Dave Hannibal, Global Manager, Channel Partners at FactSet also contributed to this article.

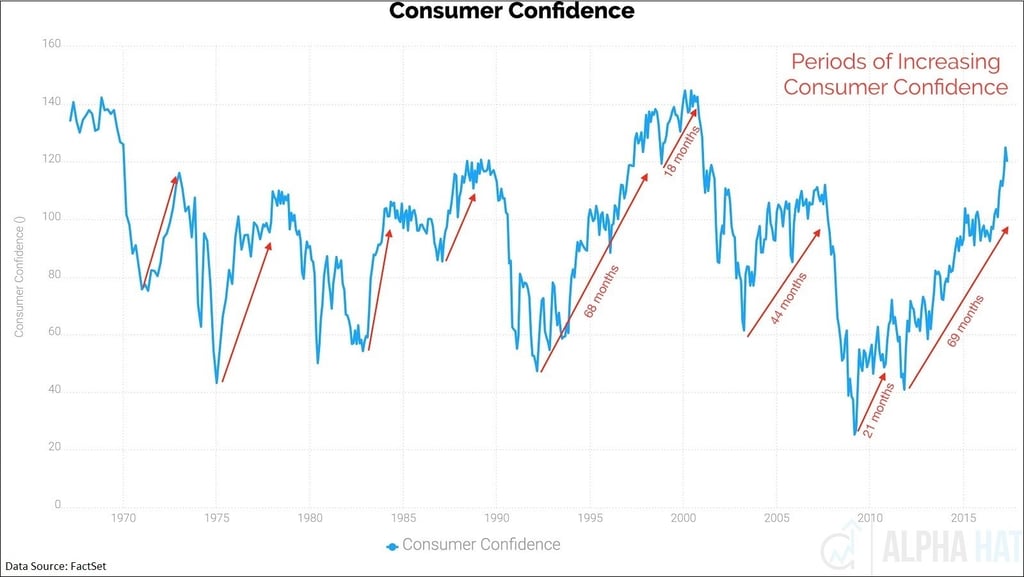

Since November 2016, consumer confidence as measured by the Conference Board has increased sharply, reaching a 16-year high in March. The current upward trend is the longest since the data began in 1967. While April data ticked down slightly, it is still higher than any time since December 2000. Regardless of whether this portends a further downward trend or is a temporary deviation from an otherwise upward trend, investors can gain insight from analyzing how sectors and macro assets performed during periods of increasing and decreasing consumer confidence, enabling them to position appropriately.

Using the event study tool of one of our Channel Partners from the FinTech Sandbox, Alpha Hat, we mathematically identified periods when consumer confidence was on an upward trend, which we defined as a 12-month rolling window where at least six of the 12 months experienced a year-on-year increase. This methodology identified nine periods since 1967 during which consumer confidence was on an upward trend. The current stretch has been going on for 69 months, which is, again, the longest period of increasing consumer confidence on record. The second longest stretch happened in the 1990s when consumer confidence was on an upward trend for 68 months. The current stretch was interrupted in 2011 when the debt ceiling debates dragged on until nearly the last minute, and Standard & Poor’s downgraded the U.S. sovereign credit rating.

