Falling prices and increased volatility in both Brent and West Texas Intermediate (WTI) crude oil prices have dominated headlines in 2015. In 30 of the first 70 trading days of the year, the price of oil has moved up or down by more than 3%. Since hitting its one year high of $107.26 per barrel on June 20, 2014, the price of WTI has fallen 50%, with Brent following suit with a 49% dip. Despite these steep price declines, shares of oil refiners within the Energy sector continue to outperform.

As the oil narrative continues into the second quarter of 2015, the refining industry has been a bright spot in a sector otherwise hampered by the negative outlook on oil. An oil refiner distills raw or unprocessed crude oil into useful products such as gasoline or diesel fuel. Large companies like Exxon and BP are classified as integrated oil companies, which means that they have refining arms that function as part of their overall operations. Other companies, like Valero and Tesoro, focus specifically on refining. While falling oil prices typically result in lower profits for energy companies in future periods, refineries benefit from lower input costs today. Because the prices of refined products generally don’t fall as quickly or as drastically as crude oil prices, this translates into higher profits for refiners. The price differential between crude and refined products is referred to as the crack spread, and is one of the key drivers in the oil refinery industry.

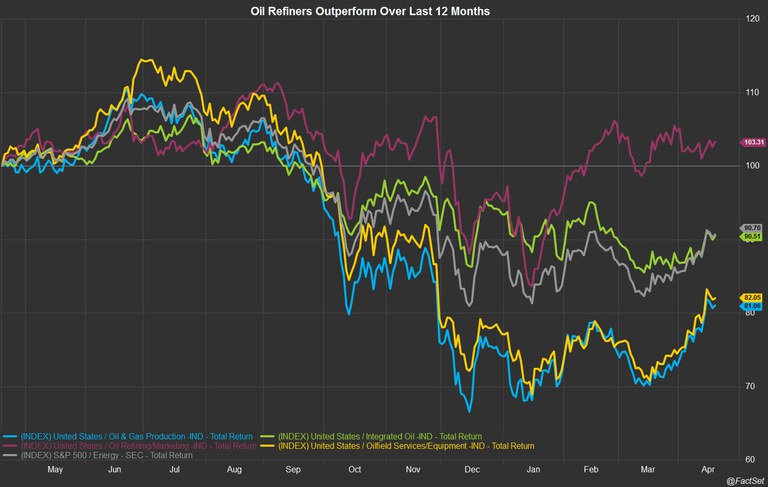

As illustrated in the chart below, oil refining is the only industry in the Energy sector that has had positive returns over the last year, with a total return of 5.8%. Integrated oil was the next best performing industry, with a total return of -7.6%. If oil prices were to recover, could this run continue?