The eurozone appears ready to emerge from the doldrums.

With major elections now over in France, the Netherlands, and Austria, a good deal of the uncertainty that has hovered over the euro area has lifted. What we now are seeing is a region where economic growth is exceeding expectations so far in 2017. However, performance is not uniform across the region, and there are still pockets of risk and uncertainty.

FactSet clients: launch this chart

FactSet clients: launch this chart

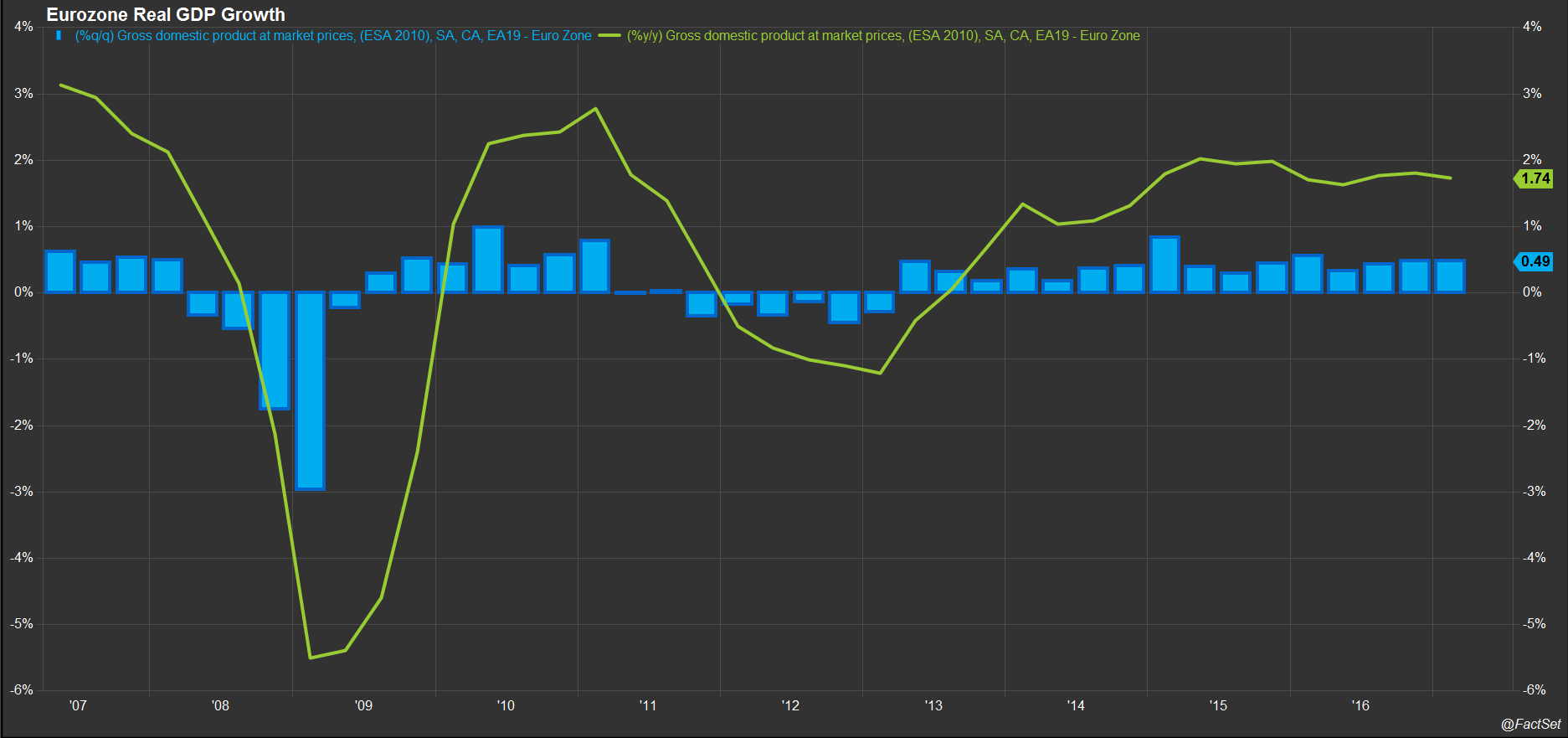

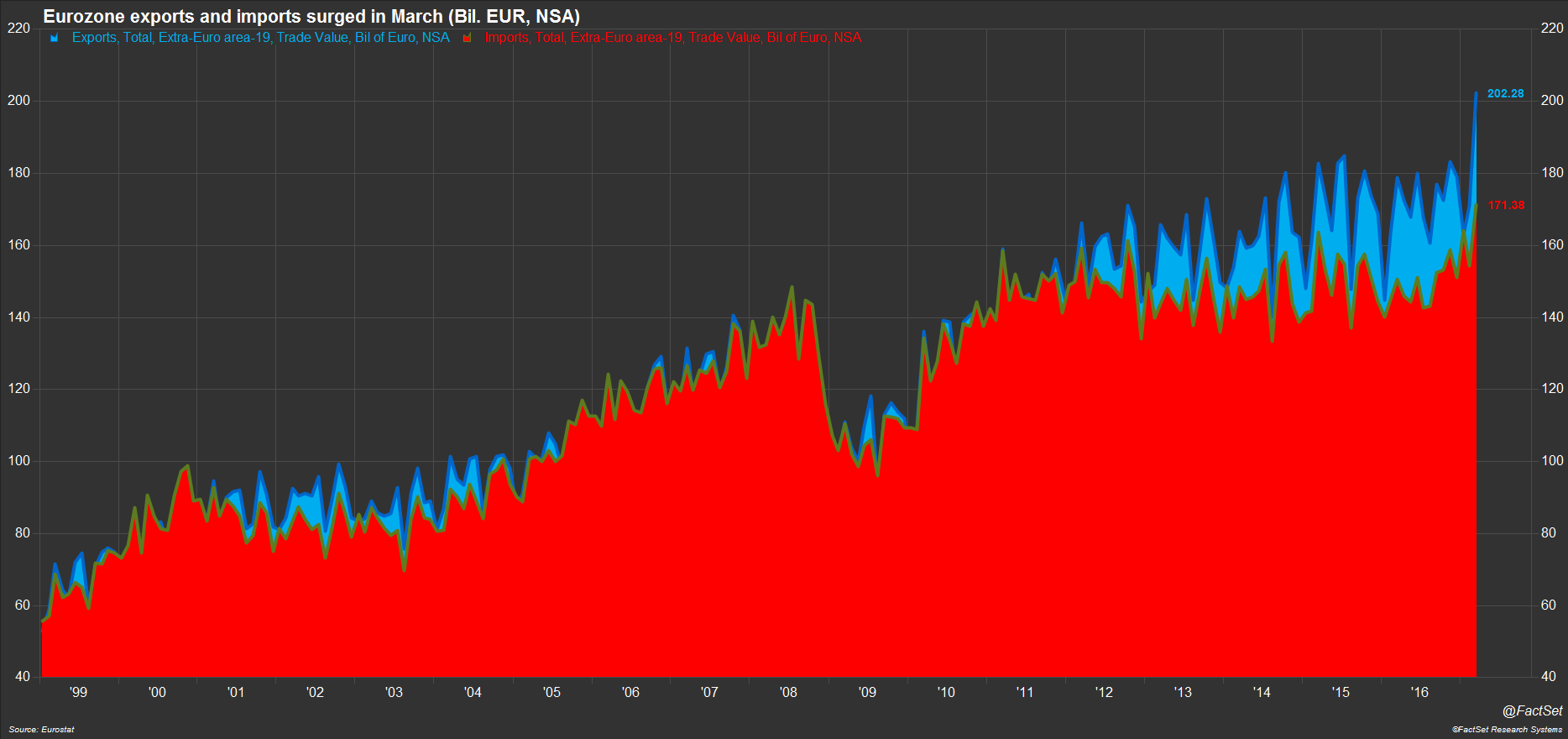

Eurozone real GDP growth grew 0.5% in the first quarter of 2017 versus the fourth quarter of 2016; compared to a year ago, the economy grew by 1.7%. The trade sector likely led the strong first quarter number; in March, the eurozone’s trade surplus in goods was the largest in the history of the single currency at €30.9 billion (not seasonally adjusted basis). Both exports and imports were strong, growing 13.1% and 13.5% from a year ago, respectively; both components also set new all-time highs, €202.3 billion for exports and €171.4 billion for imports.

