In FactSet’s latest Emerging Ideas webcast, How to Effectively Manage Multi-Asset Class Risk, our presenters explore the challenges in managing risk in a global multi-asset class portfolio, where security fundamentals, market conditions, asset correlations, and risk exposures can change daily. Core to the approach is FactSet’s Multi Asset Class (MAC) Risk Model, a sophisticated global risk model that helps users understand and communicate the total market risk of portfolios across a wealth of different asset types and classes.

The foundations of FactSet’s MAC model begin with capturing inputs from equities, fixed income securities, commodities, currencies, returns-based assets, and derivatives on a global basis. After gathering the risk-related benchmarks and analytics, the holdings and recent trades of investors are evaluated against the risk-related benchmarks and analytics that have been collected.

Understanding VaR in a true multi-asset class framework is increasingly important for fund managers, advisors, and their clients. VaR, when used in conjunction with stress testing, forms the foundation of a complete risk management tool.

In the webcast, Louis Scott, Director of Risk and Quant Research, demonstrates how stress testing can help identify safe havens during crisis. Using the credit crisis of October 2008 as the extreme event, he stress tests a safe haven portfolio via Monte Carlo simulation. The equity portion of this defensive portfolio was exposed to low beta and high quality credit (i.e., equities were largely underweighted, with financials in particular) and was overweight in corporate bonds to gain indirect exposure to equities. The commodity strategic allocation was used to diversify but was line with the benchmark returns; the fixed income component consisted of short duration instruments that were higher quality than the index, thus added value to the overall portfolio.

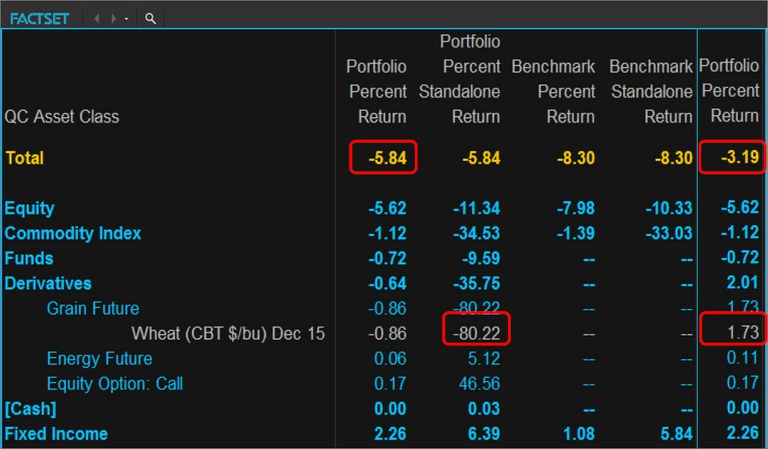

The derivatives in this portfolio should be diversifying, but through the stress test we see that the estimated stand-alone return for the Grain Futures is significantly negative (-80.22). Why? In the 2008 financial crisis, the widening of credit spreads had a very adverse effect on futures markets that relied on margin lending. When the measure of counterparty credit risk surged, the resulting credit crunch led to a global slowdown, in turn hurting the futures markets, particularly perishable assets such as Grain futures, which resulted in a steep price drop. The final column on the right illustrates what the return would have been if the Grain Futures were shorted.

Such effects would not be captured without the cross-asset class factor exposure that make these relations known. Commodities that were accepted to be diversifying were strongly exposed in the credit crisis of 2008, and, unlike other sub-portfolios, this was not a safe haven. Only a true multi-asset class risk model is able to expose these cross-asset class linkages.

Learn more about how FactSet’s MAC risk model can help you manage your portfolio in our Emerging Ideas webcast.