The North American Free Trade Agreement (NAFTA) went into effect in 1994 and sought to eliminate trade barriers between Canada, Mexico, and the United States. The Agreement has become a subject of scrutiny for President Trump. The new administration has stated, "President Trump is committed to renegotiating NAFTA. If our partners refuse a renegotiation that gives American workers a fair deal, then the President will give notice of the United States’ intent to withdraw from NAFTA.”

Given a possible withdrawal from NAFTA, what are the implications for companies in the S&P 500?

What is the Revenue Exposure of the S&P 500 to Canada and Mexico?

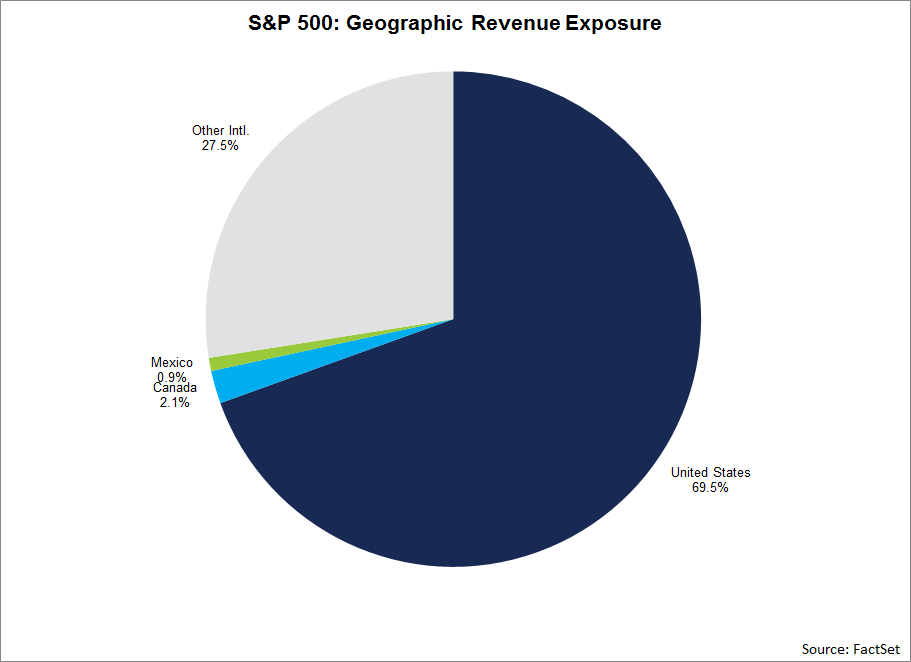

As Canada and Mexico are the main trading partners of the U.S. impacted by potential changes to NAFTA, what is the revenue exposure of the S&P 500 to these two countries?

According to FactSet Market Aggregates and FactSet GeoRev data (based on the most recently reported fiscal year data for each company in the index), the aggregate revenue exposure of the S&P 500 to Canada and Mexico combined is 3.0%. The S&P 500 has aggregate revenue exposure of 2.1% to Canada and aggregate revenue exposure of 0.9% to Mexico.

