Suzy Valdes-Rodriguez, Senior Consultant and Emily Kobyra, Senior Consultant, also contributed to this report.

Whether a flower between friends or a life-altering ring for your partner, billions of dollars are spent each year on Valentine’s Day. This influx of cash creates a very happy February for a number of companies. But while many capitalize on the holiday, few reap the rewards as intensely as specialist companies like Tiffany & Co. and 1-800-FLOWERS.COM.

Tiffany & Co. (TIF-US)

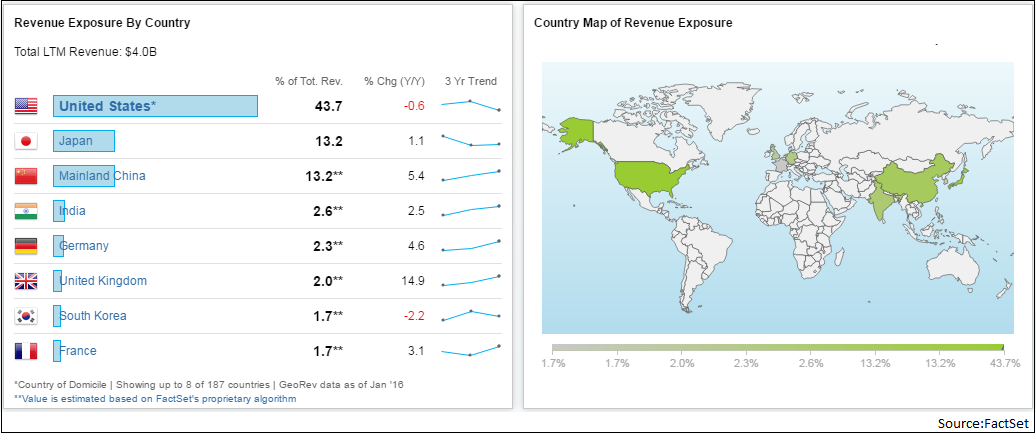

Known for its little blue box, Tiffany & Co. is frequently on the shopping list for consumers with a budget for more than a box of chocolates on Valentine’s Day. While the company is based in the United States, Tiffany derives less than half of its sales from the U.S., relying on Japan and China for 26% of its revenue, with China’s share growing at over 5% year over year.

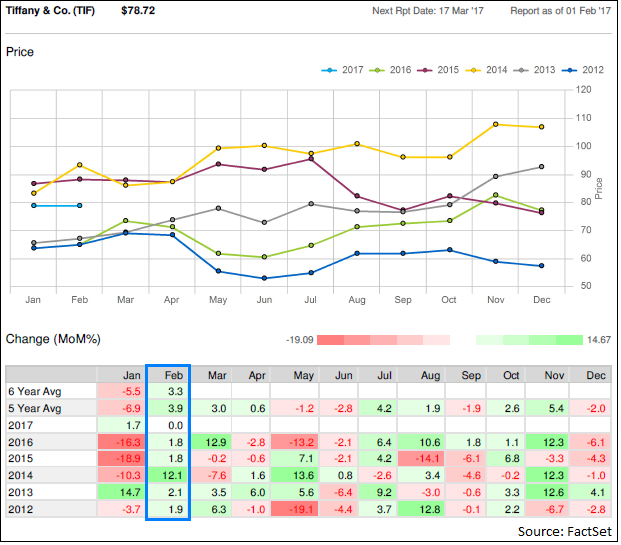

With Valentine’s Day festivities spreading across the globe, Tiffany and Co. has historically had a strong February. Looking over the previous five years, February is the only month in which Tiffany has not seen a decrease in stock price. January has historically been tough for the company as it comes out of the holiday season, but its a good sign for investors that TIF is consistently able to pick up business again in February.

