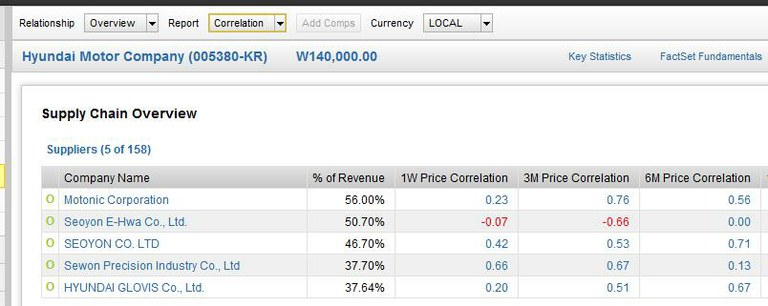

Next week, Hyundai Motor Company will report earnings. With 156 companies in Hyundai’s supply chain relying on that relationship for revenue, the report will no doubt by closely watched by investors. FactSet identifies these suppliers and shows the revenue percentage and price correlation to the company.

Motonic Corporation, for example, is a Korean automobile parts company that specializes in oil pumps and air induction components and receives 56% of their revenue from their relationship with Hyundai. U.S. automotive supplier Visteon Corporation receives 10% of their revenue from their relationship with Hyundai, while 27% comes from Ford Motor Company, and another 10% comes from KIA Motors Corporation.

Companies do not live in isolation; they exist in an entire ecosystem of global relationships. The increasing complexity of these networks highlights the need for investors to look beyond major connections of supplier, customer, and competitor and include other important global relationships such as distribution, manufacturing, joint ventures, investors, and licensing. FactSet’s Supply Chain DataFeed provides visibility into these underlying core risk factors so investors can prevent unnecessary losses and identify new investment ideas.