Benny Sada, Global Macro Analyst at FactSet StreetAccount, contributed to this report.

Following a contraction in the third quarter, Australia’s GDP grew by 1.1% in the fourth quarter of 2016 compared to the previous quarter. The Australian economy has only seen four (non-consecutive) quarters of negative growth since 1991, when the country last saw a recession. However, the outlook continues to have risks. Of particular concern are sluggish wage growth, rising consumer debt, and surging housing prices, the latter characterizing what some are calling a housing bubble.

The Australian Consumer

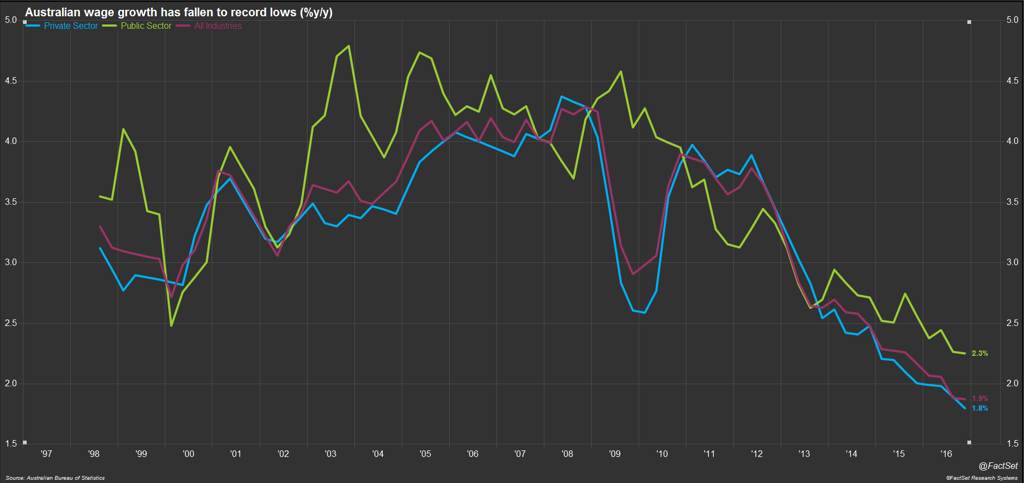

The household consumption numbers in the Q4 GDP release gave us mixed takeaways. While personal consumption contributed 0.5% to overall GDP growth, the savings ratio dipped to 5.2% from 6.3% as employee compensation contracted for the first time since the third quarter of 2012. Gross disposable income climbed 0.2%, outpaced by nominal spending, which rose 1.2%. This raises concerns around the sustainability of consumer spending given record low wage growth. Wage growth on a year-over-year basis fell below 1.9% in the second half of 2016, the weakest growth we have seen since the inception of the series in 1998 by the Australian Bureau of Statistics (ABS).

FactSet clients: launch this chart

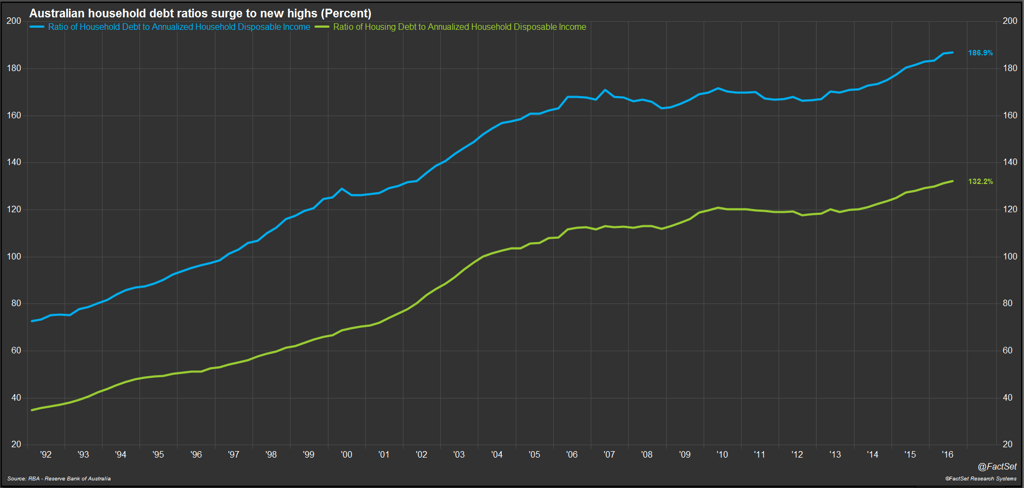

Australians appear to be financing their spending by taking on more debt. The ratio of household debt to disposable income reached a new high of 187% in September 2016; housing debt represented the bulk of the borrowing, at a ratio of 132% of household disposable income. In its interim Economic Outlook forecast published in March 2017, the OECD cited high mortgage-debt-to-income ratios as a concern.

FactSet clients: launch this chart

In addition, Reserve Bank of Australia (RBA) Governor Philip Lowe has emphasized the interaction between borrowing and consumption patterns, seeing this as one of the key uncertainties facing the economy. He has argued that elevated debt levels are affecting household spending and expressed concern that a buildup in debt, partly due to low interest rates, could increase the fragility of household balance sheets and lead to a sharp cutback in consumption.

