Kirsi Inki, Sales Specialist, Economics, Economics Strategy, and Workstation Solutions, contributed to this report.

In January 2013, Prime Minister David Cameron promised voters an in-or-out referendum on European Union membership if his Conservative party won the 2015 general election. When the Conservatives gained an outright majority in Parliament, the stage was set for changes that would have impacts beyond the UK.

Fast forward to February of this year, when Cameron participated in a marathon two-day summit with fellow European leaders to negotiate changes to Britain’s relationship with the EU. Immediately following the Brussels meetings, Cameron set June 23 as the date for a nationwide referendum on EU membership. In the weeks since that announcement, the debate between the “remain” and the “leave” campaigners has intensified, with most opinion polls currently predicting a draw.

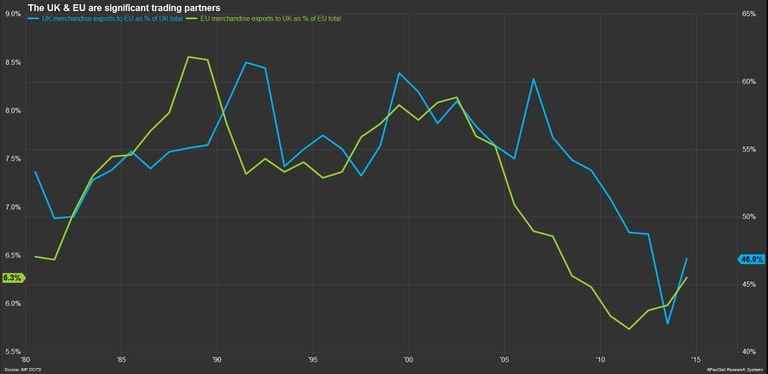

Although both sides are arguing about the benefits and costs of the UK’s EU membership, there is no denying that the UK and the EU are significant trading partners. According to the IMF, Britain’s 2014 merchandise exports to the European Union represented nearly half of total exports (46.9%); at the same time, EU merchandise exports to the UK accounted for 6.3% of total EU exports, ranking it as the third most important destination in the EU, behind Germany and France. Market uncertainty about the UK’s prospects has led the British pound to depreciate sharply against the euro and the U.S. dollar in the last few months. However, the pro-Brexit (i.e., British exit from the EU) campaign sees this as a good sign because the weaker pound will boost UK exports.

If UK citizens vote to stay in the European Union, the reforms that Mr. Cameron agreed upon with the other European leaders will take effect immediately. The settlement covers four main topics (economic governance, competitiveness, sovereignty, and welfare/free movement) and includes changes to child benefits and welfare payments to migrants, better protection of non-Eurozone member states, safeguards for Britain’s financial services industry, and the reduction of bureaucratic red tape to improve competitiveness.

If the British public votes to leave the EU, the exit process will start promptly according to the rules set out in the Article 50 of the Lisbon Treaty, which describes the procedure for countries to exit the Union. This will trigger a series of talks that will take a minimum of two years. The UK will first have to negotiate the withdrawal agreement and then new trade deals with the EU and economies outside of the EU. It will also need to consider how to replace existing EU laws and how to secure the rights of UK citizens currently living in other EU states. If the UK exits the EU there may also be another referendum on Scottish independence, and the results may not be the same as the last time when Scottish voters narrowly opted to stay.

There is a lot of economic uncertainty surrounding the Brexit vote, which is starting to negatively reflect on UK business and consumer confidence indicators. The February manufacturing, services, and construction PMIs declined compared to January, but all three still remain above the 50 mark, indicating that those sectors are still expanding. Although UK consumers remain optimistic regarding their own personal finances over the next 12 months, they are increasingly negative about the general economic situation.

It will be interesting to see how these indicators develop with the release of March sentiment figures next week.