Among the policy changes expected under President Trump, an increased focus on building up the military is one of the most highly anticipated. In an address to the National Governors Association on February 27, President Trump proposed a military spending increase of $54 billion, and his cabinet selections for the Department of Defense and Homeland Security point towards increases in defense spending. While the country waits for military policy details to be constructed and implemented, markets have been closely following indications that these changes are forthcoming.

Defense Price Performance

It has been well publicized that U.S. equity markets experienced a “bump” following President Trump’s election. Following this initial bump, have defense stocks continued to react positively to news that suggests that a military buildup is imminent?

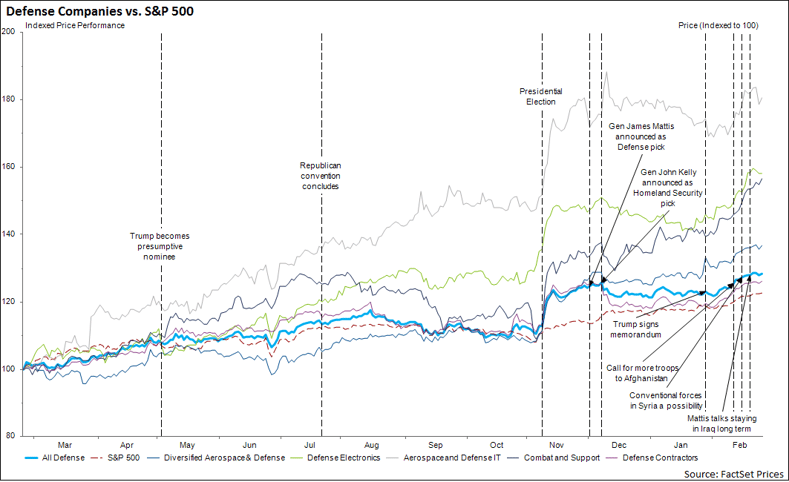

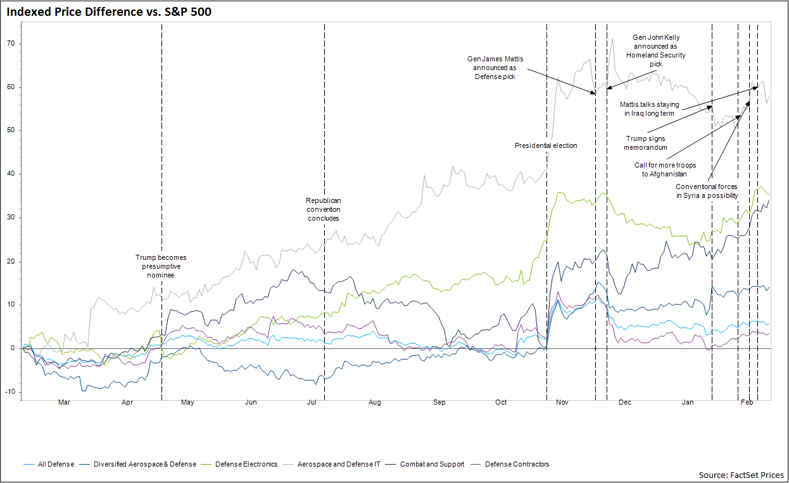

Leading up to the 2016 presidential election, the price performance of an index of the top U.S. defense stocks aligned closely with the price performance of the S&P 500. Following the election, however, prices of the two began to diverge as defense stock prices increased at a quicker rate than the S&P 500. When broken down further to the FactSet RBICS sub-industry level, the gains of groups such as Aerospace and Defense IT as well as Defense Electronics are even more pronounced.

Since the election (market close on November 8, 2016), the S&P 500 has increased by 10.65%. Comparatively, this group of defense companies has outpaced the S&P 500, increasing by 13.71% over the same period. Combat and Support stocks have seen the largest gains—increasing by a whopping 40.45% since November 2016.

