As the second quarter comes to a close, analysts currently expect the S&P 500 index to report a year-over-year decline in earnings of -5.2% for the second quarter. If the index does report a decrease in earnings for the quarter, it will mark the fifth straight quarter that the index has reported a year-over-year decline in earnings.

Related: Analysts Project 10% Price Increase for S&P 500

However, this streak of consecutive declines is projected to end in Q2, as analysts believe the index will report earnings growth in both Q3 2016 (+1.1%) and Q4 2016 (+7.4%).

What Sectors Are Expected to See The Highest Earnings Growth in the Second Half of 2016?

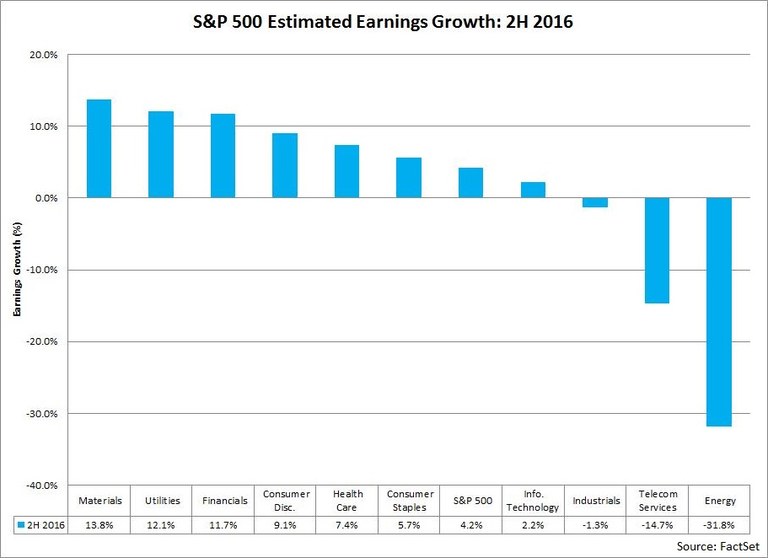

For the second half of 2016, the estimated earnings growth rate for the S&P 500 is +4.2%. This number is calculated by aggregating the estimated earnings for Q3 2016 and Q4 2016 and comparing these figures to the aggregate year-ago numbers for Q3 2015 and Q4 2015. For 2H 2016, seven of the 10 sectors are projected to report earnings growth, led by the Materials, Utilities, Financials, and Consumer Discretionary sectors. Three sectors are projected to report year-over-year declines in earnings, led by the Energy sector.

Materials: Freeport-McMoRan Leads Growth

The Materials sector is expected to report the largest year-over-year earnings growth (13.8%) of all 10 sectors for the second half of 2016. The estimated earnings growth rate for Q3 is 8.5%, which is the second highest growth rate of all 10 sectors for the third quarter. The estimated earnings growth rate for Q4 is 19.6%, which is also the second highest growth rate of all 10 sectors for the fourth quarter. At the industry level, three of the four industries in the sector are projected to report a year-over-year increase in earnings for the second half of 2016, led by the Metals & Mining (291%) industry. At the company level, Freeport-McMoRan is expected to be the largest contributor to earnings growth for this sector in the second half of 2016, due in part to comparisons to losses in the year-ago period. The mean EPS estimate for the company for 2H 2016 is $0.62, compared to a year-ago loss in 2H 2015 of -$0.17. If Freeport-McMoRan is excluded, the 2H 2016 earnings growth rate for the sector falls to 6.1% from 13.8%.

Utilities: NRG Energy Leads Growth Due to Loss in Q4 2015

The Utilities sector is expected to report the second largest year-over-year earnings growth (12.1%) of all 10 sectors for the second half of 2016. The estimated earnings growth rate for Q3 is 5.8%, which is the fourth highest growth rate of all 10 sectors for the third quarter. The estimated earnings growth rate for Q4 is 23.3%, which is the highest growth rate of all 10 sectors for the fourth quarter. At the company level, NRG Energy is expected to be the largest contributor to earnings growth for this sector in the second half of 2016, due in part to a substantial loss reported by the company in Q4 2015. The mean EPS estimate for the company for 2H 2016 is $0.50, compared to a year-ago loss in 2H 2015 of -$1.16. If NRG Energy is excluded, the 2H 2016 earnings growth rate for the sector drops to 7.7% from 12.1%.

Financials: Insurance and Capital Markets Industries Lead Growth

The Financials sector is expected to report the third largest year-over-year earnings growth (11.7%) of all 10 sectors for the second half of 2016. The estimated earnings growth rate for Q3 is 5.1%, which is the fifth highest growth rate of all 10 sectors for the third quarter. The estimated earnings growth rate for Q4 is 19.0%, which is the third highest growth rate of all 10 sectors for the fourth quarter. At the industry level, six of the seven industries in the sector are projected to report a year-over-year increase in earnings for the second half of 2016, led by the Insurance (41%) and Capital Markets (28%) industries. At the company level, AIG and Goldman Sachs are expected to be the largest contributors to earnings growth for this sector the second half of 2016 due in part to a loss reported by AIG in Q4 2015. The mean EPS estimate for AIG for 2H 2016 is $2.39, compared to a year-ago loss in 2H 2015 of -$0.58. The mean EPS estimate for Goldman Sachs for 2H 2016 is $8.56, compared to year-ago EPS in 2H 2015 of $4.17.

