By Dave Nadig | February 8, 2016

You’d think with the amount of hyperbole being thrown around about how ETFs are going to completely destroy global capitalism, flipping billions of dollars around inside the First Trust ETF complex might expose the cracks in the system or at least raise a few eyebrows. Instead, all it’s done is point out how resilient the ETF structure is.

The story’s pretty simple (as broken by Chris Dietrich at Barron’s on Friday.)

It’s sitting at over $3.6 billion in assets after less than two years. It’s an astonishingly simple fund. It simply holds the five First Trust sector funds that the classic Dorsey Wright methodology thinks are buys (based mostly on relative strength).

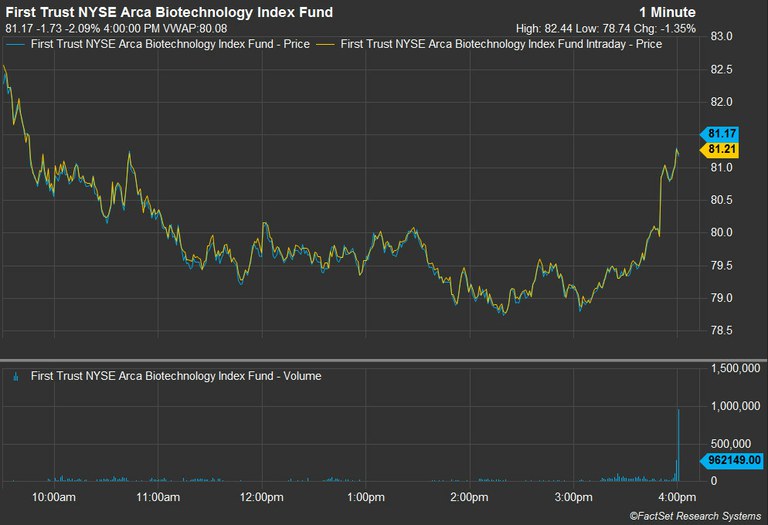

On Friday, FV rotated out of the First Trust NYSE Arca Biotechnology ETF and into the First Trust Utilities AlphaDex ETF. Even if you don’t understand the Dorsey Wright methodology all that well, just knowing it’s basically a momentum strategy should make you understand from this chart.

Plenty of momentum in evidence here, just going the wrong way. Importantly, note that the fund has basically traded close to its net asset value (NAV) perfectly over this period. Also note that the volume on Friday was insane: 20 times higher than an average day.

So how does a trade this large actually happen, especially when the fund doing the trading is an ETF, and the actual securities being traded are also ETFs?

Going into Friday morning, FV was 21.44% in FBT—21.44% of $3.682 billion is $789 million, or 44% of the $1.791 billion in FBT. Swapping one fund for another in a single day would gut FBT and double FXU, all in an instant. Surely this has to be a test of the very fabric of an ETF.

Here's how FBT traded during the day, versus its intraday NAV:

Again, while it was definitely a down day for a while, note that the fund pretty much perfectly tracked iNAV, so at any point during the day, you were getting awfully close to the fair value of the underlying securities. So why do we see this weird pattern of steady selling and then a sharp recovery? Because the actual trades from FV aren’t on this chart. Not even, likely, at the end.

Here’s the actual tape.

See that trade at the top for 9,524,855 shares? That's $761 million of FBT, which is conveniently just about how much FV reported holding going into the day. And note the price here—$79.9756—below the closing auction price of $81.11 (highlighted above) and about 10 cents of 0.12% below the volume weighted average price (VWAP) of the day (80.08, in the upper right hand corner).