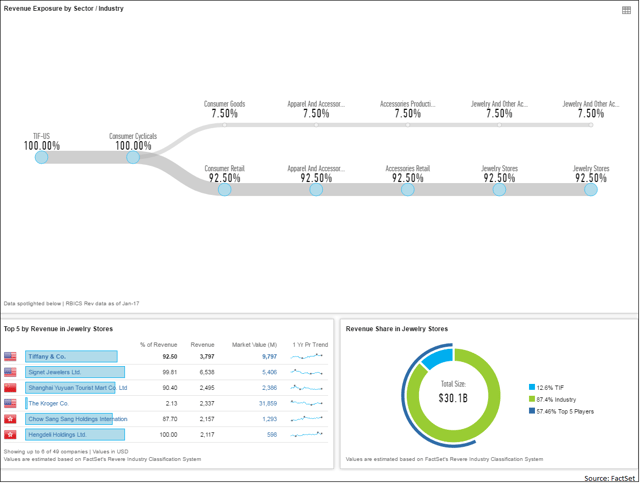

Over 92% of Tiffany & Co.’s sales come directly from jewelry stores, giving them about a 12% stake in the industry. The company relies on commercialized celebrations like Valentine’s Day, anniversaries, and birthdays to drive sales throughout the year.

Looking back to 2014, the Engagement Jewelry and Wedding Bands product segment increased total revenues by 5% for the year. Valentine’s Day 2014 clearly inspired consumers to “put a ring on it,” as the Engagement Jewelry and Wedding Bands category revenues increased by 11% due to growth from solitaire diamond rings and wedding bands.

However in 2015, it appears fewer consumers used the holiday as an occasion to pop the question. Tiffany & Co. reported 29% of total sales from engagement jewelry and wedding bands, however there was an 11% decrease from the previous year in engagement jewelry and wedding bands revenues during Q1, specifically from solitaire diamond rings and wedding bands in Japan. Looking forward to Q1 2016, Tiffany & Co. reported a decrease in net sales of 9% in the Americas and 7% globally. The Engagement Jewelry and Wedding Bands category decreased by 4% during Q1'16, due to a “shift in sales mix toward wedding bands within the engagement jewelry and wedding band category.”

1-800-FLOWERS.COM Inc. Class A (FLWS-US)