FactSet clients: launch this chart

FactSet clients: launch this chart

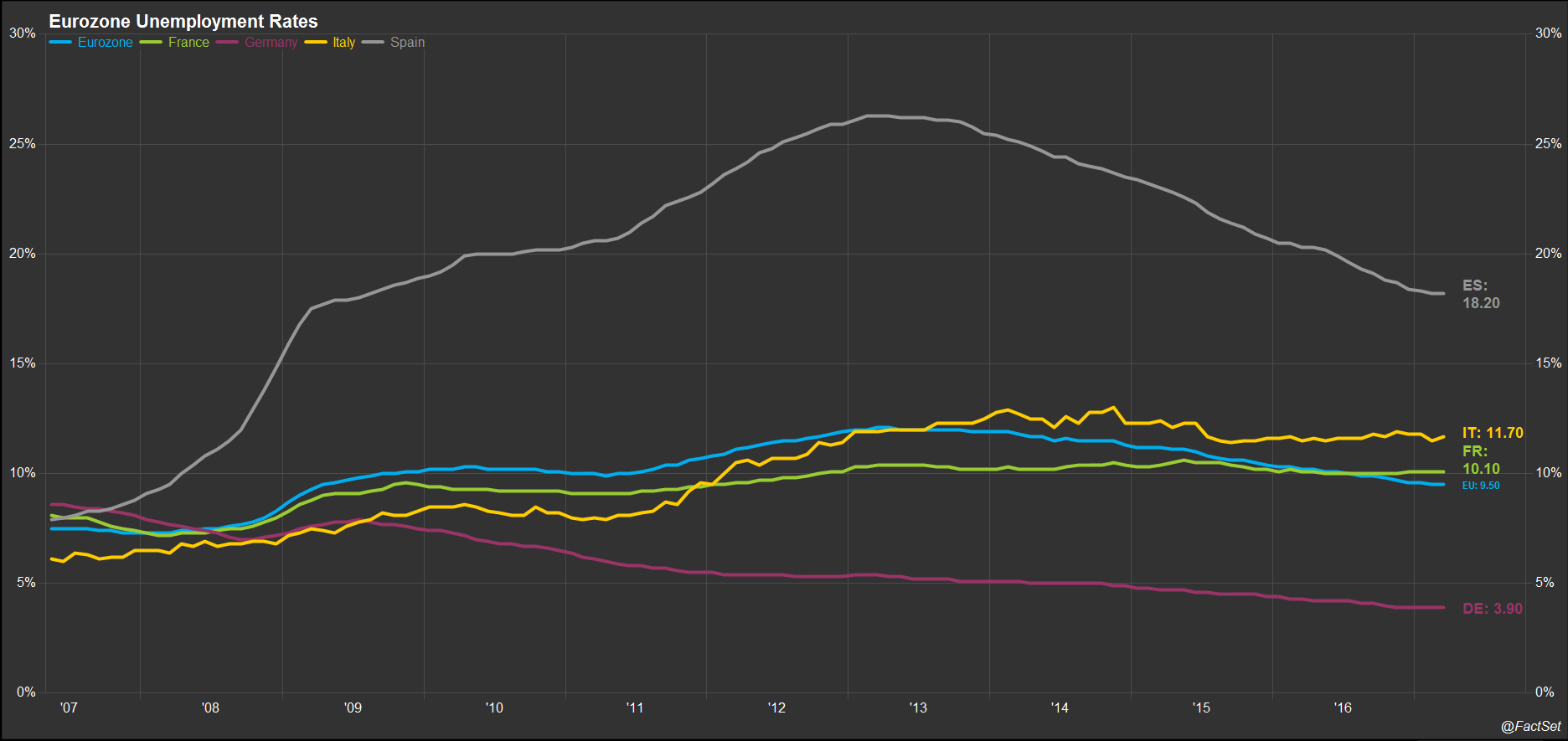

The job market also continues to improve. The region’s aggregate unemployment rate has fallen steadily since early 2013 and is now back to single digits, registering 9.5% in March. However, the jobless rate remains more than two percentage points above the low seen just before the global financial crisis. There is also a wide range of unemployment rates across the region. The countries at the center of the European debt crisis still have high double-digit rates: Greece 23.5%, Spain 18.2%, Cyprus 12.5%, and Italy 11.7%. At the same time, Germany, Malta, Netherlands, Austria, and Estonia all have rates below 6%.

FactSet clients: launch this chart

FactSet clients: launch this chart

Consistent with this positive news, we are seeing rising confidence among both consumers and businesses in the eurozone. In April, consumer confidence rose to its highest level in two years. Meanwhile, the IHS Markit PMI composite output index for the eurozone rose to 56.8 in April, firmly in expansion territory (above 50) and at a six-year high. The European Commission’s composite economic sentiment indicator, which combines measures of industrial, services, consumer, construction, and retail trade confidence, had its highest reading in nearly 10 years in April. Not surprisingly, all of this strong activity is translating into higher inflation. According to numbers released this week, the headline harmonized consumer price index was up 1.9% in April compared to a year ago, just below the European Central Bank’s (ECB) 2% threshold of “price stability.” Meanwhile, core inflation (excluding energy and unprocessed food) jumped to 1.2% on a year-over-year basis. The ECB has indicated that it intends to continue the ongoing program of net asset purchases through the end of 2017, and key interest rates are expected, “to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases.” Analysts surveyed by FactSet agree with this outlook, with the main policy rate expected to remain at current levels through 2018.

