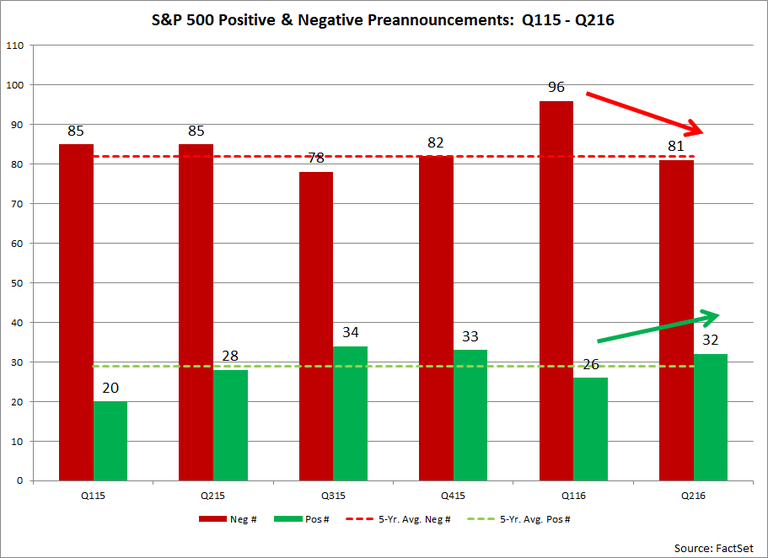

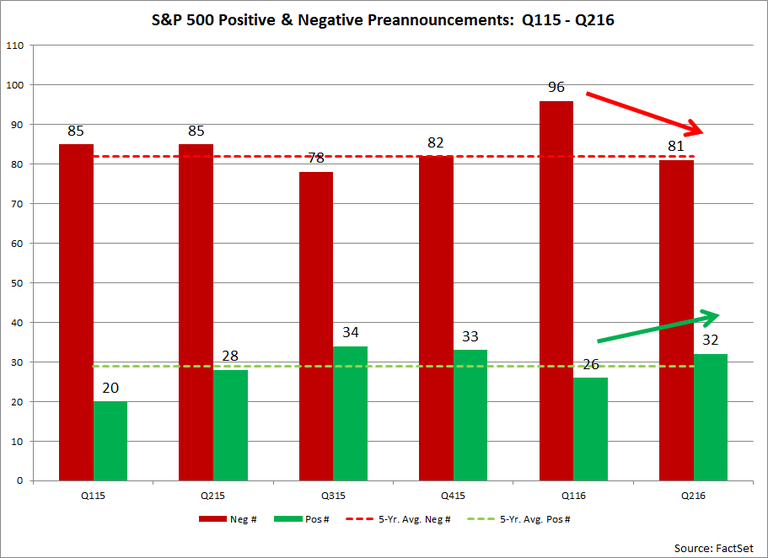

For Q2 2016, 81 companies have issued negative EPS guidance and 32 companies have issued positive EPS guidance.

After hitting a record high in Q1 2016 (96), the number of companies issuing negative EPS preannouncements for Q2 2016 has declined by 15 compared to the first quarter. If 81 is the final number for the second quarter, it will mark the second lowest number of companies issuing negative EPS guidance for a quarter since Q4 2012 (79).

In addition, the number of S&P 500 companies issuing positive EPS guidance for the second quarter (32) has increased by six relative to Q1 2016 (26).

Four sectors have led the positive shift in EPS guidance since last quarter: Health Care, Industrials, Information Technology, and Consumer Staples. The Health Care (+4), Industrials (+3), Information Technology (+2), and Consumer Staples (+2) sectors have witnessed the largest increases in the number of companies issuing positive EPS guidance since Q1 2016. The Health Care (-6), Information Technology (-5), and Industrials (-4), and Consumer Staples (-3) sectors have also seen the largest declines in the number of companies issuing negative EPS guidance compared to Q1 2016.

On the other hand, the Consumer Discretionary sector has recorded the largest decrease in the number of companies issuing positive EPS guidance (-3) since Q1. This sector has also recorded the largest increase (along with the Financials sector) in the number of companies issuing negative EPS guidance (+2) during this time.

Percentage of Companies Issuing Negative EPS Guidance Below Five-Year Average

With the positive shift in EPS guidance for Q2, the number of companies issuing negative EPS guidance for Q2 2016 (81) is now slightly below the five-year average (82) for a quarter, while the number of companies issuing positive EPS guidance for Q2 (32) is slightly above the five-year average (29) for a quarter.

Related: Can S&P 500 Break Streak of EPS Declines?

