When it comes to working with some of the wealthiest individuals in the world, there is no room for complacency. While our research of 1,022 high net worth individuals (HNWIs) highlights that they are broadly satisfied with their primary wealth managers, we also uncovered that, as clients, they feel they are putting a significant amount of effort into their advisory relationships. In an industry where expectations are evolving, wealth managers will need to do more to streamline the experience for their clients if they are to maintain high satisfaction levels and demonstrate the value in delegating responsibility of managing their wealth

Integrating technology into the advisory relationship seems to be the key here. Technology should no longer be seen as a "nice to have" but rather a "must have." This is not just about creating efficiencies in the business model, but acknowledging that digital support is mutually beneficial to wealth managers and the HNWIs they serve.

For clients, technology delivers a more insightful and less labor intensive customer experience. For firms, technology presents the opportunity to deepen client engagement and move customers along the advisory spectrum towards a more delegated relationship.

The Advisory Spectrum

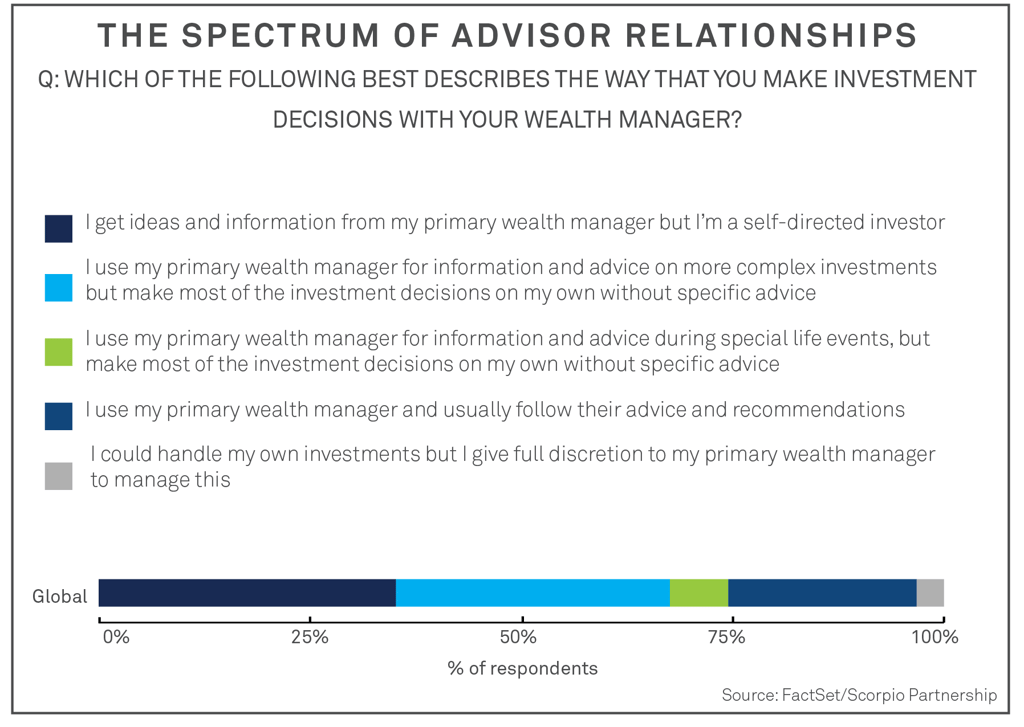

It is often seen in the wealth industry that the provision of financial advice is polarized. It is assumed that clients typically fall into one of two categories: either do-it-yourself, self-directed investors who require little support from professionals or delegators who defer all financial decisions to experts.

Yet out of the sample of HNWIs we surveyed in 2016, just 41% fell neatly into either of these two profiles. The range of advisory relationships is, in fact, much broader, as shown in the chart below. With stiffening competition among wealth managers, it’s critical to consider the 59% of prospective clients with investment preferences that fall somewhere between "do it yourself" and "delegator."

