Addition of Apple will Reduce Expected Earnings Declines of DJIA in 2015

On March 18 after the close of trading, the Dow Jones Industrial Average will feature the addition of a new component. Apple will be added to the index, while AT&T will be removed from the index. In terms of earnings growth, If Apple had been added in Q4, how would earnings growth for the DJIA have been impacted? What is the expected impact of Apple on expected earnings growth for the DJIA going forward?

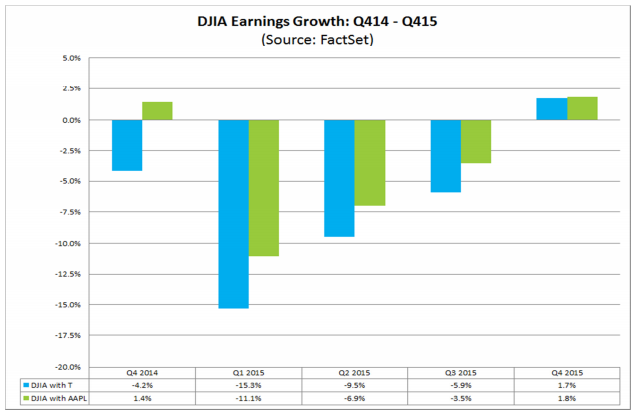

For Q4 2014, the DJIA reported a year-over-year decline in earnings of -4.2% (utilizing the same methodology used to calculate earnings growth for the S&P 500). For Q4 2014, Apple reported EPS growth of 48%. If Apple had been added to the DJIA (and AT&T removed) during Q4 2014, the DJIA would have reported earnings growth of 1.4%.

Looking ahead to 2015, the DJIA is projected to report year-over-year declines in earnings in Q1 2015 (-15.3%), Q2 2015 (-9.5%), and Q3 2015 (-5.9%), as both Exxon Mobil and Chevron are predicted to report significant declines in earnings in each of those quarters. For Q1 2015, Q2 2015, and Q3 2015, Apple is projected to report EPS growth of 27%, 30%, and 24%, respectively. Thus, the addition of Apple will reduce the expected earnings declines for the DJIA in each of these quarters, but it will not result in expected earnings growth for any of these quarters (as it would have in Q4 2014).

However, it is interesting to note that in Q4 2015 the addition of Apple is predicted to have little impact on the estimated earnings growth rate for the DJIA. For Q4 2015, the DJIA is projected to report yearover-year earnings growth of 1.9%. Apple is predicted to report EPS growth of 3.5% for the same quarter. As a result of the lower expected EPS growth rate for Apple in the fourth quarter of this year, the addition of Apple is expected to have little impact on the projected earnings growth rate for the DJIA in Q4 2015.

How Did Industry Analysts React to Announcement of New Apple Products?

Apple was a focus company for the markets in recent weeks leading up to the unveiling of several new products and services this past Monday, including new details regarding Apple Watch, a new Mac-Book, the release of ResearchKit software, and the availability of HBO NOW on Apple products. Given these announcements, have analysts revised their outlook for Apple over the past week? Have there been any significant changes to EPS estimates, ratings, or target prices over the past week?

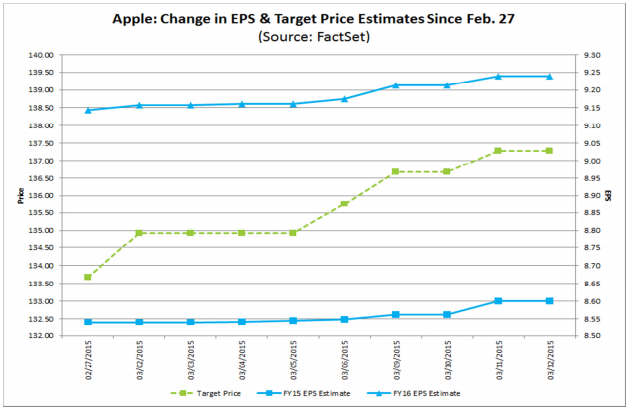

In terms of EPS expectations, analysts did increase EPS estimates for fiscal year 2015 and fiscal year 2016 slightly over the past week. The mean EPS estimate for FY 2015 has increased by 0.6% during this time frame (to $8.60 today from $8.55 on March 6). The mean EPS estimate for FY 2016 has increased by 0.7% over this period (to $9.24 today from $9.17 on March 6).

In terms of ratings, there was no change in the opinions of analysts over the past week. The overall number of Buy ratings (38), Hold ratings (11), and Sell ratings (2) remained unchanged.

In terms of target prices, analysts did increase their target prices slightly. The mean target price for Apple increased 1.1% during the past week (to $137.27 today from $135.75 on March 6). The current mean target price of $137.27 is 10.3% above the March 12 closing price of $124.45.

It is interesting to note that the market reaction to the announcements appeared to be mixed. The price of the stock rose 0.4% (to $127.14 on March 9 from $126.60 on March 6) on the day of the announcement. However, the price of the stock is down 1.7% overall (to $124.45 yesterday from $126.60 on March 6) during the past week.