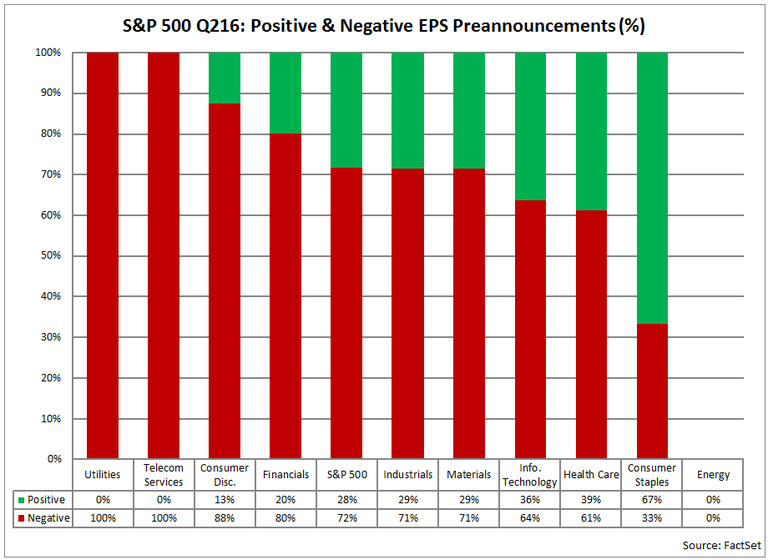

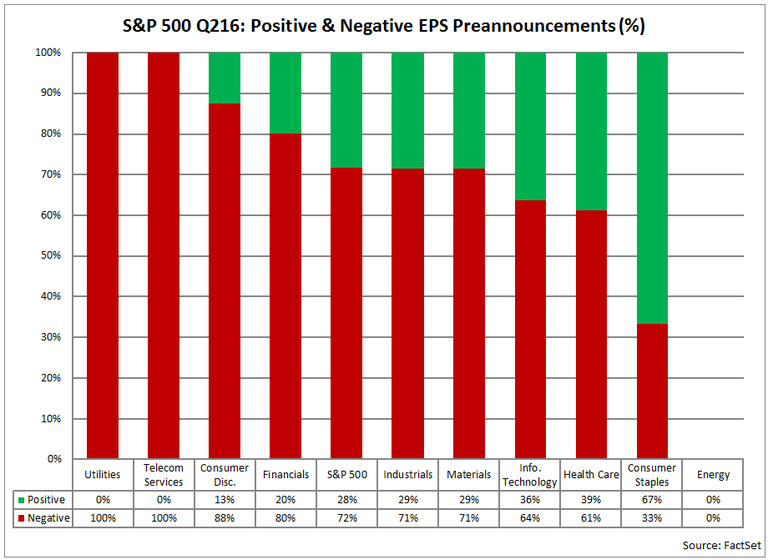

As a result, the percentage of companies issuing negative EPS guidance for Q2 2016 is 72% (81 out of 113), which is slightly below the five-year average (74%) for a quarter.

At the sector-level (with a minimum of five companies issuing quarterly EPS guidance), the Consumer Discretionary sector has the highest percentage of companies issuing negative EPS guidance for the quarter at 88% (21 out of 24). On the other hand, the Health Care sector has the highest percentage of companies issuing positive EPS guidance for the quarter at 39% (7 out of 18), while the Information Technology sector has the second highest percentage of companies issuing positive EPS guidance at 36% (12 out of 33).

Surprise Percentage (-5.3%) for EPS Guidance Smaller Five-Year Average

Not only is the number of companies issuing negative EPS guidance below average for Q2, but the amount by which companies are guiding EPS estimates lower is also smaller than average. The 1113 companies that have given EPS guidance for Q2 2016 have guided earnings 5.3% below the expectations of analysts on average. This percentage decline is smaller than the five-year average of -9.7%.

Market Rewarding Both Negative EPS Guidance and Positive EPS Guidance

To date, the market is rewarding both companies that have issued negative EPS guidance for Q2 2016 and companies that have issued positive EPS guidance for Q2 2016.

The 81 companies that have issued negative EPS guidance for Q2 2016 have seen an average increase in price of +0.1% from two days before the guidance was issued through two days after the guidance was issued. This percentage is much higher than the five-year average price decrease of -0.6% during this same window for companies issuing negative EPS guidance. Overall, 35 of the 81 companies that have issued negative EPS guidance recorded an increase in price during this time frame. Of these 35 companies, eight recorded a double-digit price increase.

As of now, the second quarter will mark the third straight quarter in which companies issuing negative EPS guidance on average recorded an increase in price two days before the guidance was issued through two days after the guidance was issued.

The 32 companies that have issued positive EPS guidance for Q2 2016 have seen an average increase in price of +3.1% from two days before the guidance was issued through two days after the guidance was issued. This percentage increase is above the five-year average price increase of 2.6% during this same window for companies issuing positive EPS guidance. Overall, 23 of the 31 companies that have issued positive EPS guidance recorded an increase in price during this time frame. Of these 23 companies, 2 recorded a double-digit price increase.

One S&P 500 Company Has Cited “Brexit” in EPS Guidance Since June 23

Since the “Brexit” vote was held on June 23, no S&P 500 companies have issued EPS guidance for the (calendar) second quarter and only one S&P 500 company has issued EPS guidance for the current fiscal year: Carnival. On June 28, Carnival stated that it expects adjusted EPS of between $3.25 and $3.35 for the current fiscal year. The mid-point of this EPS range ($3.30) was below the mean EPS estimate of $3.37 on June 28.

Carnival also discussed the impact of the “Brexit” vote in relation to EPS guidance for the year during the company’s earnings conference call.

On that call, Arnold Donald, President and CEO of Carnival said, “The second quarter results, combined with our strong book position, has enabled us to maintain the midpoint of our full year guidance range, despite a $0.17 drag from fuel and currency. Essentially, the strength in underlying demand for our product fostered greater ticket prices in both the quarter and in the remainder of the year, offsetting the rise of fuel prices since the time of our last guidance as well as the very recent significant movement in currency exchange rates following the Brexit vote.”

The company stated that it did not feel the need to make any additional adjustments to guidance due to the “Brexit” vote beyond the currency impact.

As more S&P 500 companies release earnings results in the coming weeks, the market will certainly watch for more commentary from these companies regarding the potential impact of the “Brexit” vote on earnings and revenues going forward.

Insight/Author%20Bios/JohnButters2.jpg)