Housing Market

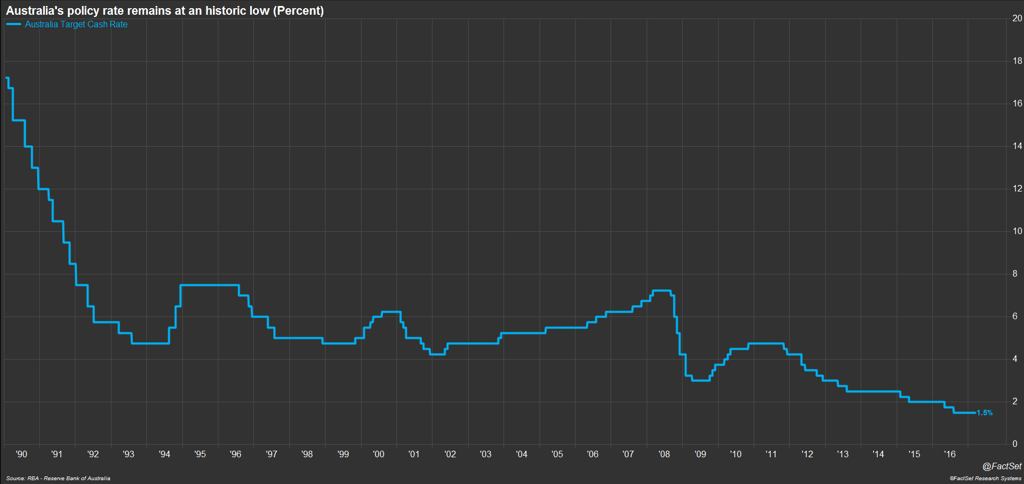

Historically low interest rates have boosted the Australian housing market. The RBA cut the target cash rate twice last year in order to stimulate economic growth, encouraging more investors to enter the property market. In addition, many observers believe that tax policies artificially inflate investor demand for housing, including tax benefits from negative gearing and the capital gains tax discount. At the same time, government regulations strictly control the supply of land available for building, which has created a shortage of land for development. Together these factors have created a scenario where demand outstrips supply, driving up housing prices and reducing housing affordability.

FactSet clients: launch this chart

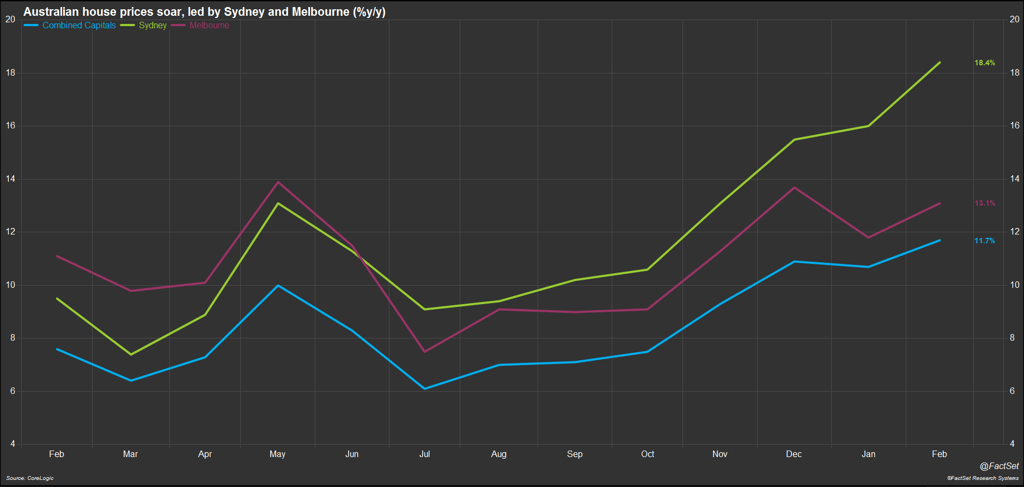

The overall growth rate of housing prices for the capital cities appeared to be easing in early 2016, but CoreLogic’s home value index shows a return to double-digit growth in the last three months. The most dramatic growth has been in Sydney and Melbourne, where values surged 18.4% and 13.1%, respectively, from a year earlier in February 2017. Meanwhile, housing prices have been falling over the last two years in Perth and Darwin. In its March report, the OECD cautioned on the risks of recent rapid housing inflation in advanced economies, including Australia. According to the OECD report, “a rapid rise of house prices can be a precursor of an economic downturn.”

Housing affordability is a key concern of the federal government, and is expected to be addressed in the May federal budget. Some reports indicate that the government is considering policies aimed at curbing negative gearing and/or capital gains tax concessions, as well as infrastructure improvements that would encourage demand for cheaper houses in outer suburbs, which would alleviate supply constraints on cities.

FactSet clients: launch this chart

Central bank officials have also expressed concerns about the acceleration in property investment lending growth. In prepared remarks this week, RBA Assistant Governor Michele Bullock noted that with the effects of past policy prescriptions potentially fading over time, regulators are prepared to do more if needed. She urged consideration about “how monetary policy considerations should factor in financial stability issues, the role that macroprudential policies might play in addressing system-wide risks in a low interest rate environment…and whether policy responses might be required.”