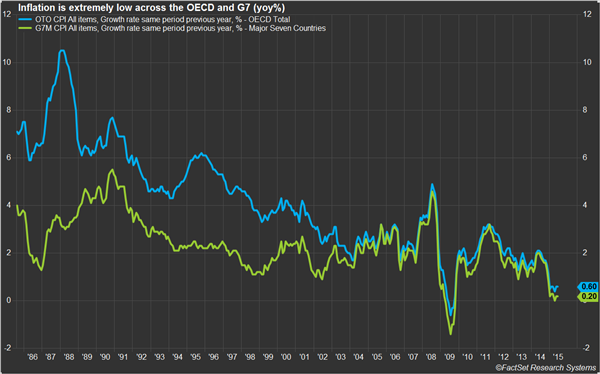

This summer has brought a new wave of weakness across all commodity markets, which is having ripple effects throughout the global economy. The price of West Texas Intermediate crude is down 56% from a year ago, gold has fallen by 15%, copper has lost 27%, and even sugar has dipped 35% over the past year. For the world's largest developed countries, this has brought inflation rates to new lows. According to the Organization for Economic Cooperation and Development (OECD), CPI inflation for its member countries was 0.6% on a year-over-year basis in June, with the G7 countries coming in with just 0.2% inflation. These are the lowest inflation rates since the global financial crisis in 2009.

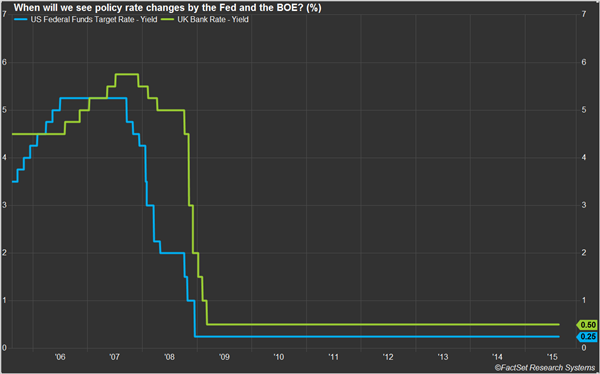

For most large industrial countries, this low inflation is accompanied by weak economic growth, and central banks are combatting both with expansionary monetary policy. Quantitative easing programs continue for the European Central Bank (ECB) and the Bank of Japan, and the Bank of Canada cut its key interest rate in July. However, there are two major central banks considering rate hikes in the coming year: the U.S. Federal Reserve (the Fed) and the Bank of England (BOE).

Like the rest of the world, inflation remains extremely low in both the U.S and UK; U.S. CPI was up 0.2% in June compared to a year ago, while the UK saw prices remain flat on a year-over-year basis. Core CPI in both countries is running higher, but not dangerously so; in the U.S., core CPI (excluding food and energy) was up 1.8% in June while in the UK CPI excluding energy, food, alcohol and tobacco was up just 0.8% from June 2014. Compared to the other G7 countries, though, these two economies are much healthier. U.S. year-over-year real GDP growth has averaged 2.5% over the last six quarters, while the UK has averaged 2.9% over the same period. According to analysts surveyed by FactSet, quarterly year-over-year growth rates will remain above 2% well into 2016. At the same time, both nations have also seen their unemployment rates drop dramatically; the U.S. jobless rate has plummeted from a high of 10.0% in October to 2009 to just 5.3% in July, while UK unemployment has dropped from a peak of 8.5% in October to 5.6% in May.

Despite the current absence of inflation, policymakers at both the Fed and the BOE are sounding increasingly hawkish on inflation. With growth accelerating and unemployment low, these central banks are trying to stay ahead of anticipated price growth down the road. Currently, analysts are expecting an upward move by the Fed in September, while the BOE is expected to wait until 2016 to raise rates. However, this week’s devaluation of the Chinese yuan could derail the Fed’s plans for a near-term rate hike. In order to deal with slower economic growth and recent stock market turmoil, this week the People’s Bank of China allowed the yuan to sharply depreciate against the U.S. dollar. The weaker yuan threatens to widen the U.S. trade deficit with China, as it makes U.S. exports more expensive and Chinese imports cheaper. It also puts upward pressure on the already-strong U.S. dollar, a trend which could force the Federal Reserve to delay its widely anticipated September rate increase.

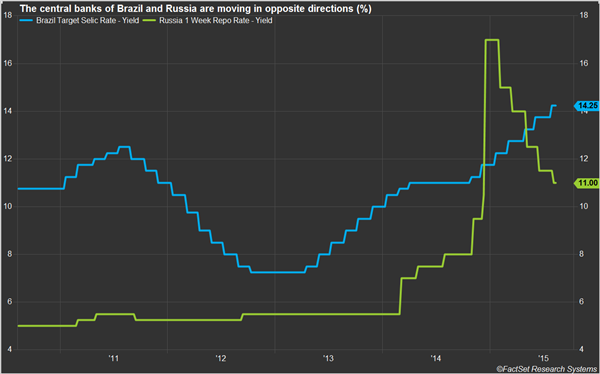

It is interesting to note that while most countries around the world are dealing with low inflation, two of the world's largest emerging economies are experiencing high inflation: Brazil (y/y: 9.6% in July) and Russia (y/y: 15.6% in July). In Russia, the weak ruble has sent domestic prices soaring while sanctions imposed by the U.S. and Europe, combined with weak global oil prices, have caused the economy to contract sharply. In Brazil, a drought has sent electricity prices soaring as hydroelectric plants find themselves without water. These problems pose a very different conundrum for these countries' respective central banks, and their responses have been very different; Brazil has already raised its target interest rate five times this year, while Russia has cut rates five times so far in 2015. We have already seen a pickup in activity by central banks so far this summer—expect to see this continue or even accelerate over the next several months.