For years, fixed income attribution was a headache for performance measurement specialists. Data was unreliable, there were no widely accepted models for attribution, and the market was evolving faster than performance measurement could keep up.

But fixed income attribution has entered a new age, and in many cases, models have evolved beyond the needs of fund managers. While fixed income still troubles parts of the performance measurement industry, there can be no denying how far it has come. Part of the catalyst was the accession of new blended, strategic bond funds. This exposed the inadequacies of the original ”siloed” approach to fixed income attribution, where government bonds would be analyzed independently of high-yield bonds and so on.

Equally, returns-based attribution was good at showing that a manager did well in, for example, longer-dated bonds, but poor at showing why. Where returns were multi-dimensional—potentially involving currency, inflation, duration and credit risk—the results could be misleading.

The New Age of Fixed Income Attribution

Since the early days, these models have evolved rapidly. It is now possible to disaggregate whether a manager’s long-rates position has worked and why. It’s possible to analyze security returns based on sensitivities to systematic factors such as shifts in the yield curve.

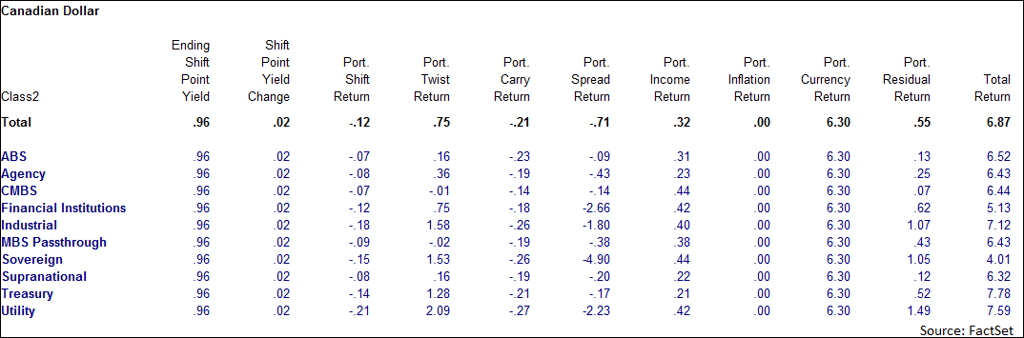

We can see one instance of this in the twist calculation; it’s not detailed enough. There may not be enough detail on the yield curve, for example. Is effective duration being used instead of key rate durations, or are more key rates needed to sufficiently analyze the yield curve positioning?

Similarly, when we look at spread management, we could ask, “How are we measuring this?” Are we using a spread duration and OAS approach? Or a duration-times-spread (DTS) approach that takes account of the proportionality of spread levels and term structure? The method chosen may be material to fully understanding the performance during the measurement period.

As such, it is possible to tell the extent to which returns are the consequence of a portfolio manager’s intended positioning on the fund and which have crept into portfolio returns unconsciously.

It is also possible to warn portfolio managers of looming risks. Is inflation becoming an increasingly important factor in overall returns? What about the currency picture? There are now tools to gain real insight into a fixed income portfolio, not just tell the story.

For example, in the current low-rate environment in the eurozone, carry return is minimal. However, FX volatility has been a major contributor to the risk/return profile over the past year. Depending on a portfolio’s base currency and the portfolio manager’s decision to hedge the currency exposure, currency could have been either a major detractor for performance or a non-event.

As the market continues to evolve, models can now incorporate a broad range of fixed income products, from vanilla derivatives (such as interest rate swaps) to FX calculations and markets that are still evolving (such as the floating-rate note or asset-backed markets).

It is now possible to carry out effective scenario planning to see the impact of including different instruments on the composition of yield. What is a CDS or currency swap likely to do to the fund? Attribution is not the problem; it’s what is being done with that attribution.

To some extent, the fund management industry needs to catch up. It is easy to forget that many of these diversified bond funds are still relatively new. The M&G Optimal Income fund, often considered the granddaddy of the sector, has only just celebrated its 10-year anniversary.

Inflation expectation and potential unwinding of quantitative easing could make for a different market to come. Many funds are only just building sufficient expertise to exploit the full flexibility available to them.

The fixed income market will always evolve. The potential rise in inflation, and a resulting increase in bond yields, could make for a very different market in future years. As such, managers will need to understand the risks they are taking in ever greater depth. Thankfully, attribution models have now firmly caught up with the complexity of the market.