Low rates and the search for yield are an old story, but today that story has a new twist.

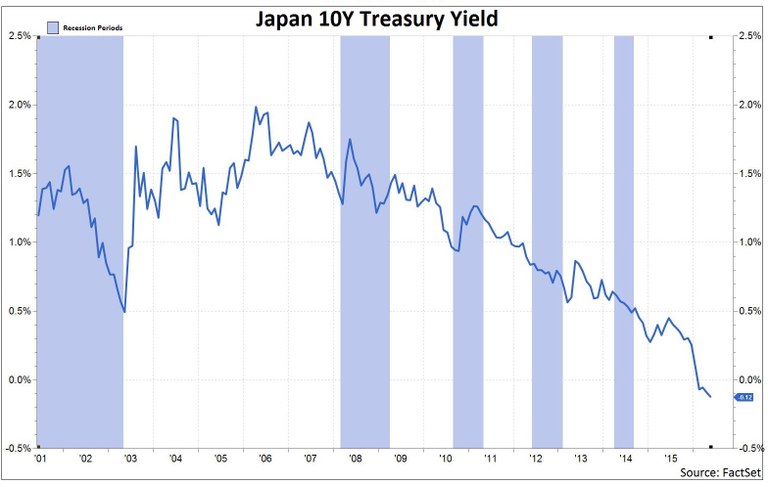

The past several months have seen an increasing level of divergence in the global marketplace. We’ve seen incredible levels of volatility in equity markets, beginning signs of lift off in the US (or at least nudges away from a zero interest rate policy), negative rates have become the tool du jour in the Eurozone and Japan (out to nearly the 10-year and 15-year points on their respective curves), nonexistent liquidity in most fixed income markets (except those being used in central bank quantitative easing schema), and wild currency swings across any number of crosses (USD/GBP, USD/JPY, anything/BRL – you name it).

So in light of those developments, what are investors doing now to make sense of this crazy mixed up world?

Shifting the Hunter-Gatherer Approach

While the trends discussed above have broad implication for the global financial ecosystem, where they impact fixed income investors on the hunt for Alpha is in investment attractiveness and yield spreads.

For fixed income investors, lower quality and/or longer duration have been go-to options for many years; however, this strategy is not always palatable from a risk budgeting position. The reduced level of liquidity across most markets also warrants discussion. Consequently we are seeing a few notable repercussions.

Related: US Muni Funds Jolted by Puerto Rico's Debt Crisis

First, there is now greater acceptance of leveraged loans outside of the traditional US or Euro HY/Credit shop. Long a favorite of the private equity and venture capital set, the seniority, floating rate, and attractive spread levels of leveraged loans can offset the riskiness seen in the underlying issuer and make for an attractive vehicle for more mainstream investors.

Second, security types that went wildly out of favor during the financial crisis are creeping back into the market. For example, subprime auto loans have returned in force with the maxim that “borrowers will give up their house before their car. You can’t drive the house to work.” Another example is seen in the RMBS space, where Barclays just started issuing 100% loan to value mortgages. While still a rarity, this is something that would have been unheard of even 12 months ago.

Third, where liquidity has disappeared, we’re seeing a significant uptick in the credit derivatives market via CDS/CDX issuance.

In addition to these headwinds, right now currency rates are puppets at the end of central banking strings. Many global investors are finding greater opportunity in carry trades. For example, depending on your thesis around the Brexit, Eurozone recovery, or outcome of political issues in Brazil and South Africa, the currency market is the most liquid in the world; it’s incredibly easy to move from risk on to risk off depending on your book.

Filling Your Quiver

Taken in isolation, these trends impact the ability of individual strategies to generate returns, but they also pose challenges in aggregate; with the advent of multi-asset class investment styles Alpha-hunters must be prepared to capitalize on a variety of environments. The natural evolution of this can be seen in the popularity of unconstrained or multi-asset class products that allow for a “go anywhere” approach.

As a result, the strategies and toolsets investors rely on to manage their portfolios (multi-asset class or otherwise) require another look, and there are three attributes that investors need to evaluate when selecting platforms to support today’s market: flexibility, consistency, and power.

Flexibility ensures you’ll maintain the ability to adjust your perspective contingent on the landscape you’re approaching. Be it ex-ante risk, performance and attribution, ad hoc analysis, or ongoing monitoring, investors facing this new reality need the tools to adapt to any situation. Consistency ensures your tools give you the ability to repeat an approach. After all, being able to rerun successful strategies day in and day out is what leads to returns for investors and their clients. Last but not least, powerful investment tools provide full multi-asset class support, whether that is issuer/issue coverage, macro data, idea screening, news, or portfolio analysis tools.

To get similar returns to those enjoyed only a few short years ago, investors will need to consider new options and tools.