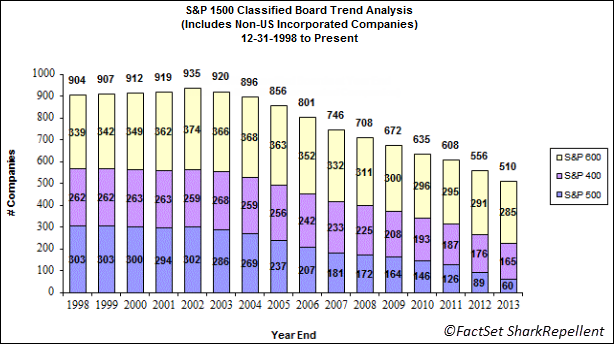

New York City Comptroller Scott Stringer is driving a process to unite institutional investors under the common goal of bringing greater accountability to corporate boardrooms. His “Boardroom Accountability Project 2015” takes aim at 75 public companies with issues related to board diversity, climate change, or executive compensation. The Project includes submitting to each company a shareholder proposal that requests the adoption a bylaw allowing shareholders who have owned at least 3% of a company’s stock for three years or more to have proxy access to nominate directors for election to the board. In the wake of board declassification, with only 60 companies in the S&P 500 maintaining classified boards at the end of 2013 (down from 300 in 2000), the success of the Project in creating proxy access could expose controversial companies to completely new slates of directors in the coming years.

Mr. Stringer has already found an ally in the California Public Employees’ Retirement System (CalPERS), which is the largest public pension fund in the United States, and has received favorable feedback from public pension funds in Connecticut, Illinois, and North Carolina. These public groups have submitted only eight proposals to remove or nominate directors, but opening proxy access would allow any holder, including activists looking for board control, to nominate directors. Of the Project’s targeted companies, eight companies have at least one FactSet SharkWatch 50 activist that currently holds a 3% ownership stake and an additional 16 companies have a FactSet SharkWatch 50 activist that owns 1%-3% of shares outstanding. SharkWatch 50 activists have engaged in 90 campaigns to nominate or remove directors since the beginning of 2013.

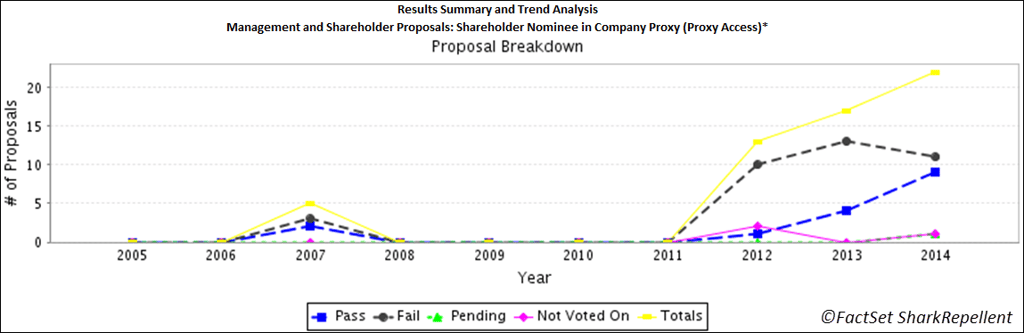

Several companies have recently adopted bylaws as a result of pressure from institutional shareholders. Chesapeake Energy, which had also previously been the target of a CalPERS proposal, Hewlett-Packard, Verizon, and Western Union each amended their respective bylaws to allow investors to submit nominations to the board at the 3% for the three years level. The proposals brought to shareholder vote, which were submitted by management in all cases, received an average favorable vote of 95% of votes cast. Thus, the investment community appears unanimously in favor of increased access. Companies may be willing to compromise to proxy access at the 3% for three years level given some proposed alternatives, such as the proposal by the public pension fund of Norway, Norges, to Western Union for proxy access at the 1% ownership level for one year. Norges has submitted five proxy access proposals at the 1% for one year level and received average support of 30% in situations where the proposal made it to a shareholder vote.

The New York City Retirement Systems, which includes the New York City Employees’ Retirement System, New York City Fire Department Pension Fund, New York City Pension Funds, New York City Police Department Pension Fund, and New York City Teachers’ Retirement System, all under the director of the Office of the Comptroller of New York City and with over $158 billion in assets under management, has submitted 25 shareholder proposals that made it to a shareholder vote since Scott Stringer took office. Three of those proposals related to proxy access, targeting Abercrombie & Fitch Co., Big Lots, Inc., and Kilory Realty Corp., and two of the proposals passed. The failed vote in the case of Kilory Realty Corp. received 47% favorable votes as a percentage of the votes cast.