On February 17, one of our M&A predictions for 2017 came partly true when Kraft Heinz announced an initial offer to acquire Unilever for $141.1 billion in cash and stock. Berkshire Hathaway is the largest shareholder in Kraft, with a 27% stake, and although many reports suggest that 3G Capital is driving the deal, certainly no company that Warren Buffett controls can do a deal of that size without Warren Buffett’s approval.

As we started combing through the details to analyze various aspects of the deal (which would have been the third largest deal in history) another one of our M&A predictions partly came true. On February 19, Kraft Heinz and Unilever suddenly withdrew their deal, demonstrating that while big deals will be done, the market for them appears to be in decline.

We had all the usual suspects, but just like that, Kraft/Unilever became the Keyser Söze of mega-deals. The whole story was right before us, but vanished just as quickly as it emerged.

Regardless, there are still interesting points to be gathered from the now cancelled deal, so let’s review what slipped through our fingers.

Options Trading

The mega-deal was officially disclosed on February 17, but on February 16, Kraft showed Call option activity 5.4 times its 30-day average, while Put option activity showed 7.1 times its 30-day average. Similarly, Unilever showed Call option activity that was 4.6 times its 30-day average and Put option activity 2.5 times average. That surge indicated that something was up.

UK regulations require disclosure of merger discussions earlier than Kraft would have liked, and ultimately this early notification is what Kraft claims undid the process. In a surprising show of restraint and respect, Kraft walked away from the deal, and both companies appear to have kept their heads held high. Now that it has walked away though, Kraft cannot make another Unilever offer for six months. Does this now mean Unilever could be a target for other buyers? Perhaps, but unlikely given how quickly it squashed this deal. Any future buyer would probably be looking at a 15-25% higher price tag, and few companies have the firepower of $160-$180 billion.

Arbitrage Opportunity

Mega-deals attract arbitrage opportunities, and immediately after disclosure, the market reacted positively to both companies; Kraft Heinz was up 10.7% on the day and Unilever was up 12.8%. The deal still showed a 9.5% gross spread by the end of the day. The spread hadn’t quite closed with the full confidence of the market, but given the preliminary stages of the offer and size of the deal it was still within striking distance of parity, especially when compared to smaller transactions that have had high hurdles and maintained wider gaps much later in the deal process.

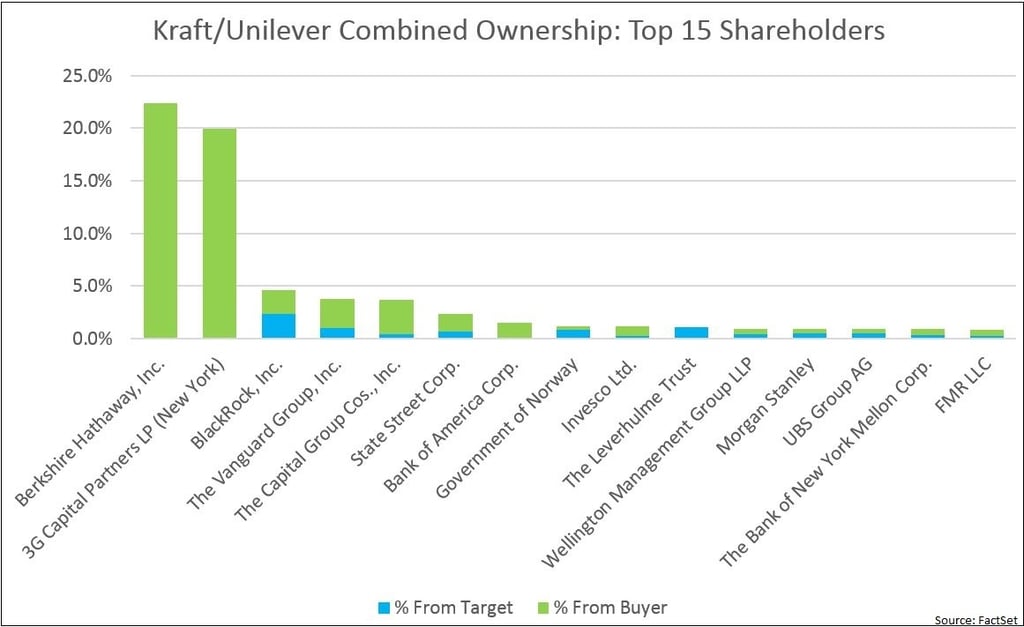

What Would Ownership Structure Have Looked Like?

As noted, Kraft Heinz is a product of Berkshire Hathaway and 3G Capital's deal-making skills. With the original offer of $30.22 per share in cash plus 0.222 shares of the combined company, Kraft shareholders would have maintained control of the combined entity. All other shareholders would have been below 5%, and only BlackRock would have entered the combined company with a sizable stake from its holdings in the target as well as the buyer.

