What will be the Actual Earnings Growth Rate for Q4?

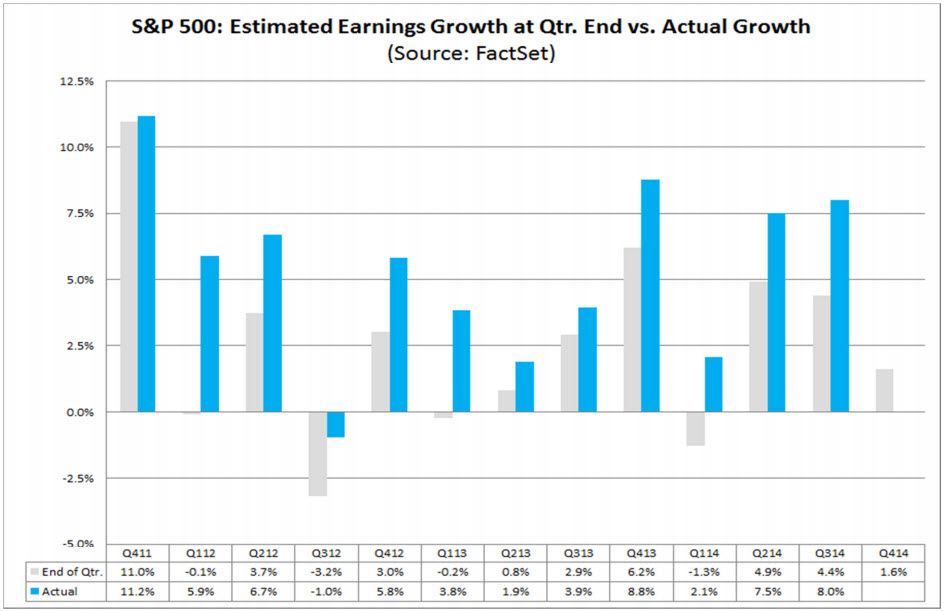

As of today, the S&P 500 is projected to report year-over-year growth in earnings of 1.1% for the fourth quarter. What is the likelihood the index will report actual earnings growth of 1.1% for the quarter?

Based on the average number of companies reporting actual earnings above estimated earnings in recent years, it is likely the index will report actual earnings growth higher than 1.1% for Q4.

When companies in the S&P 500 report actual earnings above estimates during an earnings season, the overall earnings growth rate for the index increases because the higher actual EPS numbers replace the lower estimated EPS numbers in the calculation of the growth rate. For example, if a company is projected to report EPS of $1.05 compared to year-ago EPS of $1.00, the company is projected to report earnings growth of 5%. If the company reports actual EPS of $1.10 (a $0.05 upside earnings surprise compared to the estimate), the actual earnings growth for the company for the quarter is now 10%, five

percentage points above the estimate growth rate (10% - 5% = 5%).

Over the past four years, 72% of companies in the S&P 500 have reported actual EPS above the mean EPS estimates on average. As a result, the earnings growth rate has increased by 2.1 percentage points on average from the end of the quarter through the end of the earnings season due to these upside earnings surprises.

If this average increase is applied to the estimated earnings growth rate at the end of Q4 (December 31) of 1.6%, the actual earnings growth rate for the quarter would be 3.7% (1.6% + 2.1% = 3.7%).

What Sectors and Industries May See Upside and Downside Earnings Surprises?

With the start of the Q4 2014 earnings season during the upcoming week, which sectors, industries, and companies might report upside and downside earnings surprises?

The FactSet Sharp estimate predicts the direction of upside and downside EPS surprises relative to the mean EPS estimate. When a Sharp EPS estimate is generated for a company, it is an indication of an expected earnings surprise. The direction of the earnings surprise depends on the difference between the Sharp estimate and the mean EPS estimate.

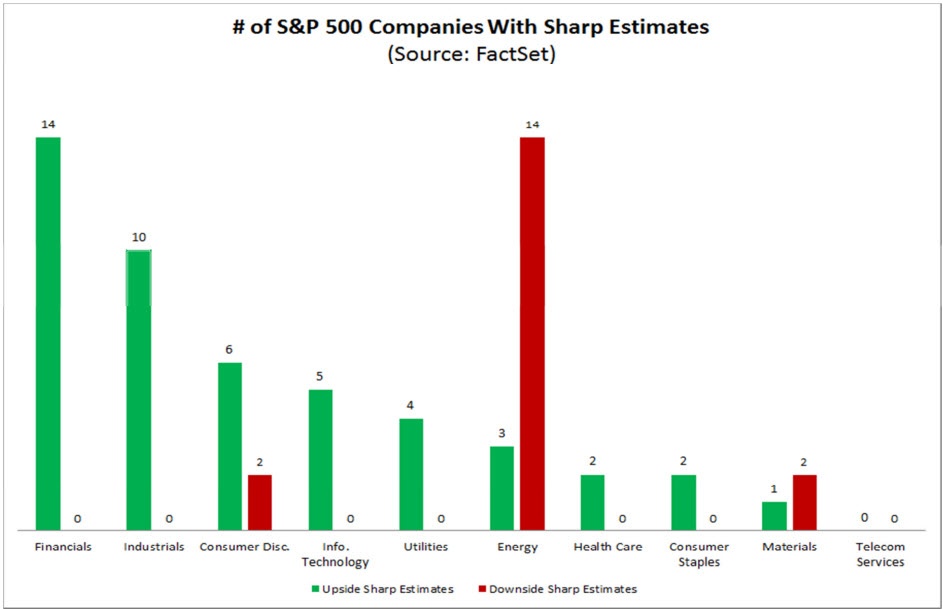

For the S&P 500 overall, 47 companies have a Sharp EPS estimate above the mean EPS estimate (upside surprise indicator) for Q4 and 18 companies have a Sharp EPS estimate below the mean EPS estimate (downside surprise indicator) for Q4. The remaining companies in the index do not have a Sharp estimate at this time for Q4 (no surprise predicted) or have already reported actual EPS for Q4.

At the sector level, the Financials sector currently has the highest number (14) and the highest percentage (16%) of companies with a Sharp estimate above the mean EPS estimate for the fourth quarter. At the industry level, 8 of these 14 companies are in the Insurance industry, including XL Group PLC, Ace Limited, and Allstate Corporation.

On the other hand, the Energy sector currently has the highest number (14) and the highest percentage (33%) of companies with a Sharp estimate below the mean EPS estimate for the third quarter. At the sub-industry level, 11 of these 14 companies are in the Oil & Gas Exploration & Production sub-industry, including Apache Corporation, ConocoPhillips, and Chesapeake Energy Corporation.