Bryan Adams, Director, FactSet M&A, contributed to this article.

Earlier this month, Amazon announced that it was acquiring Whole Foods Market for $13.7 billion. This deal represents Amazon’s largest acquisition ever, dwarfing the 2009 purchase of Zappos.com for $1.2 billion. While Amazon CEO Jeff Bezos has not released any additional details about the acquisition, it has been the main topic of conversation across various corners of the market since the announcement. Two areas of debate are the potential deflationary impact of the deal and repercussions for the grocery industry and the retail industry as a whole.

Giant Deal Not Enough to Move Inflation

Although he did not refer specifically to the Amazon-Whole Foods purchase, in an interview last week with CNBC, Chicago Fed President Charles Evans suggested that corporate mergers had the potential to put “more competitive pressures on price margins.” Evans expressed this concern on the heels of the FOMC’s 25 basis point rate increase on June 14. However, even before Evans’ comments, markets were already betting against another rate hike. CME fed funds futures are currently predicting that we will not see another rate hike for at least another six months.

How likely is this deal to put downward pressure on overall prices? Keep in mind that food and beverages represent just 14.6% of the Consumer Price Index (CPI), while housing makes up 42.6% of the index. So consumer food prices are a relatively minor portion of overall prices, and their movements are largely determined by fluctuations in commodity prices, which can be extremely volatile. In fact, the price indices followed by the FOMC are the so-called core indices, which exclude food and energy prices, both of which are highly correlated with commodity price movements. While Amazon has been able to drive down prices in other retail sectors with its sophisticated distribution network, it is not clear whether the giant would have any impact on food prices and overall inflation, especially in the near-term.

FactSet clients: launch this chart

Faster Decline for Brick-and-Mortar

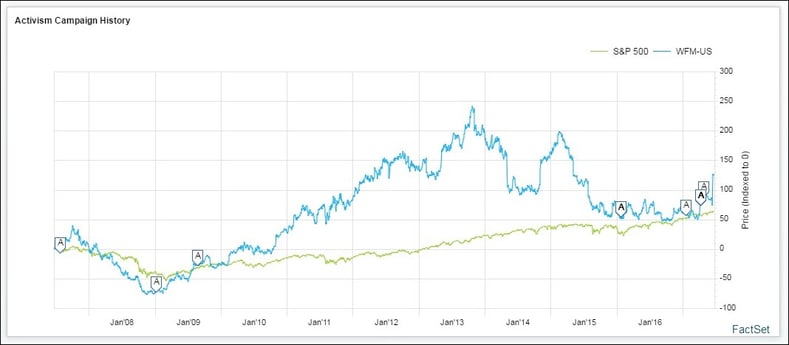

The market reaction to the news is based on the assumption that Amazon has the power to disrupt the grocery industry just as it has other retail industry segments. The deal comes at a time when all brick-and-mortar retail has been suffering, and grocery stores have not been immune. Leading up to the announcement, Whole Foods had experienced seven consecutive quarters of declining same store sales, and its stock price had fallen to nearly half of its 2013 peak. In fact, this weak performance resulted in activist investors moving on the stock and agitating for change in recent months. If largely internal or micro forces drove this deal, Whole Foods would have been the target of a takeover eventually by any number of suitors. In that case, the macro impact is even more likely to be modest unless there are many more deals in the pipeline.

FactSet clients: launch this chart

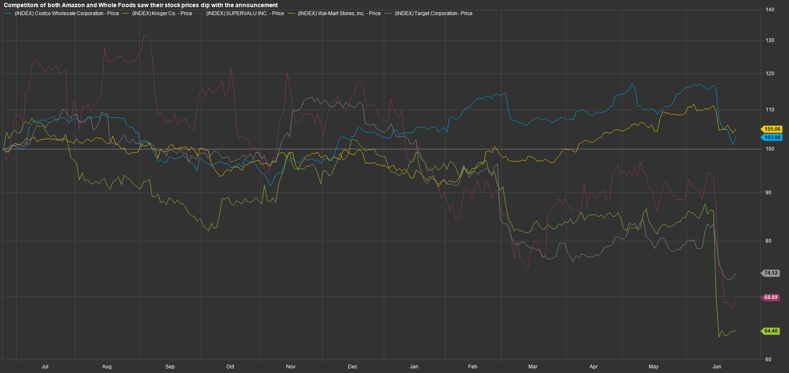

Nevertheless, the stock price impact for competitors of both firms was swift. Whole Foods competitor Kroger failed to meet estimates in its last earnings report, released one day before the AMZN-WFM news. The stock fell 18.9% that day and dropped another 9.2% with the news of the Amazon deal the following day. Food retailer SuperValu saw a 14.4% dip with the AMZN-WFM announcement. Amazon competitors Wal-Mart, Target, and Costco Wholesale also experienced price drops that day of 4.7%, 5.1% and 7.2%, respectively.

FactSet clients: launch this chart

Amazon’s foray into the grocery industry actually began back in 2007 with AmazonFresh, a grocery delivery service. The purchase of Whole Foods may be just what the company needs to transform the grocery industry, as it has with other retail sectors. But its broader economic impact may be limited to the ongoing transformation of the retail sector toward online shopping and less on overall inflation.