Last week in the series, we discussed how lack of excess return on actively managed portfolios is not purely a function of stock selection. Regardless of strategy employed, however, intelligent portfolio construction can help improve performance, and through the processes discussed in this series, can aid in the transition from pure research to portfolio construction.

We’ve already walked through our process for modeling alpha estimates across global equities. Here, we’ll discuss mean-variance optimization techniques, and how to translate our findings into an investable portfolio.

Related: Moving from Research to Construction: Stock Selection

Measuring Our Signal

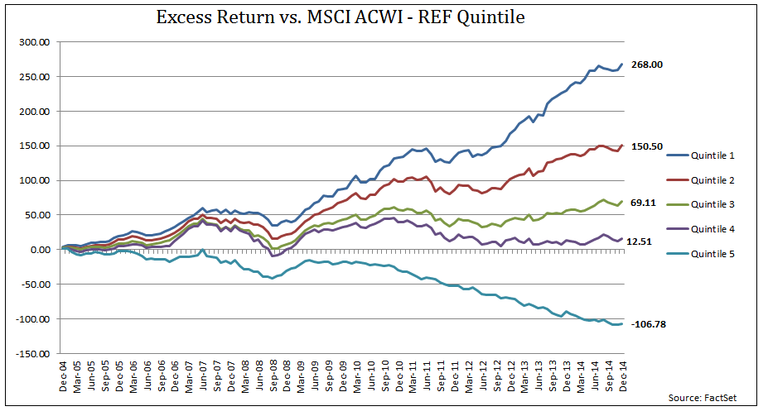

In order to measure the efficacy of our signal, we back-tested our results using FactSet Alpha Testing. We grouped our universe into quintiles and rebalanced monthly for 10 years. The first quintile represents the top 20% of securities based on high alpha estimates, and the fifth quintile is comprised of the 20% of securities with the worst alpha estimates. The chart below highlights the cumulative equal weighted return of each quintile relative to the benchmark.

