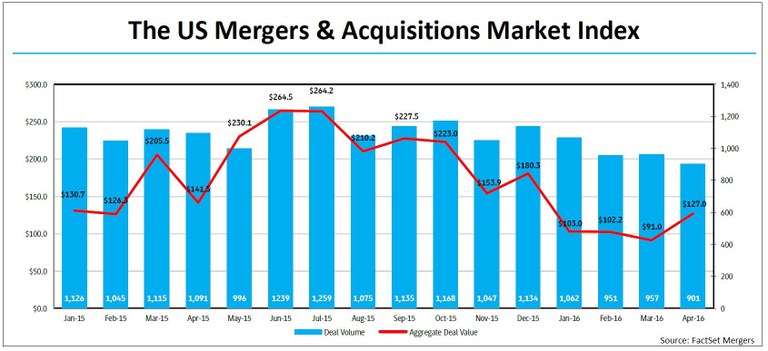

US M&A deal activity decreased in April, going down 5.9% with 901 announcements compared to 957 in March. However, aggregate M&A spending increased. In April, 39.5% more was spent on deals compared to March.

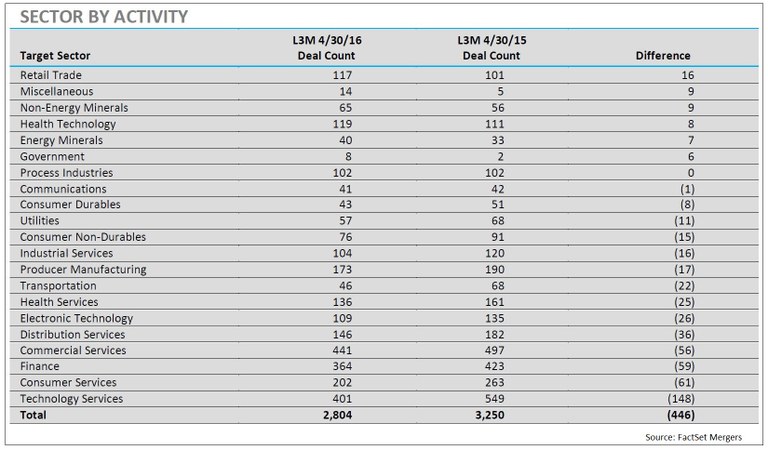

Over the past three months, the sectors that have seen the biggest increases in M&A deal activity, relative to the same three month period one year ago, have been:

- Retail Trade (117 vs. 101)

- Miscellaneous (14 vs. 5)

- Non-Energy Minerals (65 vs. 56)

- Health Technology (119 vs. 111)

- Energy Minerals (40 vs. 33)

Six of the 21 sectors tracked by FactSet Mergerstat posted relative gains in deal flow over the last three months compared to the same three months one year prior.

Over the past three months, the sectors that have seen the biggest declines in M&A deal volume, relative to the same three month period one year ago have been:

- Technology Services (401 vs. 549)

- Consumer Services (202 vs. 263)

- Finance (364 vs. 423)

- Commercial Services (441 vs. 497)

- Distribution Services (146 vs. 182)

Fourteen of the 21 sectors tracked by FactSet Mergerstat posted negative relative losses in deal flow over the last three months compared to the same three months one year prior, for a combined loss of 501 deals.

Topping the list of the largest deals announced in April are: Abbott Laboratories' agreement to acquire St. Jude Medical, Inc, for $24.1 billion; AbbVie, Inc.'s deal to acquire Stemcentrx, Inc. for $9.8 billion; Sanofi's proposal to acquire Medivation, Inc. for $8.6 billion; A private group led by Libin Sun submitting a non-binding proposal to acquire the remaining 95% of Integrated Device Technology, Inc. for $4.1 billion; NBCUniversal Media LLC, a subsidiary of Comcast Corp., agreeing to acquire DreamWorks Animation SKG, Inc. for $3.5 billion.

Related: Mega Mergers Shift Revenue Exposure

US Private Equity Activity Increased in April, up 4.0% from March

US private equity activity increased in April, up 4.0% from March. There were 105 deals in April compared to 101 in March. Aggregate transaction value increased as well, up by 15.3% to $18.9 billion from March's $16.4 billion.

The top financial advisors for 2016 based on deal announcements, are: Goldman Sachs & Co., JPMorgan Chase & Co, Morgan Stanley, Bank of America Merrill Lynch, and Houlihan Lokey, Inc. The top five financial advisors, based on the aggregate transaction value of the deals worked on, are: Goldman Sachs & Co., Bank of America Merrill Lynch, Morgan Stanley, JPMorgan Chase & Co, and Credit Suisse.

The top legal advisors for 2016 based on deal announcements, are: Kirkland & Ellis LLP, Jones Day LP, Latham & Watkins LLP, Skadden, Arps, Slate, Meagher & Flom LLP, and Weil, Gotshal & Manges LLP. The top five legal advisors, based on the aggregate transaction value of the deals worked on, are: Skadden, Arps, Slate, Meagher & Flom LLP, Wachtell, Lipton, Rosen & Katz, Cravath, Swaine & Moore LLP, Sullivan & Cromwell LLP, and Simpson Thacher & Bartlett LLP.

FactSet Flashwire Monthly Report

- Key trend information for the Overall and Middle M&A Markets, such as deal volume, deal value, mega-deals, leading buyers, leading industries, leading sectors, cross-border deals, US regional deals, average P/E, average premiums, payment methods, and much more

- Industry reports on the Internet, Telecommunications, Healthcare, Banking, and much more

- Special reports on technology, the public and private M&A markets, cancellation fees, industry activity, etc.

- Leading financial and legal advisor rankings