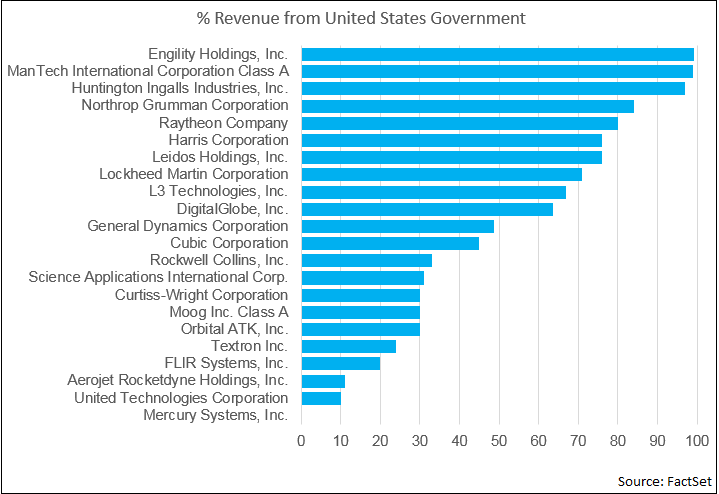

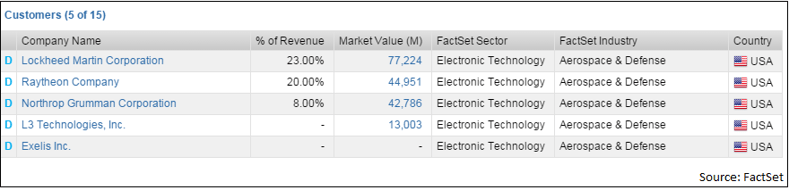

It comes as no surprise that stocks in the defense sector have outperformed in anticipation of policy changes. The U.S. government is the largest source of revenue for 19 of the top 22 U.S. defense companies by market value. Of these companies, 10 derive more than 50% of their revenue from the U.S. government. While the amount of revenue received by Mercury Systems directly from the U.S. government is unknown, the company earns most of its revenue selling to Lockheed Martin, Raytheon, and Northrop Grumman, who then supply to the government.

Reaction to Military Announcements

The selection of General James Mattis to lead the Department of Defense and General John Kelly to lead the Department of Homeland Security were early signals that the President intended to follow through on his campaign promise to strengthen the country’s military. Since then, both the administration and military officials have taken actions and made statements that show that the government is ready and willing to increase military spending and military action.

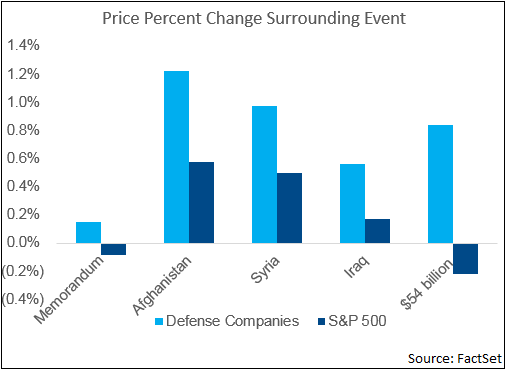

On January 27, President Trump signed a memorandum to rebuild the U.S. Armed Forces and improve U.S. military readiness. From the trading day before the event to the trading day after the event (close of January 26 to- close of January 30), defense stock prices increased 0.15%. This increase was 0.24 more than the -0.09% decrease in the S&P 500 over the same period.

Defense stocks have experienced similar upticks in reaction to statements made by military leaders. Using the same price change methodology, defense stocks saw gains stronger than that of the S&P 500 following these recent events:

- February 9: General John Nicholson, the commander of the American led military force in Afghanistan tells Congress that more troops are needed in Afghanistan

- February 15: Pentagon officials state that the Defense Department might send conventional ground combat forces into Syria

- February 20: Secretary Mattis suggests that U.S. troops will continue to be in Iraq for the long term

Furthermore, following these events the difference between the indexed price of the defense sector and the S&P 500 has increased by almost 174%. Here, Combat and Support stocks again show the largest gains, their differential to the S&P 500 has increased over 4900% since Election Day.

Interestingly, the differentials of the aggregate defense index and the Diversified Aerospace & Defense companies to the S&P 500 was greatest on December 2, 2016, the day after President Trump announced General Mattis as his pick for Secretary of Defense. Similarly, the Aerospace and Defense IT sub industry, which shows the widest price differential to the S&P 500, reached its maximum difference on December 9, 2016, - two days after it was announced that General Kelly was the President’s pick for Secretary of Homeland Security.

In his February 28 Congressional Address, President Trump reiterated that he will be calling on Congress to pass a budget that focuses on rebuilding the military. At the time of this writing, since yesterday's address, defense stocks are up 0.84% and the S&P 500 is down 0.22%. As budget debates heat up, it will be interesting to see how the market continues to react to the potential increase in national defense spending.