Ireland has come a long way since the financial crisis of 2008-2010. Following the bursting of credit and property bubbles in 2008, the Irish government was pulled into crisis, and in 2011 entered into a financial assistance program provided by the so-called "troika" (consisting of the European Commission, European Central Bank & International Monetary Fund). This included a bailout package of €67.5 billion, as well as various measures to recapitalize banks, restore fiscal sustainability and carry out growth-enhancing reforms.

FactSet clients: launch this chart

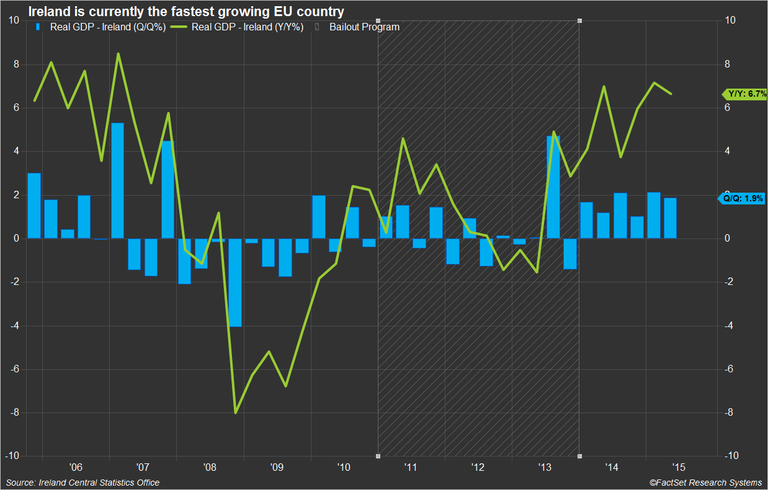

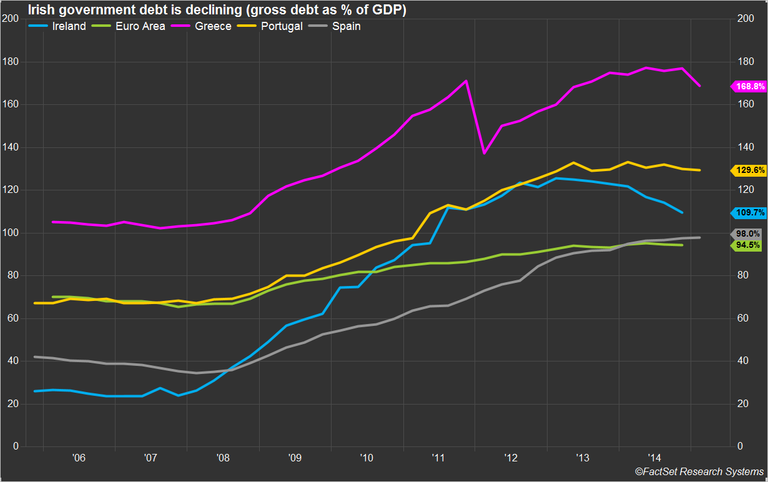

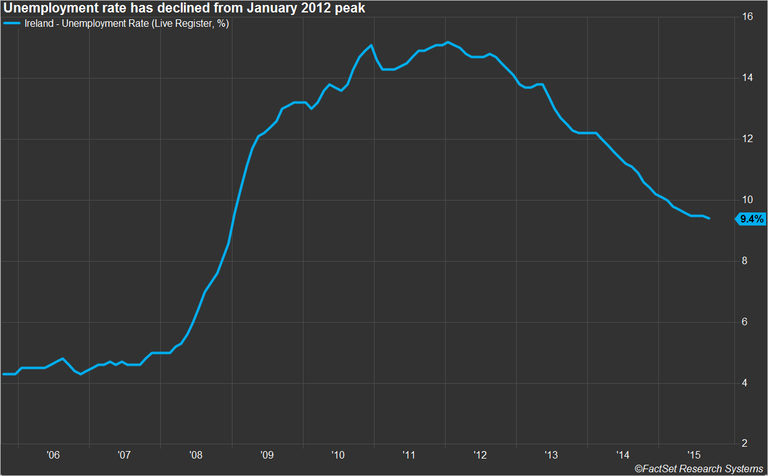

Since exiting the program in the end of 2013, Ireland has seen continuous positive GDP growth and is now the fastest growing economy in the European Union (EU). Irish real GDP grew by 6.7% year-over-year in the second quarter of 2015 and 1.9% compared to the previous quarter. The future looks relatively rosy as well with analysts surveyed by FactSet forecasting 5.5% annual growth for 2015 and 3.5% for 2016. Higher economic growth and fiscal austerity measures have enabled Ireland to reduce its government debt from 125.7% of GDP in the first quarter of 2013 to 109.7% of GDP in the end of 2014. It remains higher than the Eurozone total, which was at 94.5% of GDP in the end of 2014, but is still lower than the ratios in Portugal and Greece. Economic growth has also had a significant positive impact on the jobless rate—the unemployment rate has declined steadily since its peak of 15.2% in January 2012 and currently stands at 9.4%.

FactSet clients: launch this chart

FactSet clients: launch this chart