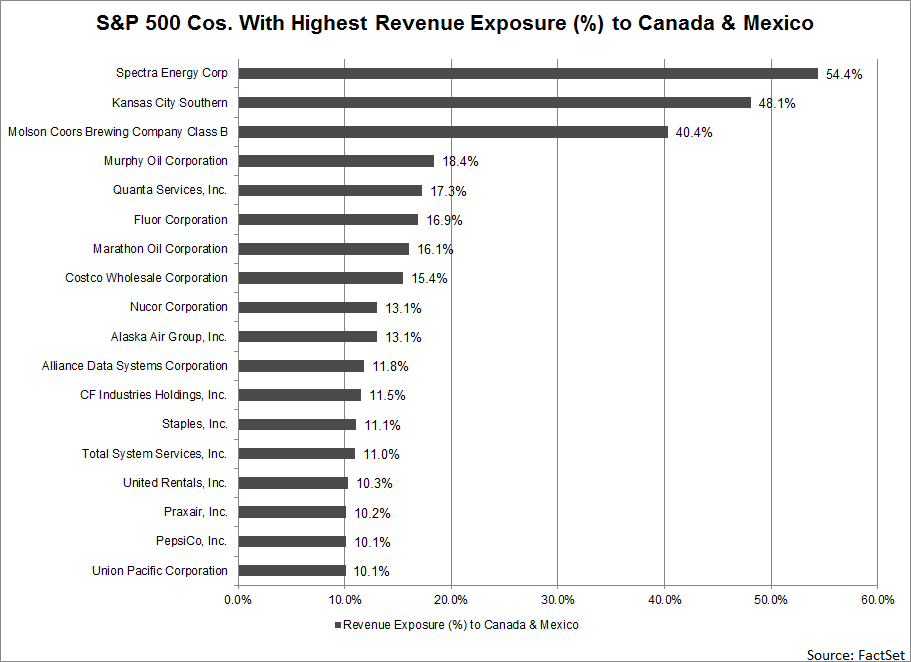

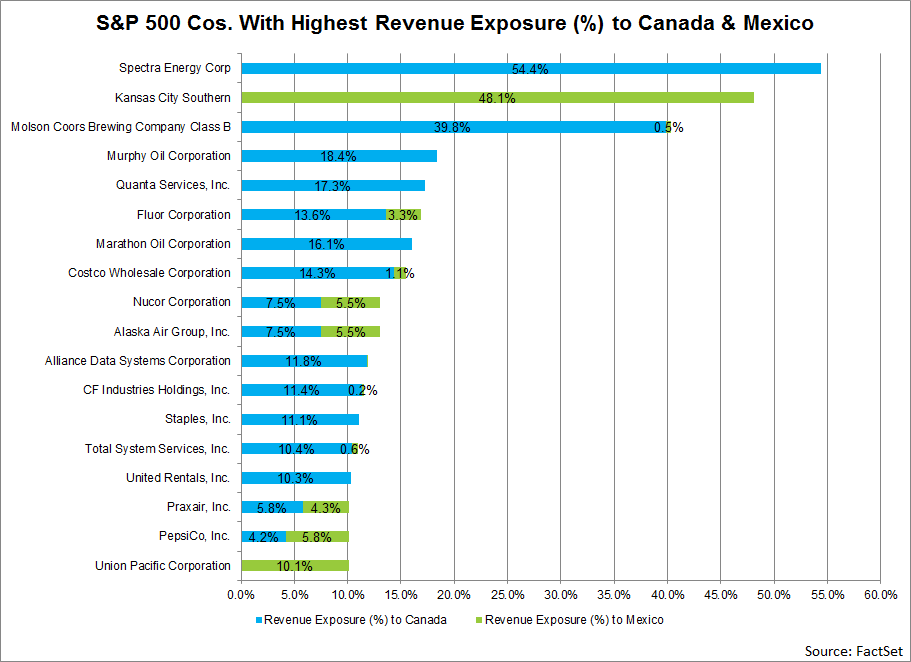

However, there are individual companies in the S&P 500 with significant revenue exposure to Canada and Mexico. The graphs below show the 18 companies in the index with revenue exposure of more than 10% to Canada and Mexico combined.

Have S&P 500 Companies Been Discussing “NAFTA” on Earnings Calls?

During each corporate earnings season, it is not unusual for companies to comment on subjects that had an impact on their earnings and revenues for a given quarter, or may have an impact on earnings and revenues for future quarters. Have companies in the S&P 500 been commenting on “NAFTA” during their earnings conference calls for the fourth quarter?

To answer this question, FactSet searched for the term “NAFTA” in the conference call transcripts of the 198 S&P 500 companies that have conducted fourth quarter earnings conference calls through January 31 to see how often “NAFTA” was cited during these calls. Of the earnings call conducted through January 31, the term “NAFTA” was cited in just seven of these calls. Five companies specifically commented on NAFTA during their calls.

Two of these five companies, Kansas City Southern and Union Pacific, have more than 10% revenue exposure to Canada and Mexico combined.

Here's a selection of quotes from others who have commented:

“Again, we still don't know very much about what specific changes may be coming in trade policy, in the re-negotiation of NAFTA; so very, very early to talk about. We do think that, broadly speaking, Mexico does have a lot of advantages, and those advantages as an economy would continue, no matter what would happen between trade with the U.S., you still have an incredible labor advantage within Mexico. I think it gives them the chance to compete in the broader globe as far as being more competitive. If there was some impact, you could end up from a trade that could end up weakening the peso. A weakening peso would again give them even more of a competitive edge. So we still think that there's a lot to like about Mexico, and when you take a look at our franchise in Mexico, it's a franchise that again, we do need to make some investments in and we laid those investments out. We talked about investing $1 billion over four years. We're on pace to keep that going, and that is a lot of infrastructure and customer service type of investments and we think that it'll still yield good results and good returns.” –Citigroup Fixed Income Call (Jan. 26)

“Now let's take some extreme cases of what could happen. In the extreme case, and I don't think by the way this is the base case, we build a wall not just in our southern border, but all around this country and we'll stop trading with the rest of the world. Well, I think the long-term impact of that actually would be negative, not just for our business, but in every business because the rate of economic growth would slow. But specific to the industrial business, for sure, manufacturing will have to take place somewhere, which means it will have to take place in the U.S. So demand will go up in the U.S., for sure. Now, there are going to be places in the world where demand will suffer, and I think Northern Mexico along the border and China would be the two places where demand would suffer. Those two markets account for 2% of our overall activity. The U.S. accounts for 73% of our activity. So, while I acknowledge that there will be a headwind on overall economic growth, actually its impact on us could be very positive in the short-term, but that's not what I want, that's not what I expect, and that's not what I'm looking for. I think the more likely outcome is going to be a cleaning up of some of the provisions of NAFTA. There are some issues that need to be modernized. I think it makes sense to do that. And I, frankly, think that the stage has been set from a negotiating point of view where that can be done pretty quickly and pretty easily compared to expectations.” –Prologis (Jan. 24)

