Net operating losses (NOLs) that can be “carried” to offset future tax burdens are valuable assets to a company. However, the use of NOL carries is subject to IRS limitations, specifically with regard to change in ownership events. An increased position by a 5% shareholder, in certain circumstances, can be sufficient to trigger a change in ownership without the shareholder actually taking over the company. Depending on the timing of share accumulation, an activist looking to attain the common 9.9% ownership in advance of an activist campaign could trigger a change in ownership and impair the value of the NOL-assets. The choice of how a company protects its NOL-assets likely affects the company’s long-term performance in addition to the short-term financials through NOL-assets.

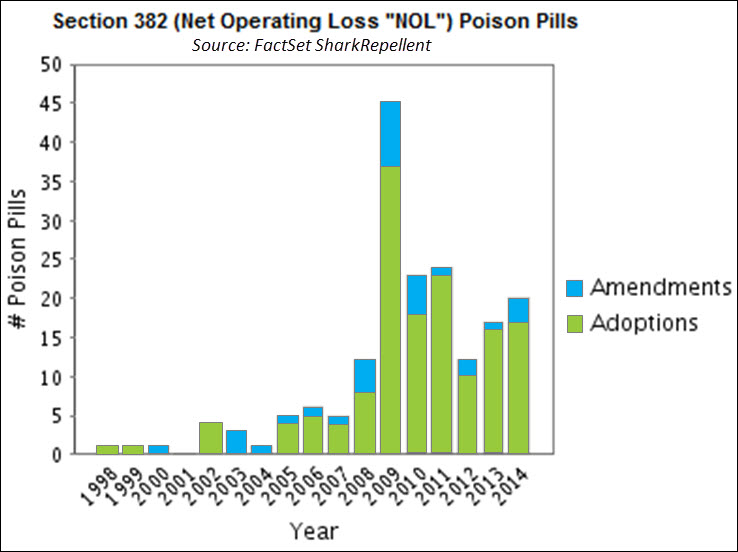

To limit the possibility of triggering a change in ownership, management may in good faith adopt limitations on the accumulation of the company’s shares through its charter and bylaws. The limitation to changes in ownership could be tailored specifically to NOL situations or be a general limitation on ownership. A collateral consequence of limiting a change in ownership in the charter/bylaws is the limitation can serve as a de facto poison pill. A company could also avoid a change in ownership through an actual shareholder rights plan/poison pill that would trigger in the event of share accumulation. These poison pills set lower trigger limits, typically between 4.75% and 5%. Since 2009, 141 companies have included NOL-specific provisions as part of a poison pill and 89 total NOL poison pills are presently in-force. Some commentators scrutinize poison pills because it can cause management to become entrenched. The inability to replace management could be particularly troublesome in this context given that large NOL-assets are created by operating losses, which may imply that current management is not effective at maximizing profitability for the company.

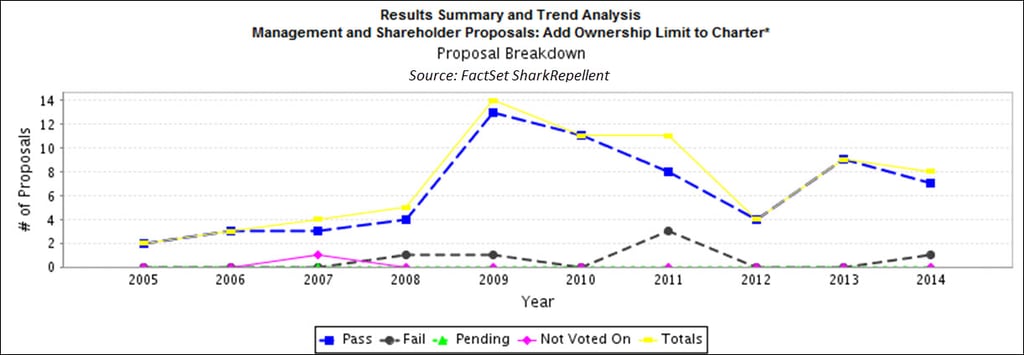

FactSet SharkRepellent identified 71 proxy proposals, all brought by management, to amend the charters and bylaws to include an “add ownership limit to charter” provision. Of these proposals, 53 included language that specifically referenced NOLs or tax benefits, and the others varied, including REIT qualification, voting rights, and gaming regulations. The breakdown of the 53 NOL proposals — 48 passed and 5 failed — implies that preserving NOLs is a reasonable management decision and is also regularly supported by investors given the average support of 90% of votes cast. An additional nine companies adopted an ownership limit without shareholder approval through the board authority to amend the charter and bylaws.

SharkRepellent also identified 171 companies that have created NOL-specific poison pills, either by adopting a new shareholder rights plan or amending the trigger and provisions of an existing one. Of those 171 companies, seven companies have adopted multiple NOL-specific pills and 16 companies also include an ownership limit in the charter or bylaws as a second layer of protection. Companies have a mixed record with regard to shareholder input on the rights plan; 69 companies put the plan to a shareholder vote while 102 companies adopted the plan unilaterally.

Relative to the complete universe of activist campaigns, the number of campaigns for board seats by activists is disproportionately small for companies that protect NOL-assets. However, the success rate for the limited number of campaigns where the activist did seek to change the board is 80%, relative to 44% for all activist campaigns that target board seats. The limited number of campaigns but high success rate in changing the board may suggest that most NOL-assets are not created due to poor management, but, in the cases where management is the issue, an activist is able to overcome the entrenchment obstacle and affect a change in board representation.

As the benchmark, SharkRepellent tracked 5,967 activist campaigns as of December 29, 2014, of which 1,532 of the campaigns targeted board control, board seats, or sought to remove directors as the primary purpose. Of those 1,532 campaigns, 678 resulted in the dissident changing at least one seat on the board. The numbers translate to 0.73 activist campaigns per company and 0.19 campaigns per company to change board representation.

Of the 73 companies that adopted an ownership limitation provision, only 11 have been targeted by activists after the adoption of the limitation to changes in ownership. The board’s knowledge of the limited position that activist can accumulate likely limited the threat an activist could impose on the board. Furthermore, only two campaigns included the dissidents attempting to gain a seat on the board of directors. All of the companies targeted had adopted NOL-specific limitations. While this may suggest that NOL-specific ownership limits are more controversial to activist investors, the more likely inference is that activists were able to work around the limits of NOL-specific ownership limits while the general ownership limits effectively served as deterrents to any campaign.

Companies with NOL ownership limits in the original charter and bylaws were targeted in 13 activist campaigns, of which five were against General Motors. Activists sought board seats in three of the campaigns and were successful in two. In total for the companies with NOL protection in the charter and/or bylaws at the time of activism, five activist campaigns with the purpose of changing board have resulted in four successful campaigns. On the basis of overall activism (0.40 campaigns per company) as well attempts to change board representation (0.07 per company), the limitations to the changes in ownership for the purpose of NOL protection does appear to deter activism.

For the 171 companies that adopted NOL-specific poison pills, these companies have been the target in 25 activist campaigns (against 18 different companies) with the purpose of changing board representation and 63 campaigns overall. In the 25 campaigns to change the board, 20 of the campaigns resulted in a board seat for the activist (against 15 different companies). Excluding companies that adopted NOL provisions within the past year, the activism rate is 0.42 campaigns per company and 0.17 campaigns per company to change board representation. The overall activism rate against companies with NOL-specific poison pills is similar to the rate for companies that adopt ownership limits, but the rate of campaigns that target changes in board representation is significantly higher and on-par with the rate for overall activism.