One key component of Ireland's economic success has always been the country's low corporate taxes; at 12.5% the corporate tax rate is among the lowest in Europe. The corporate tax regime has been strongly criticized by the EU and the United States as large multinational companies have actively shifted profits to Ireland to avoid taxes in other countries; however, the government is now looking to align Ireland's corporate tax system with the OECD's Base Erosion and Profit Shifting (BEPS) initiative, which is designed to hinder tax avoidance. BEPS is expected to be implemented at the beginning of 2016 and would require multinational companies headquartered in Ireland to make more information on their global operations available to the Irish tax authorities, who could then share this with the appropriate tax authorities in other countries as well.

FactSet clients: launch this chart

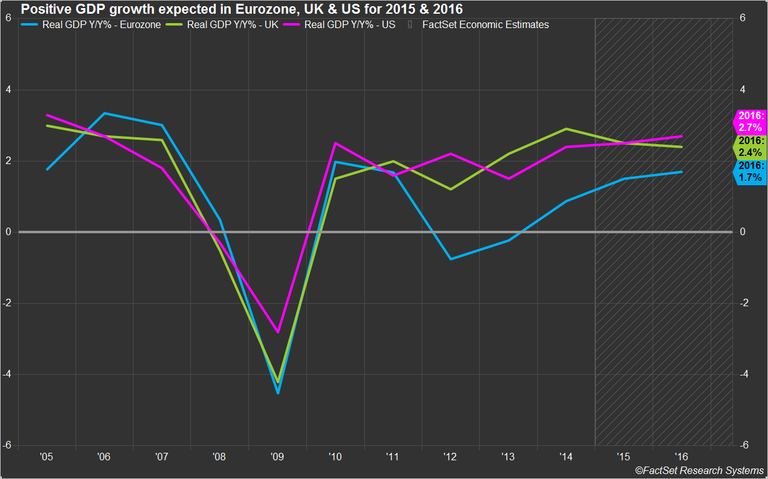

While global corporations have been looking to export profits to Ireland, Ireland's product exports to the rest of the world are also important drivers of growth. Positive economic growth in the UK and the U.S., two of its main trading partners, have helped to boost total exports, which surged by 12.1% in 2014 in real terms. In comparison, Eurozone growth has been weaker, but contributors surveyed by FactSet are expecting it to accelerate to 1.5% in 2015 and 1.7% in 2016, which should have a positive impact on Irish exports. However, as an export-driven economy, Ireland is highly exposed to global economic events. Potential risks include deflation in the Eurozone, economic slowdowns among its trading partners and the possibility of the United Kingdom exiting the EU. However, Ireland has successfully emerged from financial crisis and now leads growth in the region, which cannot be attributed just to the "luck of the Irish."