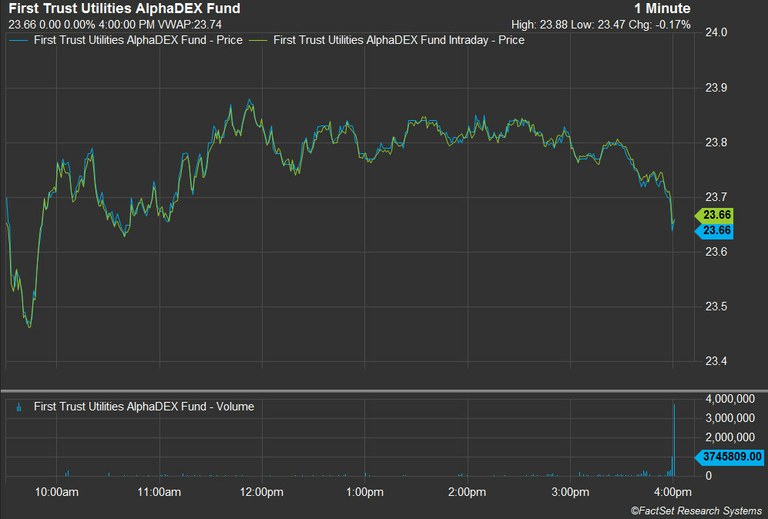

And on the flip side, here’s the chart for FXU:

And the nearly identical trade on the tape:

What's going on here? Well, to the uninitiated, these don't look like great trades—selling below VWAP, buying over it. But think about how this process likely played out (and this is all just supposition, of course).

Neither FBT or FXU has the creation/redemption activity to naturally "in-kind" this big of a rebalance, so at some point, someone has to actually make a trade. By the end of the day, FV needs to get rid of >$700 million of FBT and add the same amount of FXU.

If they had infinite flexibility in constructing their creation and redemption baskets, they could have gotten clever and done a pair of in-kind swaps with a huge trading partner or two: a Goldman, a KCG, a Cantor or someone like that.

In such a transaction, the trading partner would do a simultaneous creation of new shares in FV using FXU as the only security, and a redemption of shares in FV, receiving only FBT. We'd never see these transactions, because creation and redemption activity by itself doesn't hit the tape, and the share count for FV would remain the same, but the trading partner would then end up with a pile of FBT, and need a ton of FXU at the end of the day.

The trading partner, knowing that it was going to be very long FBT and very short FXU at 4 p.m., would spend its day preparing a giant creation of FXU and a giant redemption of FBT. It would do all the buying and selling of the underlying securities, mark the trades in FXU and FBT at the end of the day, deliver all the FBT it just got from FV back to the issuer in exchange for all the stocks it'd been selling short all day (so it could settle all those trades), and deliver all the utilities stocks it'd been buying all day to receive the FXU (so it could settle that leg of the trade). It sounds complicated (redemptions in FV and FBT, creations in FV and FXU), but it's actually pretty simple.

While that is both clever and possible, it's not what we're seeing here. The presence of the large, marked trades at 4:40 p.m. suggests actual buys and sells.

In-kind transactions are generally done to avoid incurring capital gains. However, it seems pretty unlikely, given the performance of biotech lately, that it's actually had FBT sitting on the books of FV at a gain.

If it's sitting at a loss, it's to the advantage of the fund's shareholders to actually sell and book the loss, because it can sit on those capital losses to offset future gains. In that case, the manager of FV wouldn't negotiate a custom swap, it'd simply "work" the trades, based on certain parameters: a target price based on VWAP, simple best-efforts, etc.

These kinds of worked trades end up getting somewhat double-reported.

The trading partner knows at the end of the day it's going to end up with $700 million of an ETF it doesn't really want, and owe $700 of an ETF it doesn't have. It has two ways to unwind these known end-of-day positions.

The zero-risk way of doing it is to simply put in giant market-on-close orders for all of the underlying stocks in both ETFs. After all, the NAVs of FBT and FXU are determined by the closing price of those underlying stocks, so if the AP is short those stocks and long all that FBT at the end of the day, it can have a zero-risk redemption at the end of the day. If it buys all the utility stocks and is short the FXU shares, it can do a zero-risk creation for the other leg of the trade.

The other way it can unwind the positions is by working to "get short" FBT and "get long" FXU at good prices all day. It can use any combination of street-savvy gut and algorithms to recognize prices that will likely be on the right side of VWAP. That means what you see on the tape for FBT is the trading partner "preselling" FBT all day long, knowing at the end of the day it's going to be getting a big pile of it to settle up those trades.

I suspect some combination is going on here. The two booked 4:40 p.m. trades don't perfectly match—the FBT sale is $762 million and the FXU buy is only $707 million. So in addition to the FINRA alternative display facility trades marked at 4:40 p.m., I suspect additional shares were bought and sold through the large closing auctions, and at other times during the day.

A quick look at fund flows from Friday for both funds suggests this combo too—FBT had $621 million in outflows, and FXU had $671 million in inflows, so not every share here resulted in creation/redemption activity.

