As public pension funds become more active in shareholder proposals through projects such as the Boardroom Accountability Project 2015 effort from New York City Retirement Systems, and the company-activist collaboration model as structured by Valeant and Pershing Square come under scrutiny, activists may seek larger, traditionally passive investors as potential allies for activism campaigns. Norges Bank Investment Management is one fund that may be a particularly interested, and valuable, ally.

Norges Bank Investment Management is the asset management division of the Norwegian central bank and the country’s public pension fund. The government transfers the public revenue from petroleum to the fund to avoid overheating the Norwegian economy and to shield it from the effects of oil price fluctuations. The fund’s investment strategy is defined by a legislative management mandate, which includes an initiative to actively contribute to the development of good international standards with regard to responsible investment and active ownership. The fund defines good governance standards as the principle of one share-one vote and the abolishment of all kinds of anti-takeover mechanisms and transactions that don’t treat all shareholders equally.

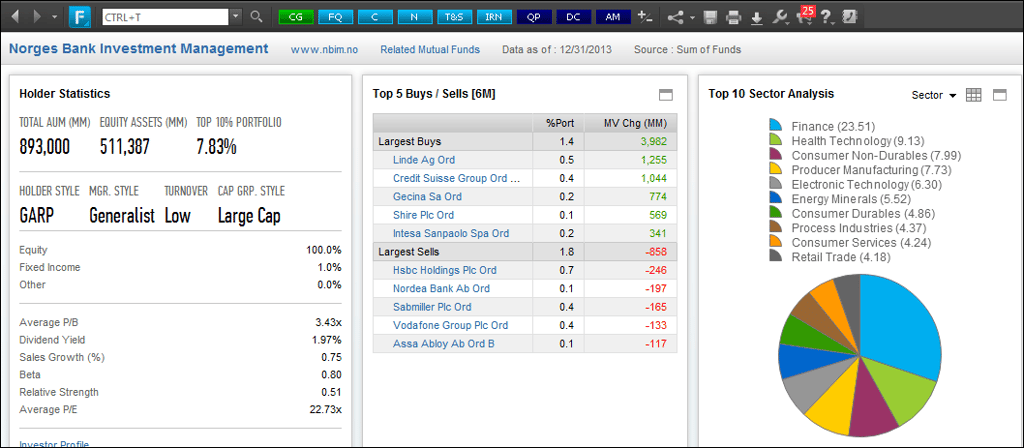

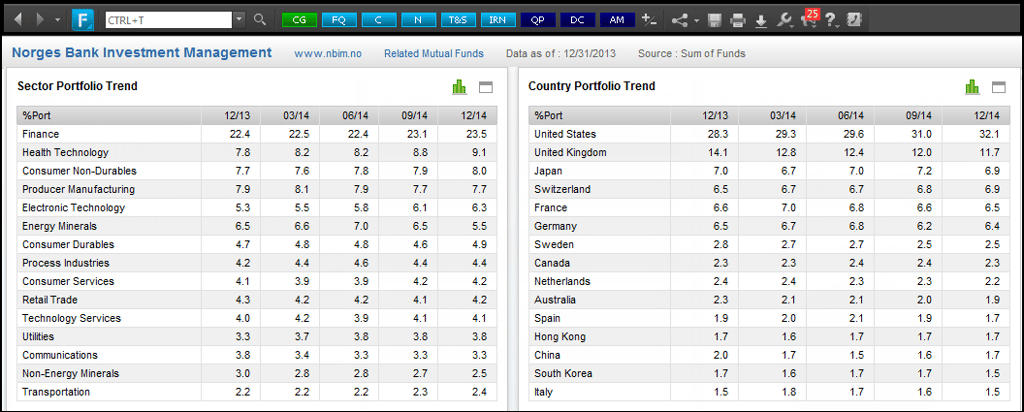

With total assets under management of over $893 billion, 98% of Norges’ current positions are equity based, in 8,251 unique companies globally. The fund has an ownership stake greater than 1% of all shares outstanding in 2,673 companies; 3% in 390 companies; 5% in 82 companies; and a greater than 9.9% stake in four companies. Of those positions, 206 of the 1% holdings, 18 of the 3% holdings, and six of the 5% holdings are in companies incorporated in the United States.

Norges is a top-20 institutional shareholder in over 40% of the Fortune 100 companies. The fund has held a 3% ownership stake in five U.S.-based companies: Aflac, Blackrock, Cadiz, Green Plains, and Itron. Norges has never submitted a shareholder proposal or started an activist campaign against one of those companies. However, the threshold is critical given Norges’ focus on submitting shareholder proposals related to increased proxy access. Since 2012, the company has filed seven such proposals against five companies: Charles Schwab, CME Group, Staples, Wells Fargo, and Western Union. In each of the proposals, Norges suggested that the threshold for proxy access be 1% ownership for one year.

Based on the correlation between its ownership positions and the proxy access proposals, however, Norges is not using proxy access proposals as a tactic to gain control of the board. In fact, the fund has a legislative mandate that it cannot be invested in more than 10% of voting shares of any individual company. However, an activist with an agenda in line with the Norges governance mandate could look to the fund for support in its campaign for board seats without worrying about competition for actual board control.

With $167 billion currently invested in U.S.-based companies, a wave of proxy access may entice Norges to consolidate its positions and reach the 3% for three years threshold to begin influencing U.S. corporate governance practices on its own accord as well. Its 206 positions in U.S.-based companies at the 1% ownership threshold is already an increase from 118 positions at the 1% threshold in 2011.