The verdict is out: China A Shares will not be included in the MSCI Emerging Markets Index, at least for now. After weeks of speculation, this week MSCI announced the time is not yet right for the A shares to be included in the index, but left open the possibility to include them at a later point outside of the annual review process. From Hong Kong, I closely experienced the anticipation of the decision, but I couldn’t help wondering whether all the commotion was warranted. Certainly, the decision will have an impact, as money will flow into China A shares the moment they are included in the index, but would there be other ways to quantify the impact and perhaps prepare for it?

Quantifying the Impact

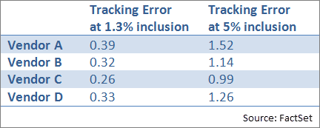

To get a feel for the impact, I investigated what the impact of inclusion would be from a risk perspective. First, I built a composite benchmark blending China A shares at 1.3% weight with the existing Emerging Markets index*. I then calculated what the tracking error would be of this “new index” to the existing index using models from the four vendors FactSet integrates on our system.

As we see, at a 1.3% inclusion rate, the results are consistent across the different vendors, with predicted tracking errors ranging from 26 to 39 basis points. From a passive tracking perspective, this might be significant; the average active manager might not sleep a second less because of this. MSCI indicated that in a later phase it might include the index at a higher weight. Though not specifying at what weight, MSCI confirmed only that it will not be at the full weight, in which case the A shares would make up 20% of the index. Therefore, I also ran the analysis weighting the A shares at 5% of the new index. In this case, the tracking errors start to become significant and the vendors tend to agree less with the predicted numbers, ranging between 99 and 152 basis points.

Be Prepared

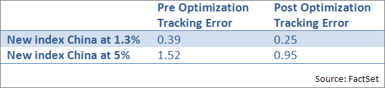

Whether due to concerns about the daily quota on the Stock Connect program or potentially the lack of a RQFII or QFII, not everyone will be jumping on the opportunity to invest in A shares. I wondered, therefore, how much of the above risk could be mitigated while only investing in H shares? Quite a few companies are in both indices after all. I ran an optimization using the most conservative risk model (vendor A), limiting my buy list to just the existing index, minimizing the risk against the “new index.”

Obviously we cannot completely reduce the risk, as the A Shares will introduce new names, but what can be seen is that the risk can be reduced by 35% without buying a single A share. This would also allow a portfolio manager to gradually tilt the portfolio in anticipation of the inclusion, minimizing the trade impact at the time of inclusion and letting the manager enjoy the anticipated rally rather than be late to the party, all while staying within the mandate of the existing benchmark.

Obviously we cannot completely reduce the risk, as the A Shares will introduce new names, but what can be seen is that the risk can be reduced by 35% without buying a single A share. This would also allow a portfolio manager to gradually tilt the portfolio in anticipation of the inclusion, minimizing the trade impact at the time of inclusion and letting the manager enjoy the anticipated rally rather than be late to the party, all while staying within the mandate of the existing benchmark.

Commotion warranted?

So was the commotion around the decision warranted? First, even though the Shanghai Composite index dropped about 2% Wednesday morning, it is now back to Tuesday’s level. Given the recent turmoil with a 6% swing, it seemed rather uneventful. Looking forward when the index will get included, the answer probably depends on your investment approach. As an active manager, 39 basis points might not be something to worry over, whereas for an index tracker, that 39 basis points might raise all sorts of red flags. Regardless, one can come prepared once the A shares are included and, even without investing in them directly, it is possible to mitigate some of the risks that would arise and hopefully enjoy an anticipated rally.

*The inclusion of MSCI China A Shares at 1.3% serves as a proxy. MSCI in its consultation is suggesting more inclusion criteria, such as foreign ownership.