The question is, how does this affect the underlying holdings? Let's consider the largest and smallest holdings in FBT.

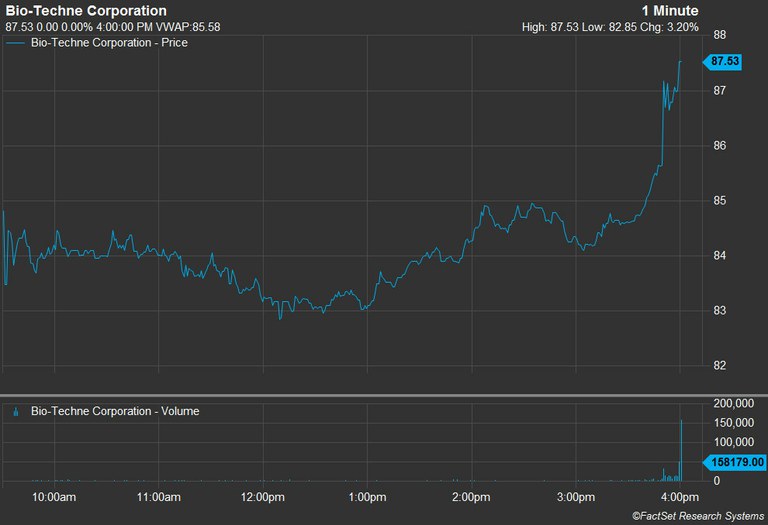

Bio-Techne Corp. (TECH) is about 4% of FBT.

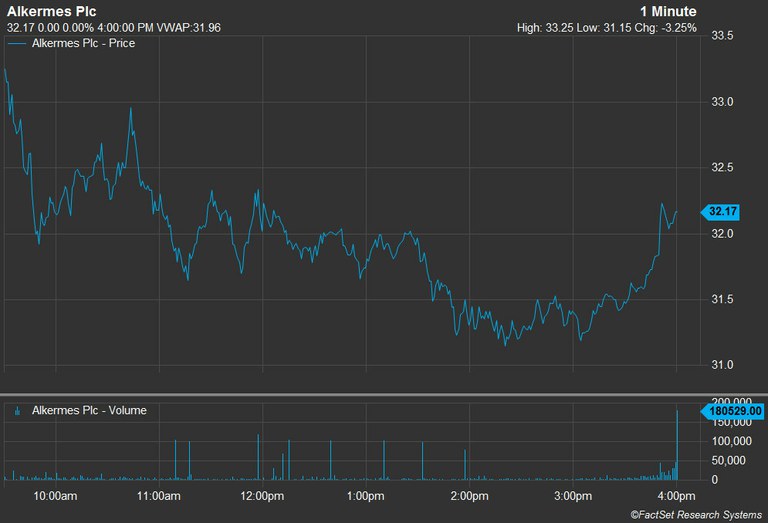

Alekermes PLC (ALKS) is about 2% of the fund.

Unsurprisingly, both stocks showed a similar "smile" pattern during the day matching FBT ... that's almost axiomatic, given FBT tracked its index all day. They also had similar patterns of volume, with ramps into the close, and decent-sized closing auctions.

In short, the whole process worked like a well-conducted orchestra, with transparent and immediate impacts from the smallest-affected stocks to the largest parts of the block trade.

Is it "good" for biotech stocks? Of course not. A very large investor just decided to dump biotech. That's going to hurt the stocks whether that big investor had owned the stocks directly, or in a mutual fund, or a separately managed account or in an ETF.

But the process of information-signaling worked just like it's supposed to, and regardless of how First Trust negotiated the trade—either all at once, or as legs, or as in-kind transfers or any combination thereof—the reality is that over $700 million moved out of one set of stocks into another, all for about 10 basis points off VWAP.

Seems pretty efficient to me, and the whole thing is a kind of object lesson in how big ETFs trade—and are traded—at the same time.

How Private Capital Is Powering the Johor-Singapore Special Economic Zone

This FactSet analysis provides insight into the early stage of the JS-SEZ progress with key data points. Stay informed on how...

How Transaction Cost Analysis Is Evolving from Compliance Tool to Trading Decision Support

Discover insights to further strengthen your TCA capabilities in this FactSet analysis. Consider how you can make the most of TCA...

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.