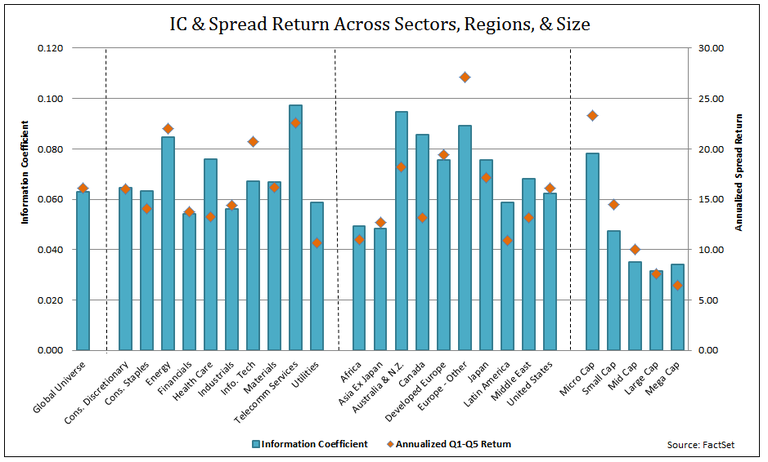

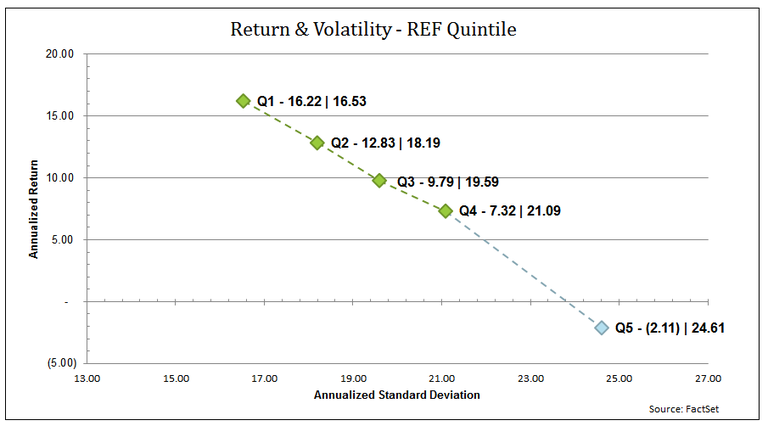

As we can see, there is a clear monotonic relationship between our alpha estimate and forward returns, with the top quintile producing 268% of outperformance over ten years. The following graphs illustrate the Information Coefficient and Spread (Long Q1 / Short Q5) Returns across GICS Sectors, Regions, and Size buckets, as well as the risk return tradeoff between investing in the various quintile portfolios.

We can then conclude that our stock selection framework does what it’s supposed to do: pick good stocks. When weighting equally, ignoring liquidity, transaction costs, and other real-world investment constraints, the Q1 portfolio does exceptionally well over the 10-year period analyzed. Our next task is to transition from signal to portfolio while hopefully achieving similar performance results.

Constructing Portfolios

How can we build an investable portfolio, through time, that harnesses the strength of our stock selection model? Our portfolios are constructed under the Markowitz mean-variance optimization framework, which seeks to maximize a utility function while adhering to portfolio constraints. We also attempt to minimize factor alignment problems through the use of the Alpha Alignment Factor approach presented by Saxena and Stubbs in 2010. We utilize the Axioma Portfolio Optimizer and Risk Models integrated within FactSet, as well as FactSet’s Portfolio Simulation utility to historically back-test the portfolios over 10 years. Our base case optimization is formulated as follows:

Model Inputs

- Initial Holdings - $1B USD

- Trade Universe / Benchmark - MSCI AC World Index

- Monthly Rebalance

- Risk Model - Axioma World-Wide Fundamental MH

- ITG Global Cost Curves

Objective

Constraints

- Fully Invested - 0% Cash

- Max Asset Weight - 8%

- Threshold Position - 35 bps

- Liquidity - 10% of Security’s 1M Avg. Dollars Traded

- Turnover - 20% Buy Side

- Active Risk - 7.5%

In addition to our base case portfolio, we augment our strategy using the following methods.

First, we employ a statistically based risk model to control active risk in the portfolio. Statistical risk models are mathematical constructs responsible for observed correlations in asset returns. Unlike fundamental risk factors, statistical factors have no descriptive value and are often referred to as “Blind Factors.” While essentially useless for attributing volatility, statistical risk factors are not confined to the definitions of fundamental factors and can thus dynamically pick up systematic effects in the market as they evolve and/or are beyond the scope of pre-defined factors. Statistically-based risk models have been shown to improve ex-post results in optimized portfolios in research conducted by Guerard, Markowitz, and Xu in 2013. See the 2010 version of the Axioma Risk Model Handbook for further detail regarding Axioma Statistical Risk Models.

Our second approach is to budget risk at the security level. Risk budgeting involves limiting the contribution to absolute or active risk from a set of assets or group of assets in the portfolio. Our “Risk Budget” portfolio incorporates a statistical risk model and limits any single security from contributing more than 8% of the portfolio’s total tracking error. Our last improvement to the base case is to incorporate transaction cost management into the utility function of the optimization model. Our new utility function considers the tradeoff between expected return and transaction costs.

- = Portfolio Utility

- = Weight of Alpha | = Security Expected Return

- = Weight of Transaction Costs | = Estimated Transaction Costs

Our final portfolio incorporates a statistical risk model, risk budget constraint, and transaction cost variable within our utility function.

Next week in the final installment of this series, we’ll review ex-post performance results across all of our portfolios, and we’ll leave you with some thoughts regarding further enhancements to the portfolio construction process through the use of exogenous factors and shifting market regimes.

Read part one of the series: Moving from Research to Construction: Stock Selection