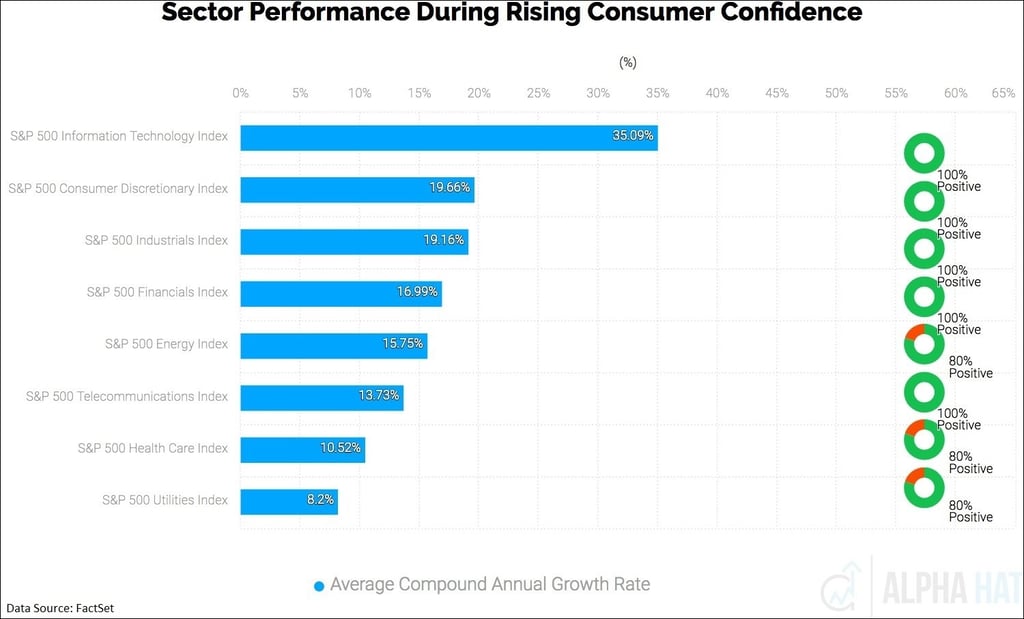

Where to Invest During Rising Consumer Confidence

During periods of rising consumer confidence, information technology and consumer discretionary stocks have performed well. Utilities and healthcare were least affected. While the energy sector did well on average during upswings in consumer confidence, unlike other sectors it was not positive 100% of the time. Energy stocks are closely tied to the price of oil, which can move due to supply or demand factors. Depending on the cause, oil could go up with consumer confidence, or it could actually hurt consumer confidence.

