Over the last two decades, Google has revolutionized the way we connect with information. The firm, which frequently tops lists of the world’s most inspirational brands, is famed for its transparency, data management capabilities, and intuitive user experience.

But our research shows that high net worth individuals (HNWI) would like to see the technology giant take a step further, by entering the wealth management space. When asked which firm would make the most exciting wealth manager, Google was the most popular choice among the responses.

This begs the question; what can the wealth industry learn from a search engine about delivering an enhanced client experience and proposition?

When HNWIs were asked which firm would make the most exciting wealth manager, Google was the most popular choice due to its transparency, data management capabilities, and intuitive user experience.

Fostering a Culture of Transparency

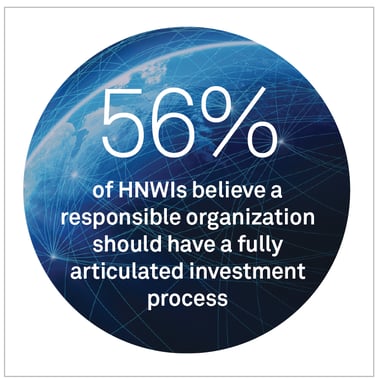

Google’s focus on transparency is one of the critical areas that wealth management firms should seek to emulate. In our recent survey of 1,022 HNWIs, transparency emerged as a key determinant of an advisor’s credibility. Indeed, the top two markers of a responsible organization are clarity over business performance (58%) and a fully articulated investment process (56%).

Transparency is not just a something that Google strives for; it is central to the way that the company does business. According to reports, every software engineer in the firm has access to almost all of Google’s code. Employees also have access to the personal goals and objectives of one and other. The purpose is to empower individuals to contribute to their environment and accelerate business growth.

But at Google, transparency is not just an internal policy, it also shapes how the organization interacts with clients. The business publishes regular transparency reports, outlining the frequency with which governments review or remove content from Google products or request information about users, as well as information about product traffic and the volume of email exchanges using Google’s Gmail accounts.

The philosophy of transparency is also encapsulated in two of Google’s core principles; “There’s always more information out there” and “The need for information crosses borders.” Google believes that by putting as much information as possible in the hands of both staff and users, they will be able to build a better, more effective, business.

Thinking about the application of these principles to the wealth industry raises questions about how to improve both internal and external processes. Are you providing clients with enough information about how your businesses work? Or your investment processes? Are you equipping your relationship managers with the level of investment insight to make informed decisions?

We believe that taking Google’s approach (and focusing on improving transparency) could revolutionize client relationships in wealth management.

Getting Intelligent with Data

To facilitate transparency, Google has developed a process of data management that allows users to find information quickly and efficiently. What sets it apart, is the integration of intelligent systems that determine from user searches and selections which content will be most relevant to future users.

With a combined focus on transparency and data management, wealth managers could think a little bit more like Google, and in turn, could upgrade their proposition to clients.

Crucially, the whole Google experience is designed to ensure that users find the insights they need quickly, efficiently, and without interruption. By tracking the searches that its users make, Google can ensure that advertisements are directly targeted to their interests and actually enhance the service. Google asserts that it does not allow adverts “which interfere with your ability to see the content you’ve requested.”

Imagine a world in which wealth managers were this effective at processing and managing data, where clients could search for investment opportunities and see what investors like them bought or sold, or where wealth managers could actively make product or service recommendations based on previous user searches.

With a combined focus on transparency and data management, wealth managers could learn to think a little bit more like Google, and in turn, could upgrade their proposition to clients.