At a time when fiscal austerity is the recommended prescription for many European countries in the aftermath of the European debt crisis, this past spring Germany passed a controversial pension reform package that lowered the retirement age for many Germans. Germany had been a strong voice for fiscal prudence in Europe, encouraging its fellow European nations to maintain or raise their retirement ages in order to bolster pension systems going forward, so the change was met with heavy criticism from many observers.

Changing retirement ages is an especially divisive issue in Europe. In 2010 then-president of France, Nicolas Sarkozy, raised the country’s retirement age, leading to massive demonstrations around the country. Two years later Francois Hollande campaigned for the presidency on a plan to reduce the retirement age from 62 to 60, a promise on which he followed through shortly after taking office. At the end of 2013 the French parliament approved a pension reform package that would once again raise the retirement age; however, the change occurs over a very long time horizon, with the retirement age gradually returning to 62 by the year 2035.

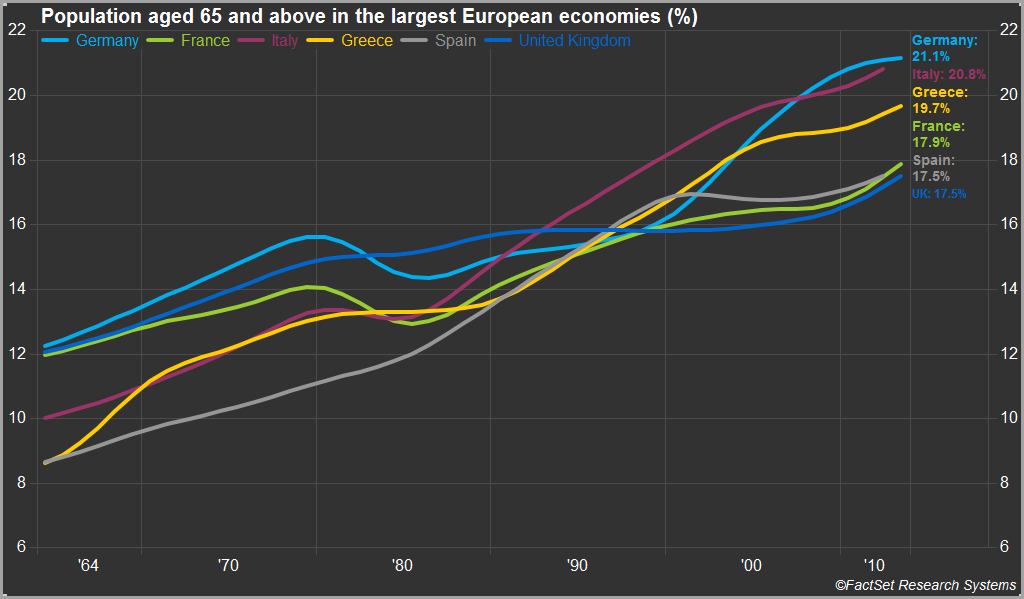

The European Commission has advocated a gradual move to a Europe-wide retirement age of 70 by the year 2060. According to data from the World Bank, Germany, Italy, and Greece lead the rest of Europe in terms of the percent of the population aged 65 and over, with rates of 20% or higher. As life expectancies continue to rise, the question of how to support these aging populations will need to be addressed as government pension expenses continue to surge.

The United States also faces future solvency problems with the pay-as-you-go social security system, although its aging problem is not nearly as severe as in other countries, with the percent of the population aged 65 and over at just 14%. It is not the age of the population or retirement age that is currently the major concern; it is the health of the population and how to pay for health care.

