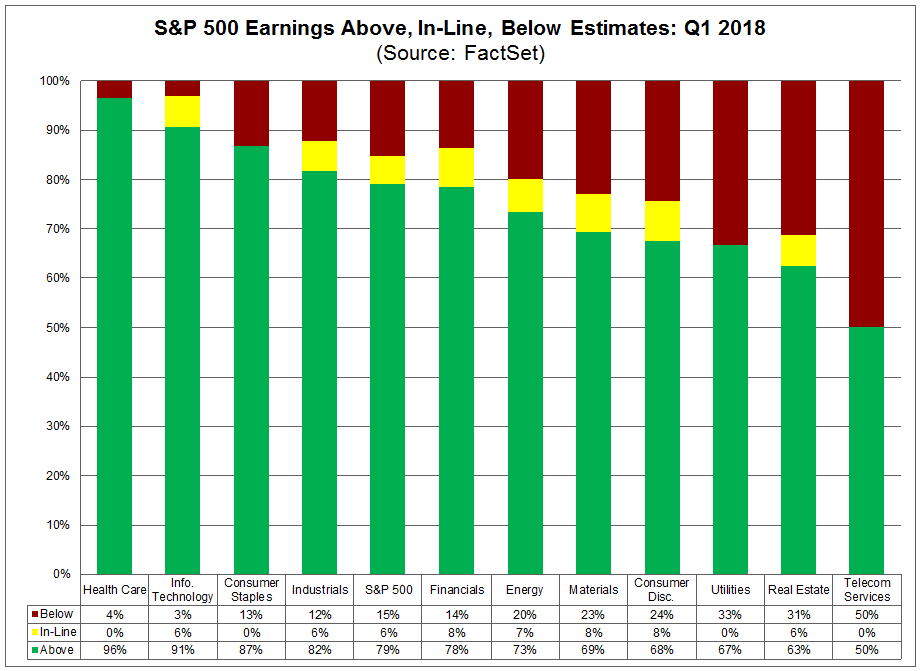

To date, 53% of the companies in the S&P 500 have reported actual results for Q1 2018. In terms of earnings, more companies are reporting actual EPS above estimates (79%) compared to the five-year average. If 79% is the final percentage for the quarter, it will mark the highest percentage of S&P 500 companies reporting actual EPS above estimates since FactSet began tracking this metric in Q3 2008. In aggregate, companies are reporting earnings that are 9.1% above the estimates, which is also above the five-year average. In terms of sales, more companies (74%) are reporting actual sales above estimates compared to the five-year average. In aggregate, companies are reporting sales that are 1.7% above estimates, which is also above the five-year average. If 1.7% is the final percentage for the quarter, it will mark the largest revenue surprise percentage since FactSet began tracking this metric in Q3 2008.

Sector-Level Breakdown

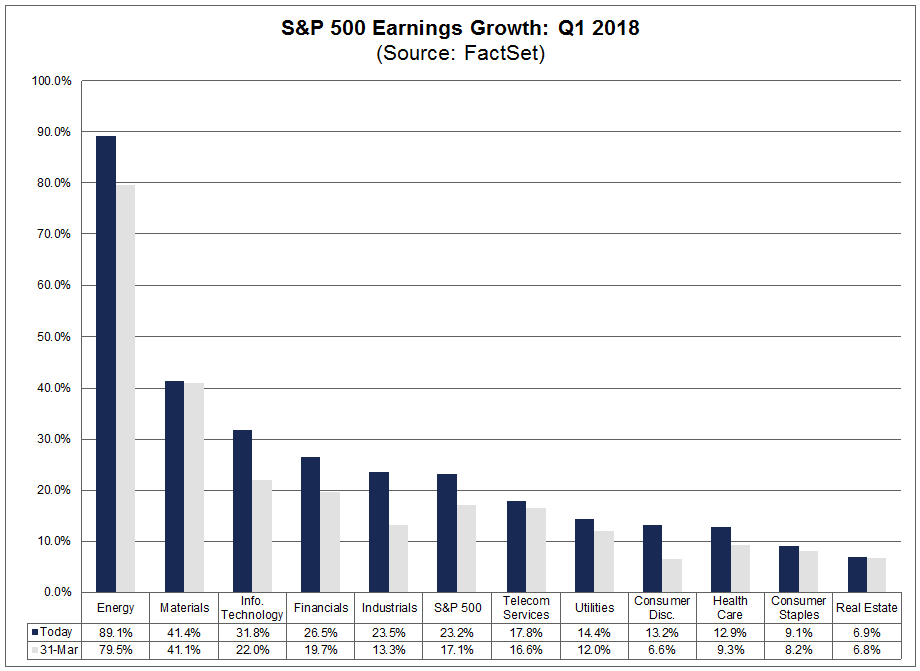

The blended (combines actual results for companies that have reported and estimated results for companies that have yet to report), year-over-year earnings growth rate for the first quarter is 23.2% today, which is higher than the earnings growth rate of 18.5% last week. Positive earnings surprises reported by companies in multiple sectors (led by the Information Technology sector) were responsible for the increase in the earnings growth rate for the index during the past week. All 11 sectors are reporting year-over-year earnings growth. Nine sectors are reporting double-digit earnings growth, led by the Energy, Materials, Information Technology, and Financials sectors.

The blended, year-over-year sales growth rate for the third quarter is 8.4% today, which is higher than the growth rate of 7.6% last week. Positive revenue surprises reported by companies in multiple sectors were responsible for the increase in the revenue growth rate for the index during the past week. Ten sectors are reporting year-over-year growth in revenues. Three sectors are reporting double-digit growth in revenues: Energy, Materials, and Information Technology.

Looking at future quarters, analysts currently project earnings growth to continue at double-digit levels through 2018.

The forward 12-month P/E ratio is 16.3, which is above the 5-year average and the 10-year average.

During the upcoming week, 142 S&P 500 companies (including five Dow 30 components) are scheduled to report results for the first quarter.

Please Note: Starting May 4 the Full Earnings Insight Report Will Be Available Only to Subscribers