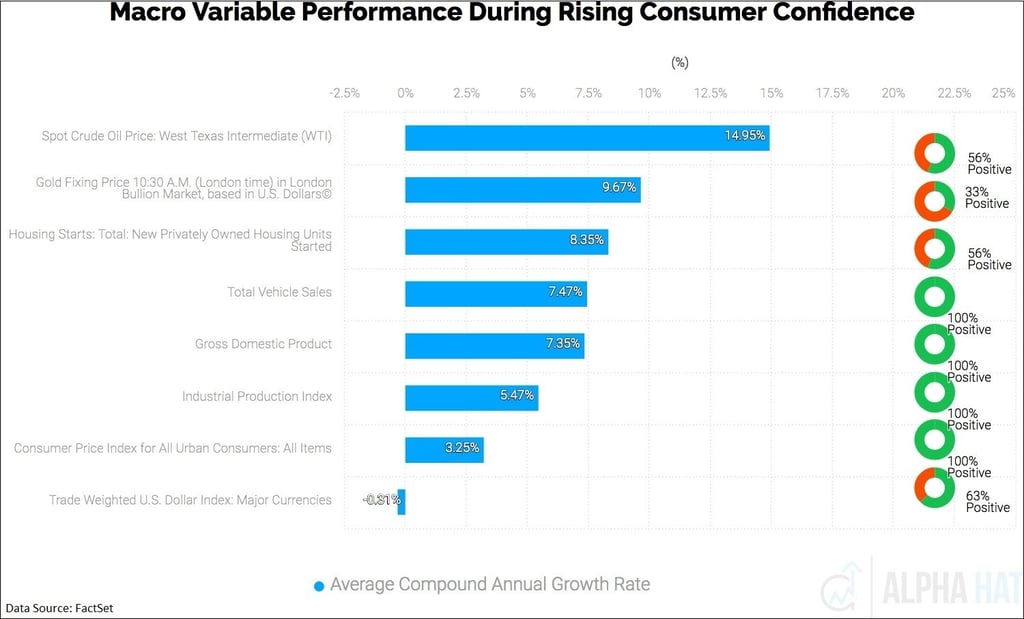

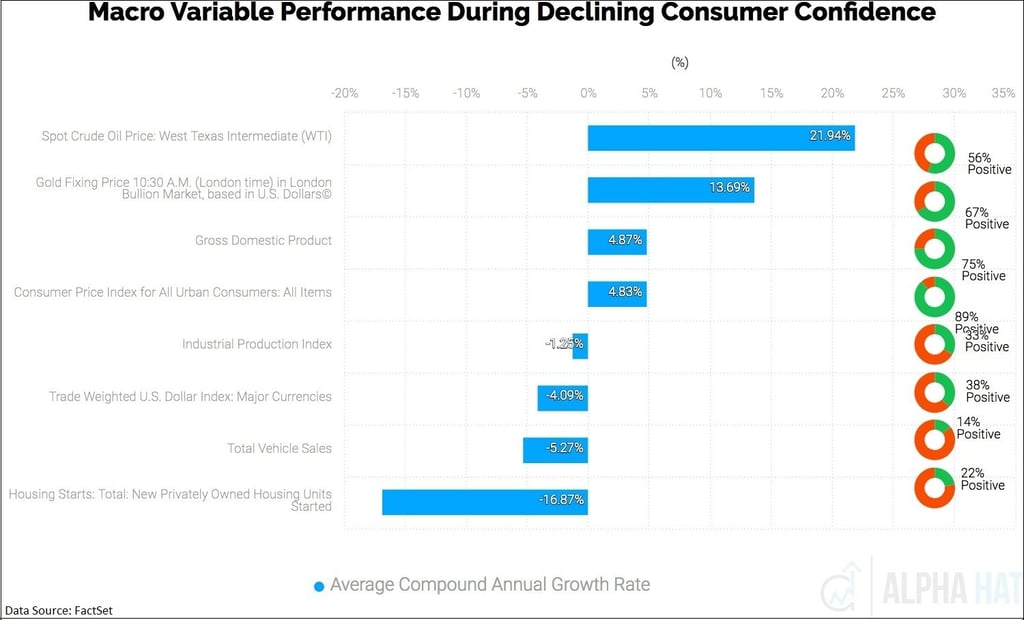

Indeed, we see that while oil was up on average by about 15% during periods of rising consumer confidence, it was positive only 56% of the time. Vehicle sales were up by 7.47%, and GDP outpaced inflation. Performance of the U.S. dollar was mixed.

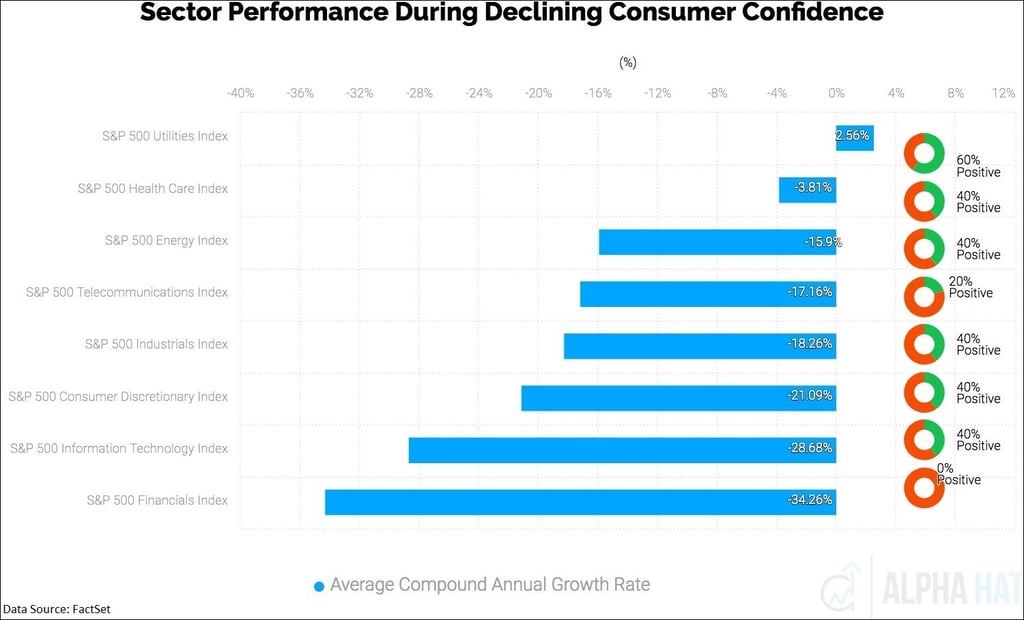

Where to Invest During Declining Consumer Confidence

During declining consumer confidence, financials stocks fell the most, followed by information technology stocks.

In the periods examined, financials stocks fell 100% of the time when consumer confidence was decreasing. Interestingly, there was some asymmetry in financials. While financials were not the biggest gainers when consumer confidence increased, they were the biggest losers when it decreased. Once again, healthcare and utilities stocks, being defensive in nature, were least affected. When the strength in consumer confidence diminishes, financials are definitely a risky sector, followed by information technology and consumer discretionary stocks.

During periods of declining consumer confidence, GDP went up 4.87% but the Consumer Price Index went up by 4.83%, eating away at GDP growth.

These examples can enable investors to understand how stocks, markets, and macro assets perform around events and are a valuable method for considering the potential market outcomes.

Alpha Hat builds next-generation analytics tools that enable investors to discover richer insights from data. FactSet has partnered with Alpha Hat through Fintech Sandbox, a program that provides innovative fintech startups with data from the world's leading data providers.