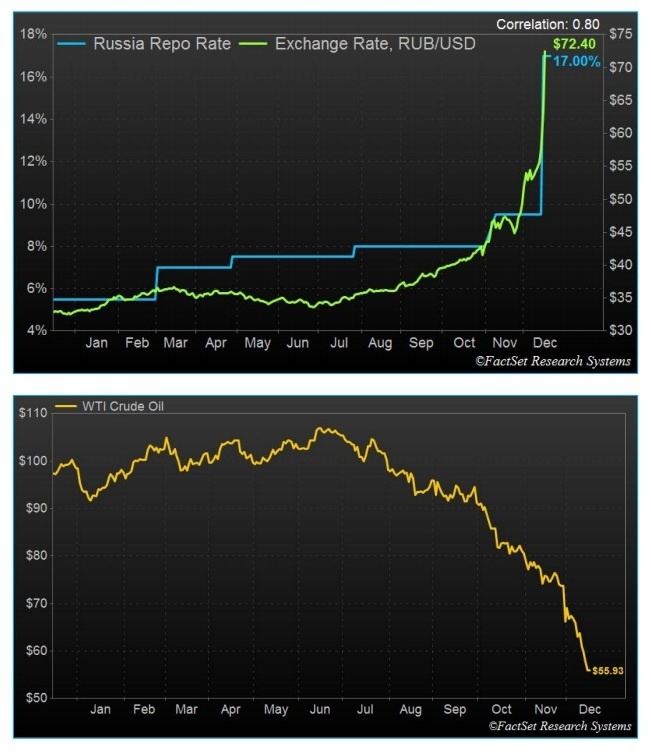

December has been marked by two significant macro events: the fall of the Russian ruble and the continual decline of oil prices. On Tuesday, the ruble hit record lows against the dollar, despite the central bank raising interest rates from 10.5% to 17%. The same day, oil prices dropped to five-year lows, and analysts expect further drops.

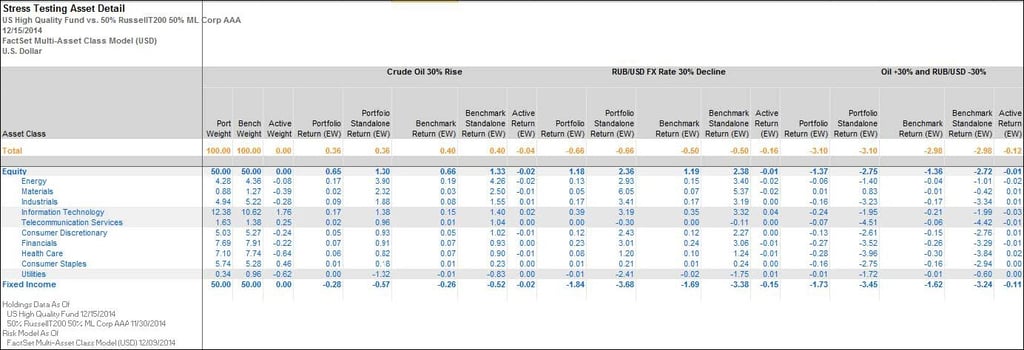

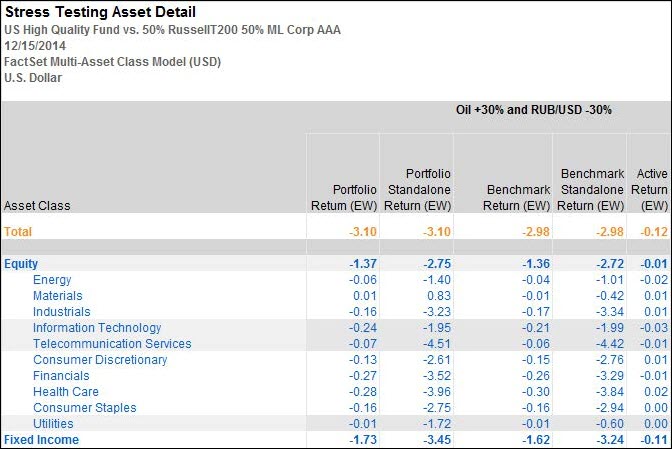

To identify and hedge against unintended sources of exposure, we ran a stress test on a sample portfolio containing U.S. equities and fixed income holdings. Using FactSet's Multi-Asset Class risk model, we can run stress tests on any asset classes, against individual shocks or multiple shocks. In this scenario we tried Oil rising 30% and RUB/USD FX Rate declining 30%.

In isolation, the Oil and Ruble shocks do not have much impact on the portfolio. Combined, however, the events hurt the portfolio significantly more.

FactSet helps you understand your portfolio’s true vulnerabilities by stress-testing it under extreme market scenarios. Learn more about our Multi-Asset Class risk model at our U.S. Investment Process Symposium, or email us to schedule a demo.