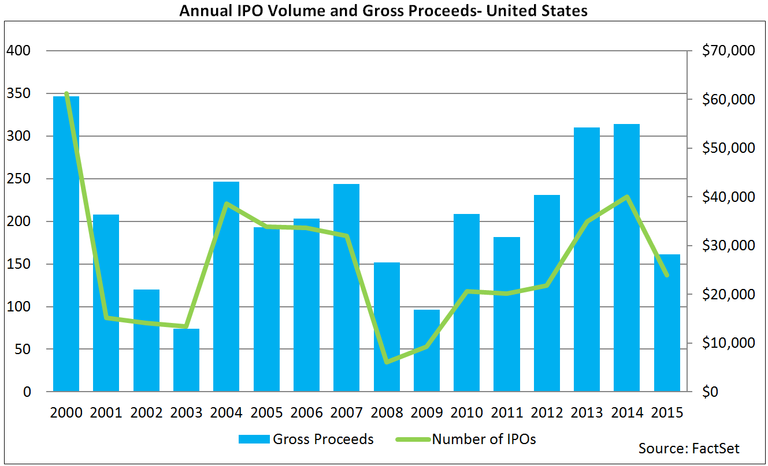

In 2014, the US IPO market had a record year. There were 229 companies headquartered in the United States that went public, which made up $55 billion in gross proceeds. This marked the most deals and largest aggregate amount of gross proceeds raised in a year since 2000. In 2015, the market for initial public offerings began to dry up. The count of US companies going public dropped by 40% (137 companies) compared to 2014, and total gross proceeds were essentially cut in half ($28.3 billion).

Lowest Number of US IPOs Year-To-Date Since 2009

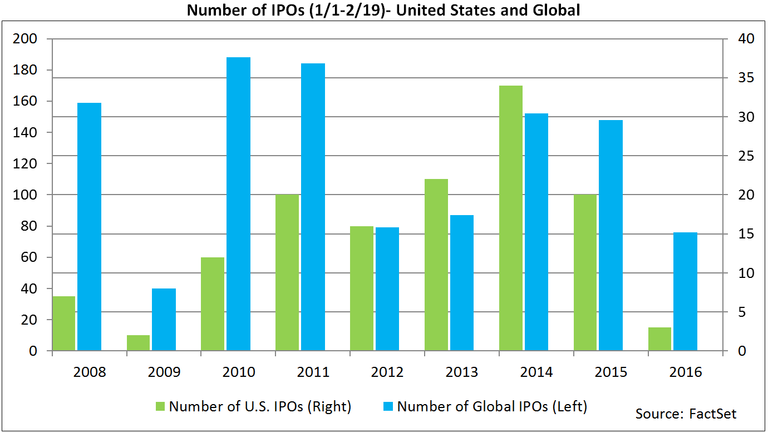

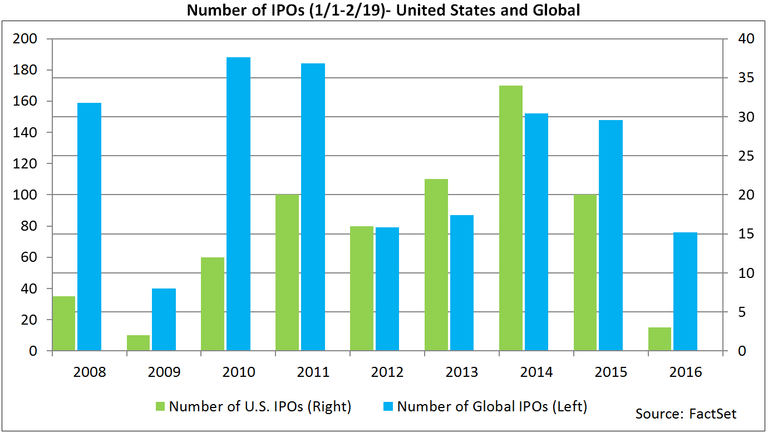

The downward trend has continued in 2016. As of February 19, 2016, only three companies headquartered in the United States had gone public year-to-date, which marked the lowest number of IPOs over this time period (1/1-2/19) since 2009, when just two companies priced in the public market. At this point last year, 20 IPOs had already occurred, with Shake Shack and Box being the most notable names on that list. This trend is not isolated to companies based in the United States. It is evident in the global IPO market as well. On a year-to-date basis as of February 19, 76 companies had gone public globally, which represented the lowest IPO count over that time frame since 2009, when 40 companies went public through 2/19. At this time last year, the market had already seen 148 initial public offerings globally, which is nearly double the number in 2016.

Twelve US Companies Postponed or Withdrew IPOs in 2016

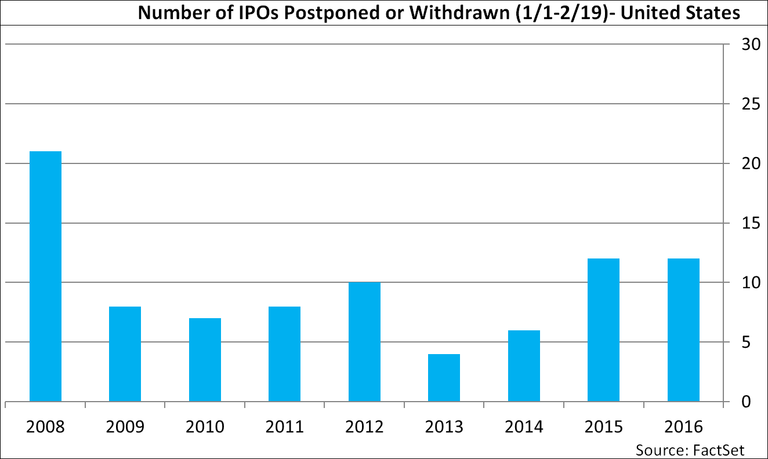

A primary reason for the decline in IPOs has been the rise in market volatility. As of the close on February 19, the S&P 500 and NASDAQ Composite were down 6.2% and 10% for the year, respectively. Additionally, the average daily value of the CBOE Volatility Index so far in 2016 has climbed to 23.5, while the average for all of 2015 was only 16.7.This has been scaring companies from entering the public market. Even when companies register their initial preliminary filings, there is no guarantee that management will follow through with the offering. As of February 19, 12 US companies had either postponed or withdrawn their initial public offerings on a year-to-date basis. This matched the total amount through February 19 back in 2015. Prior to that, the highest number of postponements or withdrawals over that same time period occurred in 2008, when the number reached 21. Of those 12 companies that had postponed or withdrawn their initial public offerings this year, five of the companies had cited market volatility or unfavorable market conditions as a primary reason for the decision. Three of those companies were online lender, Elevate Credit, restaurant and concession operator, OTG Exp, and fintech firm, AmeriQuest.

Initial Prelim Filings Show Ongoing Weakness in US IPO Market; Global IPOs Gaining Steam

Looking ahead, 17 companies in the United States had submitted preliminary IPO filings in 2016 through February 19. There has not been a lower amount of registrations over that time period since 2009, when just three registrations were filed. This represents a stark contrast to the initial preliminary filings submitted globally. On a year-to-date basis through February 19, 77 companies globally had submitted preliminary IPO filings, which marked the largest count since at least 2008, when FactSet began collecting the data. It is interesting to note that companies based in Japan and India made up almost half of these registrations (18 companies each.)