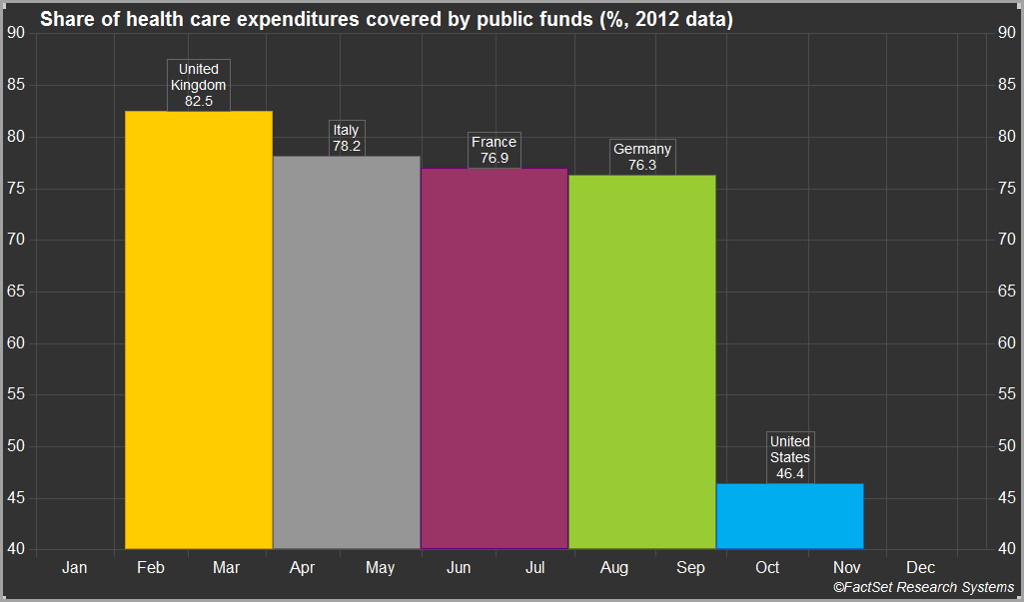

In contrast to its counterparts in Europe, the U.S. does not have a public health system that covers all of the population. In the U.S., less than 50% of total health expenditures are paid for by the government, compared with over 75% for European countries. The Medicaid program provides health care for low-income Americans, while Medicare is a social insurance program for the elderly. However, soaring health care inflation has led to reduced access to health care for Americans without access to Medicaid or Medicare.

Many Americans, including both lawmakers and the general public, have an aversion to seeing the government shoulder a greater portion of national health care spending or moving anywhere close to a European-style public health care system. Therefore, health care became a hot-button political issue in the U.S. when the Affordable Care Act (ACA) was signed into law in 2010. The law was intended to increase health care coverage and affordability for all Americans, targeting those who previously had no health insurance.

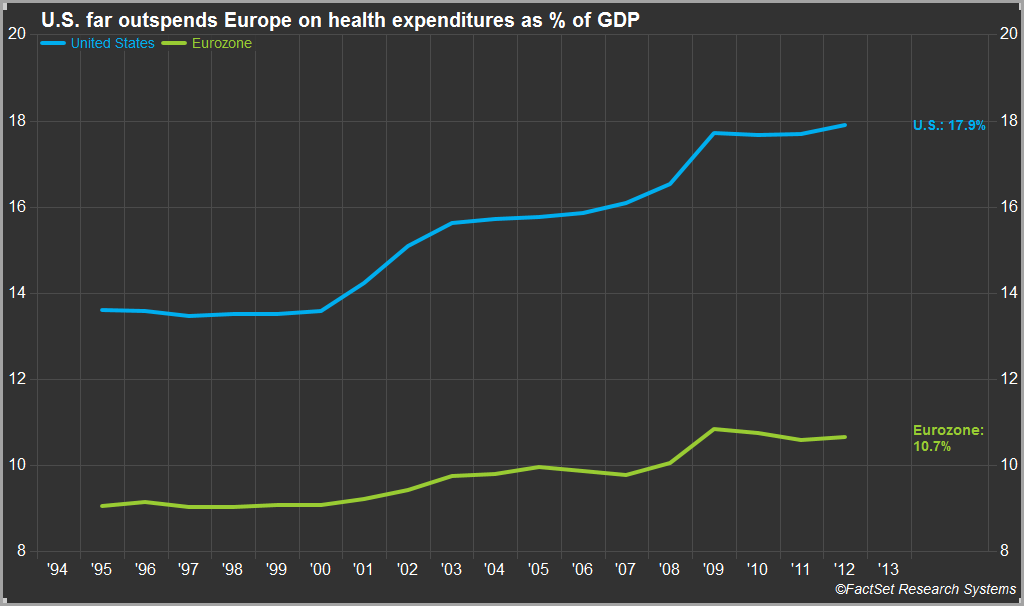

A major goal of the ACA is the reduction of price inflation for health care. According to the World Bank, the U.S. leads the world in health expenditures as a percent of GDP, and only Norway and Switzerland lead the U.S. in per capita expenditures (note that Norway and Switzerland rank 2nd and 3rd in the world for GDP per capita). There are many factors that contribute to soaring health care costs across all countries. In the U.S. unhealthy habits and obesity certainly play a role in pushing up health care spending; among the G7, the U.S. ranks first for diabetes prevalence and last for life expectancy. The global trends of aging populations, unhealthy eating habits and increasing rates of chronic diseases are pushing public spending on pensions and health care to new highs, and governments around the world should be moving toward policies to prevent future fiscal crises.