“Obviously, there are still many questions about the future of NAFTA and the trade relationship between the U.S. and Mexico. While we've gotten some indication of the direction of the new administration through the nomination of most of the key trade policymakers, we still don't have definitive answers to several of those questions. What we do know is that the President's team has indicated that there will be a process for reshaping of America's trade policies which could include updating NAFTA. The Mexican government has expressed its willingness to begin the process of modernizing the agreement as well.” –Kansas City Southern (Jan. 20)

“So, we are paying close attention to all of the talk about potential outcomes as we go forward in terms of impact on either NAFTA or other international trade agreements. Our perspective is that the United States is tightly woven with its trading partners. And our consumers benefit greatly from free and open international trade, both from a standard of living perspective, making goods available to them at lower cost than they would be otherwise as well as creating markets for U.S. goods to be sold into, creating a robust potential growth for U.S. jobs and typically the higher-paying U.S. jobs.” –Union Pacific (Jan. 19)

“Well, we certainly have an active global supply chain and we source from all over the world. And we do our best to take advantage of existing trade agreements. I would say if the new administration pulled back on existing trade agreements or made changes to existing trade agreements, there could be some impact, and we'll do our best to work around that. So, for example, we have production in Haiti and we take advantage of the trade agreements with Haiti. We have some NAFTA benefits. And if those go away, then we'll certainly have to determine how to adjust. Having said that, when you think about the cost of materials for us, specifically garments, let's keep in mind rental revenue is about 50% of the Uniform Rental and Facility Services segment.” –Cintas (Dec. 23)

What is the Economic Outlook for Canada and Mexico?

Given that economic growth is a key driver of earnings growth, what is the economic outlook for Canada and Mexico?

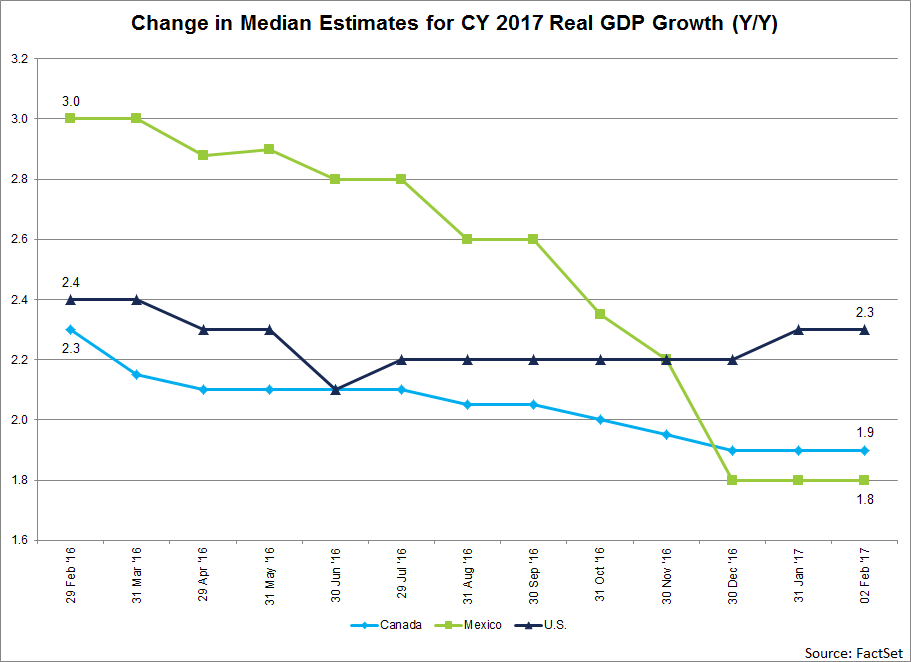

According to FactSet Economic Estimates, analysts have lowered estimates for real (year-over-year) GDP growth for 2017 for both Canada and Mexico over the past 12 months.

For Canada, the current median estimate for real (year-over-year) GDP growth for 2017 is 1.9%. Back in February of 2016, the median estimate for GDP growth was 2.3%.

For Mexico, the current median estimate for real (year-over-year) GDP growth for 2017 is 1.8%. Back in February of 2016, the median estimate for GDP growth was 3.0%.

For the U.S., it is interesting to note that the median estimate for real (year-over-year) GDP growth for 2017 is nearly identical to the estimate 12 months ago. The current median estimate for real (year-over-year) GDP growth in 2017 is 2.3%. Back in February of 2016, the median estimate for GDP growth was 2.4%.