By Doruk Ilgaz | June 8, 2015

One of the most important factors of proper risk management of corporate bond portfolios and macroeconomic policy-making is understanding the drivers of change for corporate bond yields.

Interest on a corporate bond is commonly viewed as the risk-free interest rate (such as that on a 10-year treasury bond), plus a spread related to the credit risk of the corporation issuing the bond. Empirical analysis of the determinants of corporate bond rates, however, has turned out to be more complex than it appears. This complexity has led researchers to talk about a “credit spread puzzle”—the fact that spreads on corporate bonds are about twice as large as can be explained by defaults, taxes, and illiquidity. The higher a bond’s rating and the shorter its maturity, the more complex the puzzle gets.

We’ll examine the evidence for the existence of such a puzzle, then take a closer look at some of its pieces.

Because yields are susceptible to fluctuations in the general bond market, they don’t provide enough of a basis for analyzing risk conditions in the corporate bond market. For this reason, the studies referenced here use the credit spread, the component of corporate bond yields that is above the yield of default-free treasury bonds with comparable maturity. This spread equals the “excess” interest rate that would be earned if the corporation does not default and the investor holds the bond to maturity.

The analysis of credit spreads focuses primarily on the systematic components common to all firms in the economy. In a sample of corporate bonds, the default-free interest rate component is deducted from bond yields. The resulting credit spreads are supposed to reflect solely the financial health of the firms that issued the corporate bonds, assuming no transaction costs and no tax effects.

In practice, however, empirical research has been able to explain less than half of the variation in credit spreads. Therein lays the credit spread puzzle. For example, Duffie, Saita, and Wang (2007) present and estimate a dynamic model for the default probability of 2,770 U.S. industrial firms. They find that in addition to a set of firm-specific factors, two market-based factors, the three-month treasury bill rate and the 12-month trailing return on the S&P 500 index have significant explanatory power in predicting the default probability. This suggests that the two market-based factors should be the only common factors in credit spreads on corporate bonds.

Two studies explore this issue. The first, by Duffee (1998), uses a large sample of noncallable corporate bonds to find that a little less than 20% of the variation in the average credit spread can be explained solely by the level and slope of the treasury yield curve. The second, by Collin-Dufresne, Pierre, Goldstein, and Martin, (2001) uses credit spread changes for 688 different corporate bonds. The researchers control for variables that affect the probability of default, such as leverage ratio and asset volatility, as well as for the effects of changes in short- and long-term treasury bond yields and the return on the S&P 500 index. However, they are able to explain only about 25% of the variation in the credit spread changes across the 688 different bonds. More surprisingly, the residuals from their firm-specific regressions are highly correlated across all bonds, independent of their rating and maturity. In fact, based on principal component analysis of the residuals, they find that as much as 75% of that variation can be explained by a single, common factor.

Other researchers examined non-default related factors that would be common to the credit spreads of most firms in the economy, specifically the tax difference between interest earned on corporate and treasury bonds and the difference in liquidity between corporate and treasury bond markets.

The interest earned on corporate bonds is taxed both at the federal and state levels, whereas interest income earned on treasury bonds is taxed only at the federal level. This tax disadvantage for corporate bonds should cause the corporate bond yields to be upwardly biased by the amount of the tax disadvantage in order to balance the after-tax return across corporate and treasury bonds.

In the studies referenced, there are two major arguments against the significance of this tax effect. First, the typical investor in the corporate bond market is a bank, an institutional investor, or another legal entity for which there is no difference in the tax treatment of the return earned on corporate and treasury bonds. Second, major changes in tax laws are so infrequent that they are unlikely to explain the frequent, large swings in bond spreads.

Elton, Gruber, Agrawal, and Mann (2001) find that imposing an effective state tax rate of 4% maximizes the part of the credit spread changes that can be explained by their model. However, this still leaves more than half of the variation in credit spreads unexplained. Elton et al. also shows that the unexplained residuals likely represent compensation for other risk factors, since they are correlated with the factors that explain excess returns in the stock market. One such key risk premium could be a liquidity risk premium.

The trading volume for corporate bonds is far less than for treasury securities. Moreover, the information content of bond prices tends to be even lower for less actively traded securities. Investors demand additional compensation for holding securities that are less liquid, and the compensation for this liquidity risk shows up in higher interest rate spreads over otherwise comparable treasury bonds.

Houweling, Mentink, and Vorst (2005) analyzes the effect of liquidity risk on corporate bond credit spreads while controlling for two common factors: the excess return from the stock market and the excess return of long-term corporate bonds over long-term treasury bonds. They find that liquidity risk is priced into credit spreads and explains a significant portion of observed credit spreads. The size of the liquidity premium is determined by the size of the bond issuance, the yield volatility, and the age of the bond. They also find that the liquidity risk premium is time-varying.