Consumer Discretionary: Broad-Based Growth

The Consumer Discretionary sector is expected to report the fourth largest year-over-year earnings growth (9.1%) of all 10 sectors for the second half of 2016. The estimated earnings growth rate for Q3 is 9.0%, which is the highest growth rate of all 10 sectors for the third quarter. The estimated earnings growth rate for Q4 is 9.1%, which is the fifth highest growth rate of all 10 sectors for the fourth quarter. At the sub-industry level, 25 of the 31 sub-industries in the sector are projected to report a year-over-year increase in earnings for the second half of 2016, led by the Housewares & Specialty (127%) and Internet Retail (50%) sub-industries. At the company level, Amazon.com is expected to be the largest contributor to earnings growth for this sector. The mean EPS estimate for the company for 2H 2016 is $3.28, compared to a year-ago EPS in 2H 2015 of $1.17.

Energy: Earnings Growth Projected to Return in Q4 2016

On the other hand, the Energy sector is expected to report the largest year-over-year decline in earnings (-31.8%) of all 10 sectors for the second half of 2016. However, the entire earnings decline is projected to occur in Q3 2016 (-52.3%). The sector is actually predicted to report earnings growth of 15.1% for Q4 2016, which is the fourth highest growth rate of all 10 sectors for the fourth quarter. At the sub-industry level, three of the six sub-industries in the sector are projected to report a year-over-year decrease in earnings for the second half of 2016, led by the Oil & Gas Drilling (-104%) and Oil & Gas Equipment & Services (-92%) sub-industries.

Related: Where the S&P 500 Faces Brexit Exposure

How Accurate are the Projections of Analysts on Second Half Earnings Growth Rates?

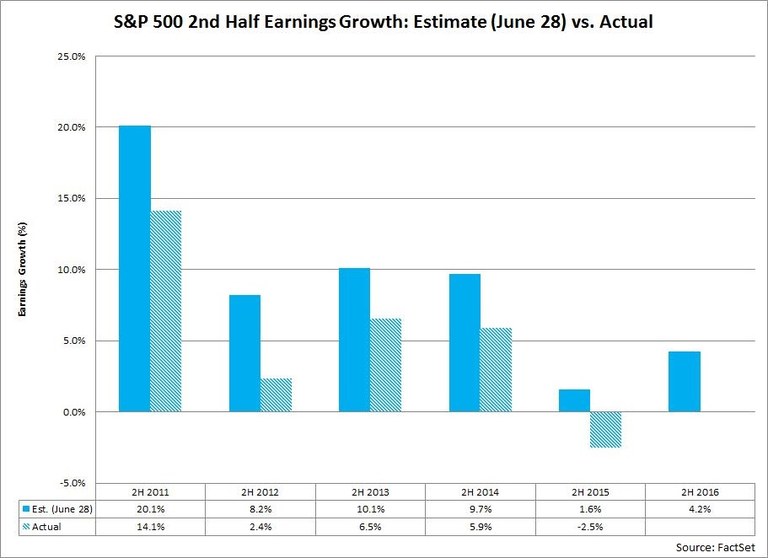

After five straight quarters of year-over-year earnings declines (assuming the index reports a decline in earnings for Q2 2016), analysts in aggregate are predicting earnings growth will return to the index starting in Q3 2016. But, how accurate are the projections of analysts on earnings growth for the second half of the year at this point in time?

Over the past five years (2011-2015) by June 28, analysts have overestimated the actual earnings growth for the second half of the same year by nearly 5 percentage points (4.7 percentage points).

If this average overestimation is subtracted from the estimated earnings growth rate of 4.2% for the second half of 2016, the actual earnings decline for the second half of the year would be -0.5% (4.2% - 4.7% = -0.5%).

What's Ahead for 2H?

After five straight quarters of earnings declines (assuming the index reports a decline in earnings for Q2 2016), analysts currently predict the index will report earnings growth of 4.2% in the second half of 2016. Most of this earnings growth is projected to occur in the fourth quarter. Seven of the 10 sectors are expected to report earnings growth for the second half of the year, led by the Materials, Utilities, Financials, and Consumer Discretionary sectors.

However, analysts have been overly optimistic in their projections for earnings growth for the second half of the year at this point in time in recent years. If the average overestimation over the past five years is applied to the current estimate, the index would be expected to report an actual decline in earnings of -0.5% for the second half of 2016.