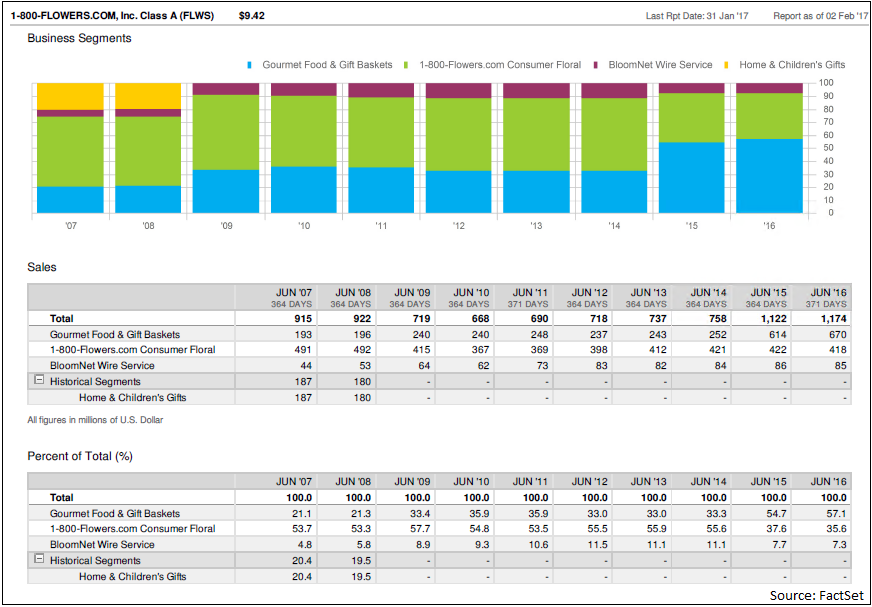

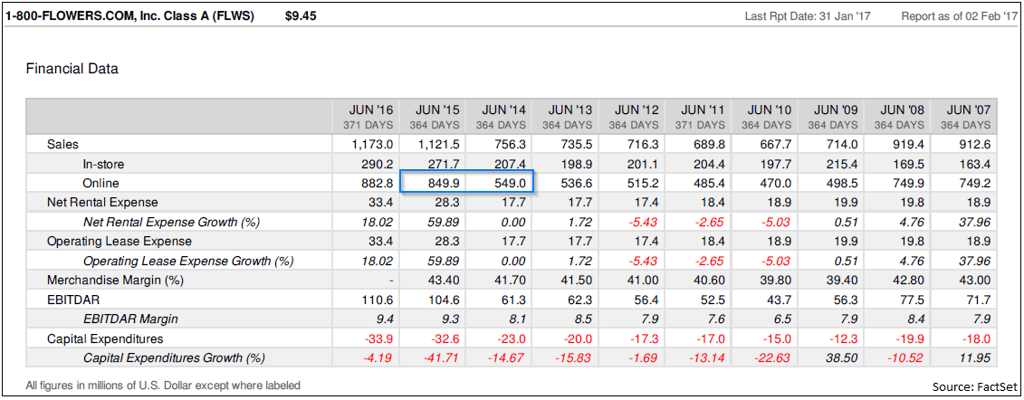

Offering traditional Valentine’s roses and more, 1-800-FLOWERS.COM Inc. is another company invested in the holiday of romance. Unlike Tiffany & Co., 1-800-FLOWERS.COM derives 99% of its revenue from the United States with the last 12-month’s revenue reaching $1.2 billion. Additionally, over the last five years the company has seen a tremendous increase in revenue, growing at over 11%.

1-800-FLOWERS' consistent sales growth over the years can be attributed to its three businesses: Gourmet Food & Gift Baskets, Consumer Floral, and the BloomNet Wire Service. Diving into each segment, we see a large shift in how sales were generated between 2014 and 2015. In particular, the percent of the total sales attributed to the Gourmet Food & Gift Baskets segment nearly doubled between 2014 and 2015, shifting from 33.3% of sales to 54.7%. During this period, the percent of total sales attributed to the Consumer Floral segment remained steady in regards to its total revenue, but its percentage was cut nearly in half, dropping from 55.6% to 37.6%.

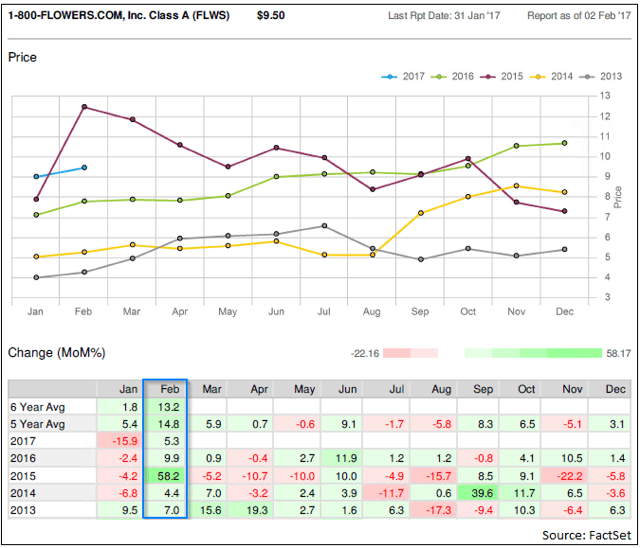

Given the variety of gift options that 1-800-FLOWERS offers (and the plethora of holidays sprinkled throughout the year for it to capitilize on), it not surprising that Valentine’s Day is a key event for boosting sales as well as stock price. Looking over the previous five years, 1-800-FLOWERS has also never seen a decrease in stock price in February. On average over the last five years, the month-over-month % change for February was 14.8%, much higher than any other month. In February 2015, the increase was especially high, at 58.2%.

This brings us back to some intersting observations concerning the data from 2014 to 2015. Considering 1-800-FLOWERS.COM’s segment data from 2015 (where there was a spike in sales within the Gourmet Food & Gift Basket segment) alongside TIF’s -11% decrease in engagement jewelry and wedding band sales during Q1 of 2015, its possible V-Day revelers were more likely to give food and gift baskets than pop the question that year. If we look at the online sales for 1-800-FLOWERS between 2014 and 2015 our conviction in the interdependencies of these two events is even stronger. 1-800-FLOWERS saw $549 million in online sales in 2014, while in 2015 they saw $849.9 million. This suggests that online shopping was more often at the fingertips of consumers in 2015 than wedding bands were.

With Valentine’s Day spending expected to be lower this year than last, will we see the trend of gains continue for these two companies? Will online shopping continue to propel 1-800-FLOWERS.COM to its sixth consecutive February growth? Will Tiffany & Co. be able to recover after the price declines with the departure of their CEO to post the eighth consecutive winning February?