Deal Valuation

Before walking away from the deal, Kraft offered an EV/EBITDA of 15.1x for Unilever. Comparing the deal multiples to other transactions, we find that no deal in the Household Goods sector above $1 billion and 10x EV/EBITDA has closed in the last five years. The exception is Walgreen's remaining stake purchase of Alliance Boots with an EV of $26.9 billion and multiple of 10.6x. The next closest valuation comparables are hardly worth mentioning (as they are less than 1% of Unilever), but they are the only other deals over $500 million in the sector to close with EV/EBITDA above 10x:

- Magic Holdings of China by L'Oreal for $719 million (21.0x)

- Laboratoires Anios of France by Ecolab for $884 million (13.3x)

In short, the deal already appeared to be generous value, even though Unilever rejected the 18.5% one-day premium as unsatisfactory. On a forward multiple basis, the deal offered 17.5x projected EBITDA.

| Enterprise Value |

| Value |

$154,466.88 |

| /Revenue |

2.6 |

| /NTM Revenue |

3.2 |

| /EBITDA |

15.1 |

| /NTM EBITDA |

17.5 |

| /EBIT |

17.9 |

| /NTM EBIT |

20.6 |

| /Tangible Book Value |

-25.0 |

| /Interest Bearing Debt |

8.8 |

| /Net Income |

26.9 |

| /NTM Net Income |

31.2 |

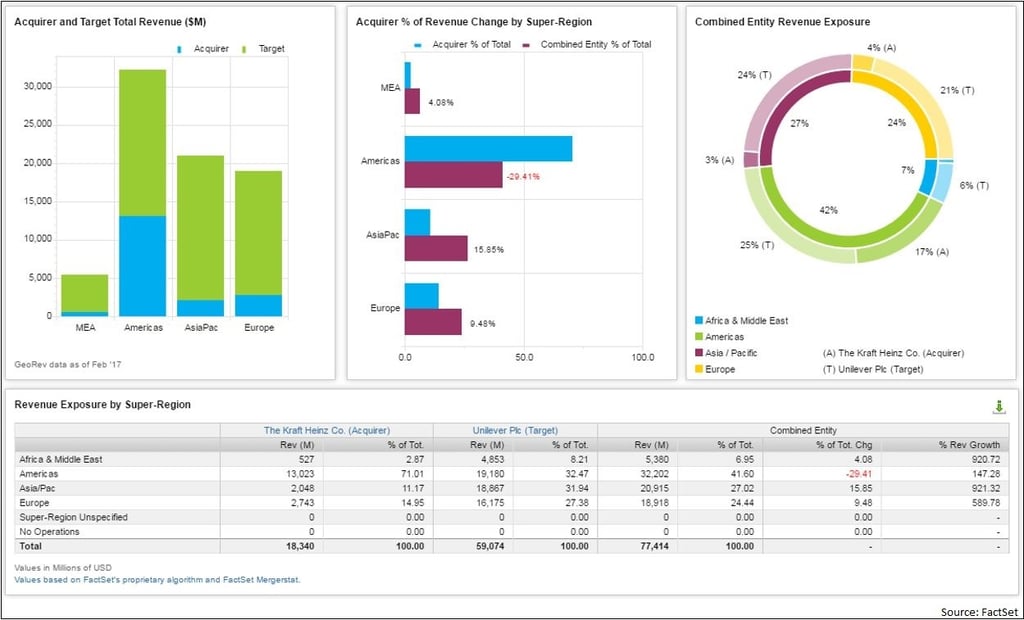

Geographic Revenue

Kraft Heinz generates 71% of its revenue from the Americas, while Unilever is a more globally balanced company, with roughly 30% each from Americas, Europe, and Asia/Pacific. Though Kraft is technically the bidder, measuring change here seems less meaningful given that Unilever has three times the sales. From Kraft's view, it would gain exposure to Europe, Asia, and Africa. But from Unilever's view, the transition would be towards Americas and away from other markets. Unlike mega-deals we have reviewed previously, this combination promised a major transformation.

