Coming into the Q4 earnings season, there were concerns in the market about the impact of the stronger US dollar (relative to last year) and the impact of lower global economic growth on the sales and earnings of companies in the S&P 500. At this point in time, 87% of the companies in the index have reported actual results for the fourth quarter. So, did companies in the S&P 500 with more global exposure report weaker sales and earnings growth relative to companies in the S&P 500 with less global exposure?

The answer is yes. FactSet Geographic Revenue Exposure data (based on the most recently reported fiscal year data for each company in the index) can be used to analyze global sales exposure for all the companies in the S&P 500. For this particular analysis, the index was divided into two groups: companies that generate more than 50% of sales inside the US (less global exposure) and companies that generate less than 50% of sales inside the US (more global exposure). Aggregate earnings and revenue growth rates were then calculated based on these two groups. The results are listed below.

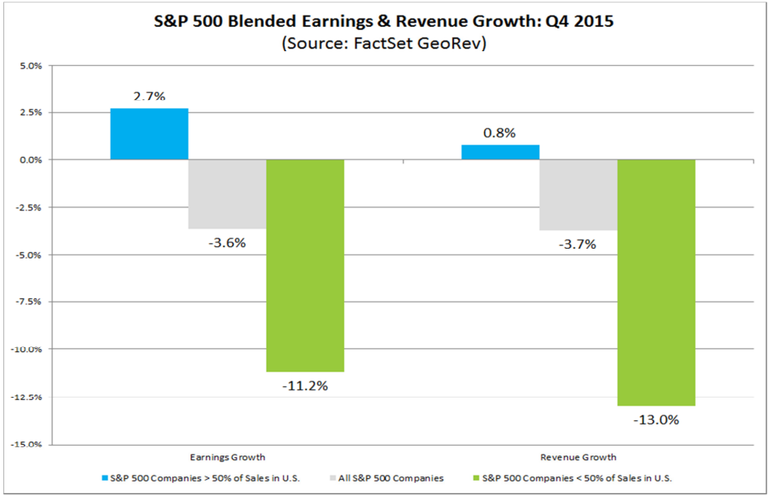

The blended (combines actual results for companies that have reported and estimated results for companies yet to report) earnings decline for the S&P 500 for Q4 2015 is -3.6%. For companies that generate more than 50% of sales inside the US, the blended earnings growth rate is 2.7%. For companies that generate less than 50% of sales inside the US, the blended earnings decline is -11.2%.

The blended sales decline for the S&P 500 for Q4 2015 is -3.7%. For companies that generate more than 50% of sales inside the US, the blended sales growth rate is 0.8%. For companies that generate less than 50% of sales inside the US, the blended sales decline is -13.0%.

For the fourth quarter, the Energy sector was the largest contributor to the year-over-year declines in both earnings and revenues for the index. If the Energy sector is excluded from the analysis, did companies in the S&P 500 (ex-Energy) with more global exposure report weaker sales and earnings growth relative to companies (ex- Energy) in the index with less global exposure?

The answer is still yes.

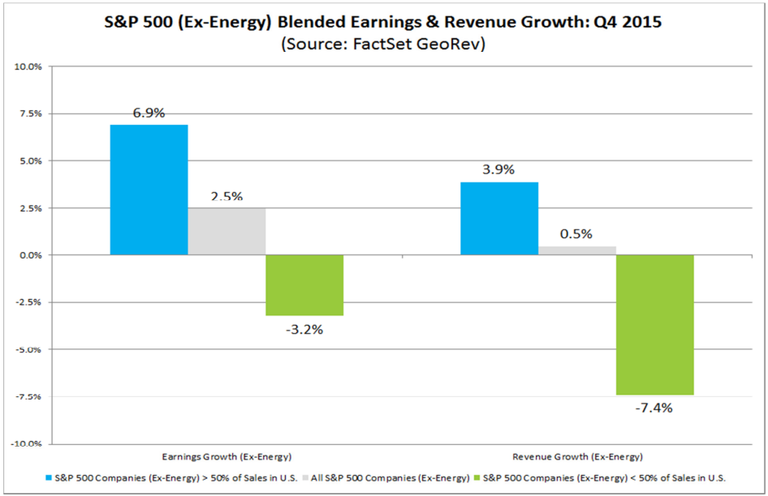

The blended earnings growth rate for the S&P 500 (ex-Energy) for Q4 2015 is 2.5%. For companies (ex-Energy) that generate more than 50% of sales inside the US, the blended earnings growth rate is 6.9%. For companies (ex-Energy) that generate less than 50% of sales inside the US, the blended earnings decline is -3.2%.

The blended sales growth rate for the S&P 500 (ex-Energy) for Q4 2015 is 0.5%. For companies (ex-Energy) that generate more than 50% of sales inside the US, the blended sales growth rate is 3.9%. For companies (ex-Energy) that generate less than 50% of sales inside the US, the blended sales decline is -7.4%.

Thus, S&P 500 companies with higher global exposure have reported lower earnings growth and lower revenue growth relative to S&P 500 companies with lower global exposure for the fourth quarter. When excluding the Energy sector from the analysis, the conclusions remain the same.