FactSet clients: launch this chart

FactSet clients: launch this chart

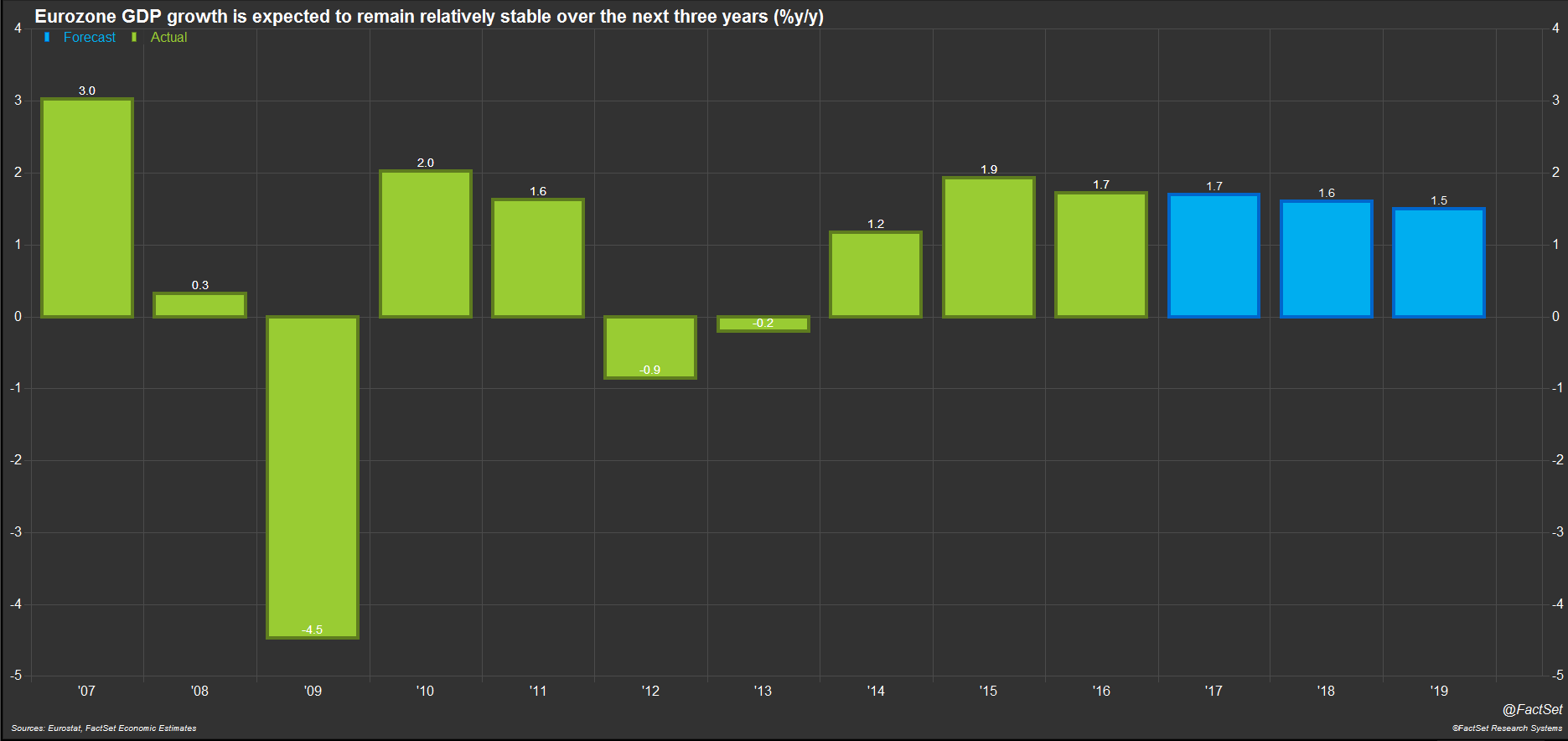

The benign outlook for rates reflects a stable predicted path for GDP. According to FactSet Economic Estimates, the consensus forecast for 2017 Eurozone GDP is for 1.7% growth, followed by 1.6% in 2018 and 1.5% in 2019. However, a country-by-country analysis shows that the forecasts vary widely across the region, with slower growth for the larger economies and faster growth in the smaller economies, generally speaking. The three largest eurozone economies are expected to see growth at or below the aggregate growth rate in 2017, with Germany at 1.7%, France at 1.4%, and Italy with the lowest projected growth among all 19 countries, with just 1.0% growth. The three smallest countries will all see growth above the aggregate, with Malta growing by 3.5%, Cyprus by 2.9%, and Estonia by 2.2%.

There are a couple of notable exceptions. Greece had the eighth largest economy in the eurozone back in 2008, but the economy has since shrunk by more than 25% and the country ranked at number 11 in 2016. Following flat GDP growth in 2016, the economy is now projected to expand by 1.1% in 2017, and to continue to accelerate in 2018. On the other end of the scale, Ireland, now the eighth largest economy in the region, is expected to remain the fastest growing eurozone economy for the fourth year in a row, with growth predicted to come in at 4.1% in 2017. However, the Irish economy is highly vulnerable to the negative impacts from Brexit. As a result, growth is expected to slow over the next two years, to 3.0% in 2018 and 1.6% in 2019.

FactSet clients: launch this chart

FactSet clients: launch this chart

Now that we are nearly 10 years past the global financial crisis, the eurozone seems poised to finally achieve the economic recovery that has eluded it until now. So far, 2017 is off to a strong start, although there remain threats to the outlook, including the Italian banking crisis, renewed bailout talks with Greece, and Brexit.