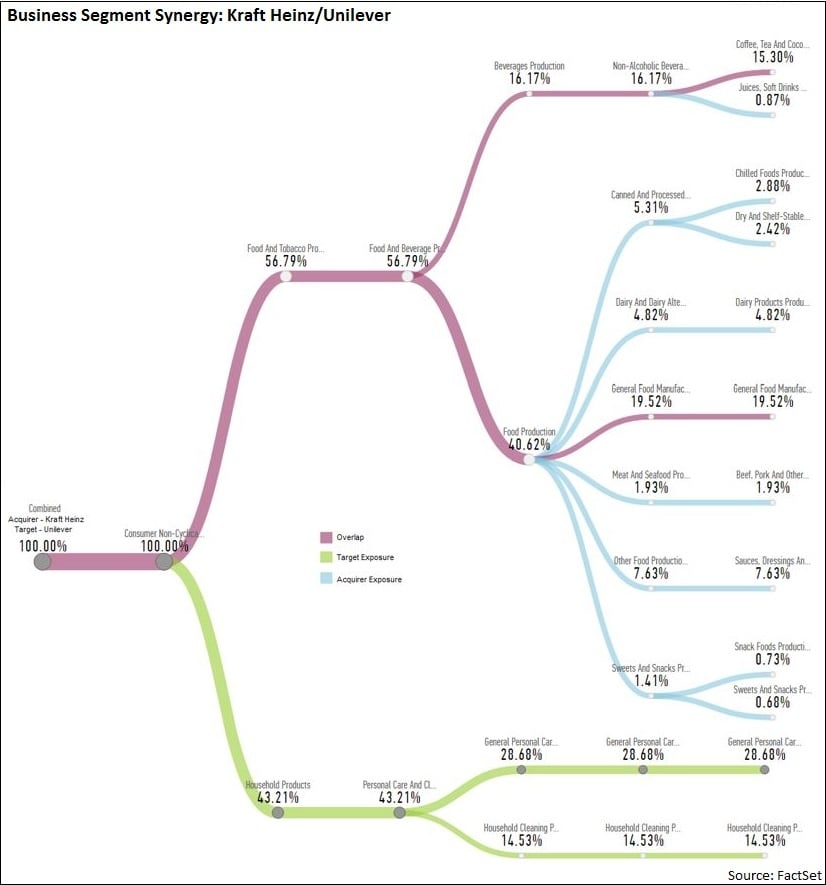

Business Segment Synergy

Unilever generates revenue from four main industry areas, while Kraft Heinz generates from 10 areas. The companies only overlap in two areas, both of which are dominated by Unilever. So the overarching question in this combination is: where is the synergy? Perhaps Kraft's plan would be to sell off the portion of the company that accounts for 43% of revenue through General Personal Care and Household Cleaning Products and focus on the remaining food businesses.

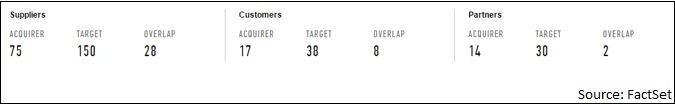

Operational Synergy: Supply Chain

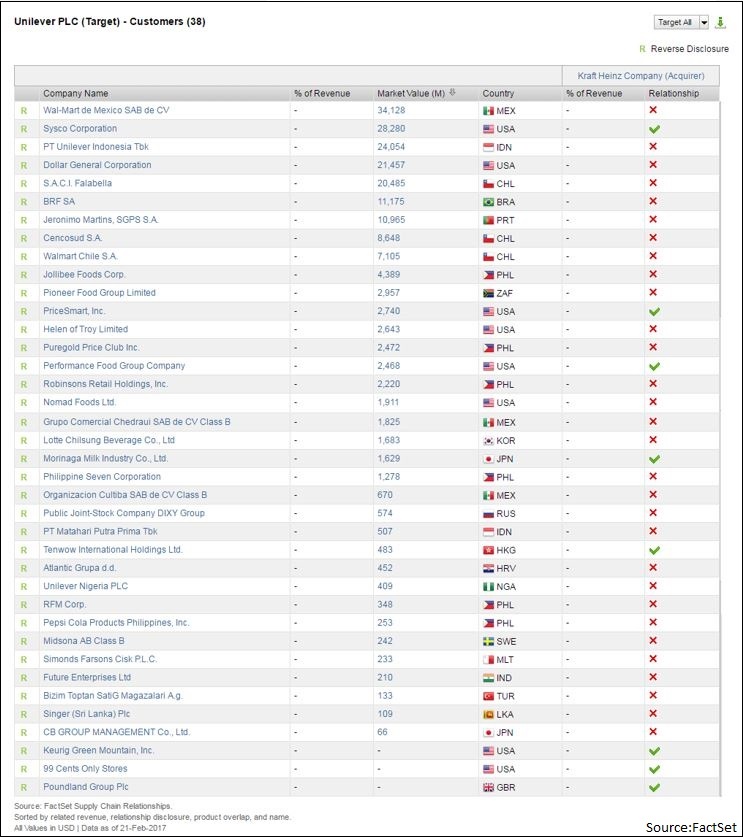

Looking at the potential supply chain from the tie-up, there appear to be opportunities for synergy. First, on the supplier side, the companies share 28 common suppliers. However, after the deal there would have been 197; this is where cost cutters like 3G would have executed and tried to consolidate. Second, there would have been 47 customers, of which Kraft Heinz would have gained 30 potential new opportunities. Finally, there is little overlap in partnerships, so both companies could have gained.

What Next?

Buffett and 3G aren't likely to go away anytime soon, but my guess is they will either lay low for a bit – plotting their next move – or strike while they are in execution mode. Either way, something is on the horizon.

It has long been speculated that Kraft Heinz may acquire Mondelez and reunite old brands, or that it could look to General Mills to expand its food business. If it wanted to focus overseas, then Danone might be a more realistic option. But if it was still interested in household goods and personal care products, then it may just see if Colgate-Palmolive is up for a deal.