The Energy sector will be a focus sector for the markets this week, as Exxon Mobil, Chevron, and ConocoPhillips are all scheduled to report earnings during the week. The estimated earnings for all three companies were lower Friday compared to the start of the third quarter. The mean EPS estimate for Exxon Mobil is $1.72, compared to an estimate of $1.91 on June 30. The mean EPS estimate for Chevron is $2.54, relative to an estimate of $2.79 on June 30. The mean EPS estimate for ConocoPhillips is $1.19 compared to an estimate of $1.48 at the start of the quarter.

During the third quarter, the Energy sector overall recorded the second largest cuts to earnings estimates of all ten sectors, as the price of oil decreased by 13% during the quarter. Given the continue decline in the price of oil to start the fourth quarter, have analysts continued to slash earnings estimates for the Energy sector for the fourth quarter and beyond?

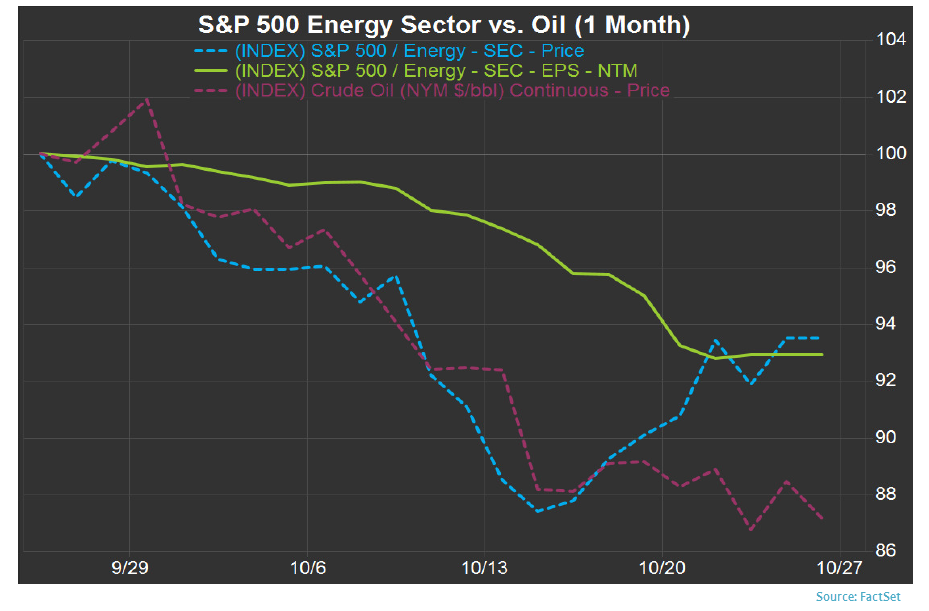

The answer is yes. Since the start of the fourth quarter (September 30), the bottom-up EPS estimate for the Energy sector (which is aggregation of the EPS estimates for all of the companies in the sector) has fallen by 9.9% (to $10.76 from $11.94), which is by far the largest decrease of all ten sectors since the start of the quarter. As a result of these cuts to estimates, the Energy sector has recorded the largest decrease in expected earnings growth (to -4.7% from 7.0%) of all ten sectors during this time.

Analysts have not only lowered earnings estimates for Q4, but have also lowered earnings estimates for future quarters as well. The forward 12-month (bottom-up) EPS estimate for the Energy sector has declined by 6.7% (to $46.58 from $49.94) since September 30. This is also the largest decrease in the forward 12-month EPS estimate for any sector over this period.

Given the drop in the price of oil and the cuts to future earnings estimates over the past few weeks, the price of the S&P 500 Energy sector has fallen by 4.7% since September 30, which is the largest drop in price for all ten sectors during this time frame.