A paper by Driessen (2005) studies a sample of corporate bonds issued by 104 U.S. industrial firms and takes all the above-mentioned factors into consideration. He estimates the level and slope factor from the treasury bond market, a time-varying liquidity risk premium factor. He then includes an effective state tax effect of 4.875%, followed by two credit risk factors, and finally applies a default risk factor for each of the firms to control for any firm-specific factors.

His results show that there is still about one-third of the credit spread that is not explained by this model. He refers to this missing piece as a large risk premium, possibly caused by a tendency for firms to default in waves. Since diversification would not eliminate this risk, investors could require a premium.

Business cycle theory has largely abstracted from incorporating financial factors into IS-LM and real business cycle models. When one reviews informational asymmetries between borrowers and lenders, borrowers’ balance sheets can play an important role in the propagation of economic shocks—the financial accelerator (Bernanke & Gertler, 1989). Informational frictions in credit markets induce a wedge between the cost of external and internal funds—the external finance premium (EFP). The size of the EFP depends inversely on the borrower’s net worth. Declines in equity valuation and/or unexpected deflation reduce the borrowers’ net worth. Procyclical net worth leads to countercyclical EFP, enhancing swings in borrowing, investment, and output.

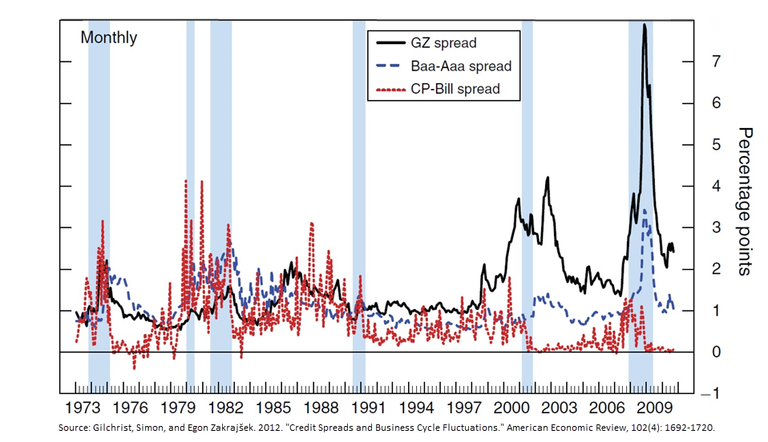

A more recent empirical study by Gilchrist and Zakrajšek (2012) re-examines the evidence of the relationship between credit spreads and economic activity over the 1973 to 2010 period. It uses prices of individual securities to construct a credit spread with high information content for future economic activity. The predictive content of a credit spread is deconstructed into two components. The first to capture countercyclical movements in expected defaults, while the second, the excess bond premium (EBP) represents cyclical changes in the relationship between expected default risk and credit spreads.

This study finds that the predictive content of credit spreads for economic activity is almost entirely due to movements in the EBP. Hence, the EBP provides a timely gauge of credit-supply conditions. Unanticipated increases in the EBP can lead to significant and protracted declines in economic activity and the stock market, an economic downturn by way of the financial accelerator mechanism. These actually account for a substantial fraction of the variation in real activity and the stock market at business cycle frequencies.

Financial shocks may also cause variations in the risk attitudes of the marginal investor that prices corporate bonds. Since the corporate bond market is dominated by large institutional investors, financial intermediaries face capital requirements. A shock to their financial capital makes them act in a more risk-averse manner, while a shift in their risk attitudes leads to an increase in the EBP. When the market is illiquid and uncertainty is greater, sellers of credit default swap charge more and CDS premiums increase.

The chart above depicts the following credit spreads and recessions:

Increases in spreads signal disruptions in credit markets that have important consequences for macroeconomic outcomes. Integrating asset pricing with macroeconomic models used in policy analysis is a necessary step to understanding the interaction between the financial sector and the real economy.

Movements in corporate bond spreads are important to many investors and can be informative forward-looking metrics of market sentiment. Extracting information from the movements in corporate bond spreads, however, is not always straightforward. The studies reviewed here show that more than half of the variation in corporate bond credit spreads is not related to the financial health of the issuing firm, but rather reflects effects such as compensation for liquidity risk (time varying), tax treatment of corporate bonds, and risk aversion of financial intermediaries. While the referenced studies contributed much to our understanding of the composition of credit spreads, the credit spread puzzle is still missing some key pieces.

How Private Capital Is Powering the Johor-Singapore Special Economic Zone

This FactSet analysis provides insight into the early stage of the JS-SEZ progress with key data points. Stay informed on how...

How Transaction Cost Analysis Is Evolving from Compliance Tool to Trading Decision Support

Discover insights to further strengthen your TCA capabilities in this FactSet analysis. Consider how you can make the most of TCA...

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.