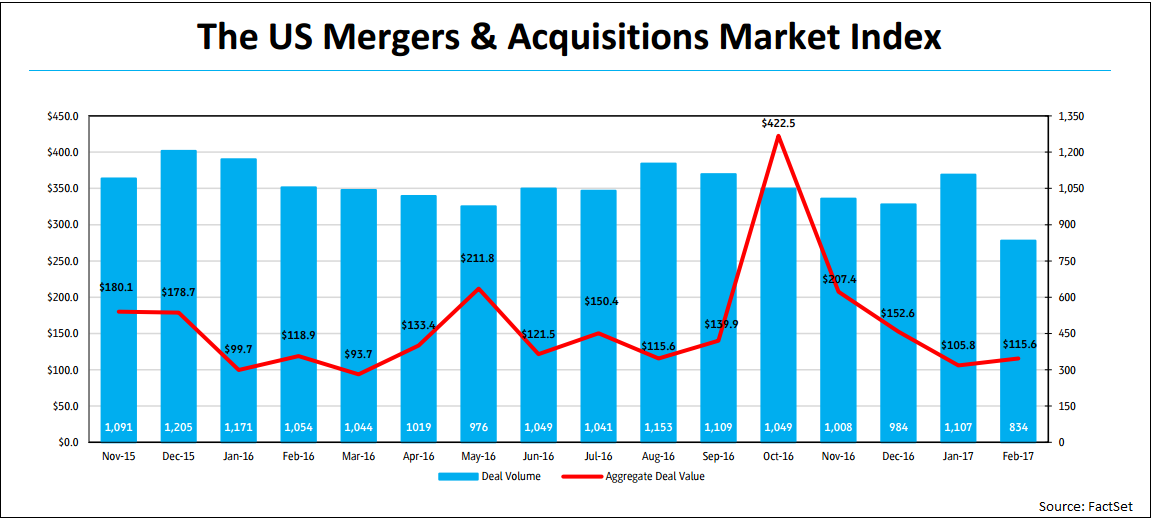

U.S. M&A deal activity decreased in February, going down 24.7% with 834 announcements compared to 1,107 in January. However, aggregate M&A spending increased. In February, 9.2% more was spent on deals compared to January.

Over the past three months, the sectors that have seen the biggest increases in M&A deal activity, relative to the same three-month period one year ago, have been: Consumer Durables (64 vs. 62), Non-Energy Minerals (71 vs. 70), Communications (43 vs. 42), and Government (6 vs. 5). Four of the 21 sectors tracked by FactSet Mergerstat posted relative gains in deal flow over the last three months compared to the same three months one year prior.

Over the past three months, the sectors that have seen the biggest declines in M&A deal volume, relative to the same three-month period one year ago have been: Commercial Services (452 vs. 574), Finance (351 vs. 418), Health Services (144 vs. 193), Retail Trade (85 vs. 131), and Producer Manufacturing (181 vs. 222). Sixteen of the 21 sectors tracked by FactSet Mergerstat posted negative relative losses in deal flow over the last three months compared to the same three months one year prior, for a combined loss of 507 deals.

| Target Sector |

L3M 2/28/17

Deal Count |

L3M 2/29/16

DEal Count |

DIfference |

| Consumer Durables |

64 |

62 |

2 |

| Non-Energy Minerals |

71 |

70 |

1 |

| Communications |

43 |

42 |

1 |

| Government |

6 |

5 |

1 |

| Indutrial Services |

135 |

135 |

0 |

| Process Industries |

114 |

116 |

(2) |

| Misc. |

13 |

18 |

(5) |

| Consumer Non-Durables |

91 |

97 |

(6) |

| Transportation |

56 |

64 |

(8) |

| Utilities |

71 |

85 |

(14) |

| Energy Minerals |

43 |

58 |

(15) |

| Electronic Technology |

84 |

103 |

(19) |

| Health Technology |

109 |

129 |

(20) |

| Technology Services |

453 |

480 |

(27) |

| Consumer Services |

212 |

240 |

(28) |

| Distribution Services |

150 |

188 |

(38) |

| Producer Manufacturing |

181 |

22 |

(41) |

| Retail Trade |

85 |

131 |

(46) |

| Health Services |

144 |

193 |

(49) |

| Finance |

351 |

418 |

(67) |

| Commercial Services |

452 |

574 |

(122) |

| Total |

2,928 |

3,430 |

(502) |

Topping the list of the largest deals announced in February are:

- Reckitt Benckiser Group Plc signing a merger agreement to acquire Mead Johnson Nutrition Co. for $16.5 billion;

- ONEOK, Inc. agreeing to acquire the remaining 60% stake in ONEOK Partners LP for $9.3 billion;

- Blackstone Group LLP's agreement to acquire Aon Plc's employee benefits outsourcing unit for $4.8 billion;

- Advent International Corp.'s offer to acquire STADA Arzneimittel AG $3.8 billion;

- SoftBank Group Corp. agreeing to acquire Fortress Investment Group LLC for $3.1 billion.

FactSet Flashwire Monthly Report

Read the full report for more. including:

- Key trend information for the Overall and Middle M&A Markets, such as deal volume, deal value, mega-deals, leading buyers, leading industries, leading sectors, cross-border deals, US regional deals, average P/E, average premiums, payment methods, and much more

- Industry reports on the Internet, Telecommunications, Healthcare, Banking, and much more

- Special reports on technology, the public and private M&A markets, cancellation fees, industry activity, etc.

- Leading financial and legal advisor rankings