The most commercially attractive customers are those closest to the delegator end of the advisory spectrum: "partial delegators," who report that they follow the recommendations of their wealth manager most—but not all—of the time. Partial delegators typically have high satisfaction levels and a larger proportion of their assets with their wealth management firms. However, they also indicate that the success of their advisory relationships is, in part, a function of their own contribution.

To impress these “partial delegators," wealth managers need to decipher how to reduce friction points in their relationship and deliver a more seamless service. These clients will require greater incentive to deepen their engagement with wealth managers and feel the effort they’ve invested in the relationship is justified, as we explore below.

Streamlining Delivery

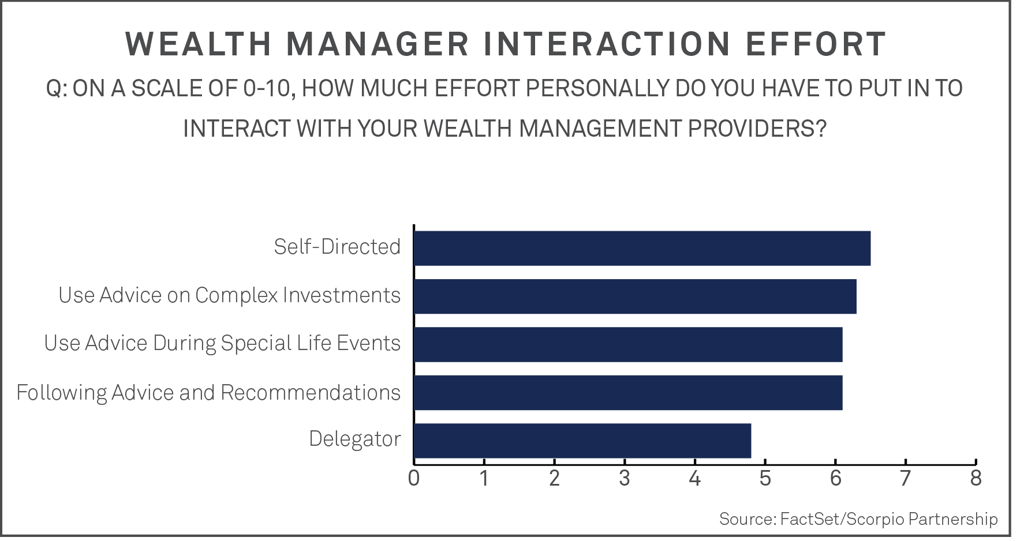

We asked HNWIs to rate on a scale of 0-10, with 10 being highest, how much effort they feel they need to put into interacting with their wealth management providers. Clients who "generally follow advice and recommendations" indicated a personal effort level of 6.1 out of 10 in their advisory interactions, just 0.4 points lower than those who are completely self-directed, as shown below. With effort high for clients across the advisory spectrum, there is hardly much incentive to delegate more decisions as well as more of their wealth to advisors.

Partial delegators exhibit a clear preference for the integration of digital channels into their relationship management. Almost half of them prefer to use digital communications to interact with their advisors. In particular, they prefer online channels when it comes to receiving news and updates and reviewing market changes. Furthermore, over 80% of them said they would innovate the quality of statements and reporting if they were in charge of their wealth management business.

Upgrading digital information delivery to provide a more streamlined information and communications management system could give wealth management firms an opportunity to meet these client expectations and reduce the effort that clients put into the relationship.

Enhancing technology will also become increasingly important to delivering value in discretionary relationships as the expectations of partial delegator clients rise. Indeed, a quarter of these clients expect risk suitability assessments on at least a weekly basis, something only achievable with technological support. The reward for wealth institutions is reducing the time burden when delivering insight to clients.

By thinking about the advisory spectrum—and the preferences of clients along it—advisors can better determine how to deliver an optimized client experience. The effort that clients say they currently put into these relationship raises questions about the relevance of delegating relationships to advisors. But with an enhanced digital offer, advisors will be able to reduce friction points around information delivery and communication to more clearly demonstrate their value.