The “blended” same store sales (“SSS”) growth rate of U.S. retailers rose from 1.8% to 1.9% over the trailing month. “Blended” growth rates use estimated results when actual results have not yet been released. The biggest contributor to the rise over the month was CVS Caremark, which reported SSS growth of 3.3% versus a mean expectation of 2.0%. This echoes peers Walgreen and Rite Aid, which have repeatedly beaten monthly SSS estimates. Headline SSS growth was also aided by SUPERVALU, which posted a significant positive SSS surprise (0.6% growth versus an expectation of 0.1%) despite missing profitability targets, and Starbucks, which accelerated U.S. SSS growth to 7.0%.

On the sub-sector level, the Retail Motor Vehicles & Parts group is again showing the strongest blended SSS growth (+6.7%), while the Electronics & Entertainment group is again reporting the lowest growth rate (-1.4%). However, a lot of divergence was reported in the Retail Motor Vehicles sub-sector over the past month. AutoNation missed its estimate by 2.6 percentage points, but Penske Automotive Group beat its estimate by 5.3 points. LKQ Corporation missed by 3.6 points, while Asbury Automotive Group beat by 3.0 points. The overall effect was a ten basis point (“bp”) drop in the sub-sector’s blended SSS rate. Meanwhile, in the Electronics & Entertainment sector SSS growth fell 40 bps over the month after seven of eight retailers missed SSS projections.

In terms of Q2 SSS guidance, 7.3% of companies have issued positive guidance and 7.3% have issued negative guidance. In Q1, the guidance breakdown was far bleaker: 5.2% positive and 12.1% negative. Positive guidance moved into balance with negative guidance this month after Burlington Stores updated its prior guidance upwards from mean growth of 2.5% to a mean of 3.5%.

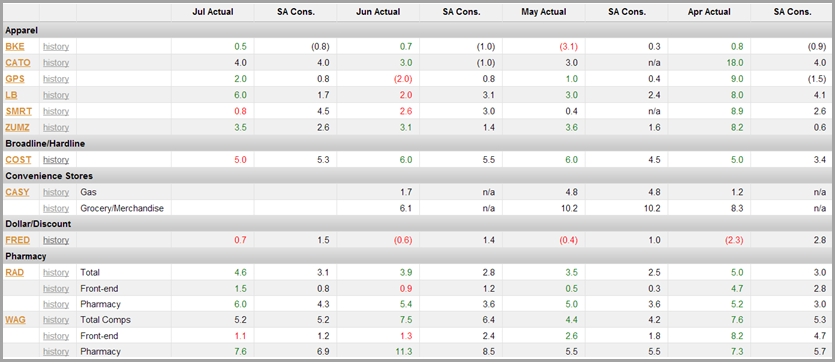

Monthly SSS from StreetAccount Show Improvement Apparel Retailers, a Step Backward for Costco

Companies reporting monthly SSS data showed positive results for July as compared to the consensus estimates from StreetAccount. Four of six apparel companies—Buckle, Gap, L Brands, and Zumiez— exceeded consensus estimates, while Cato was in line with projections and Stein Mart missed expectations. Of these retailers reporting monthly SSS results, L Brands showed the most significant divergence to projections. The company reported SSS expansion of 6.0% versus StreetAccount consensus growth of 1.7%. The company’s stock rose 4.3% on the day.

Costco, on the other hand, missed the StreetAccount consensus for the first time in five months. SSS growth of 5.0% compared to a mean expectation of 5.3%, and represented a drop of 1 percentage point from the company’s June SSS figure.

Fred’s, meanwhile, missed the consensus estimate (0.7% versus a projection of 1.5%) but recovered from six consecutive months of declines to SSS.

Finally, Rite Aid beat the consensus estimate (4.6% vs. 3.1%) and improved upon June results (+3.9%), while Walgreen reported SSS in line with the estimate (+5.2%) and down from 7.5% growth in June. Both companies showed continued strength in their pharmacy businesses.