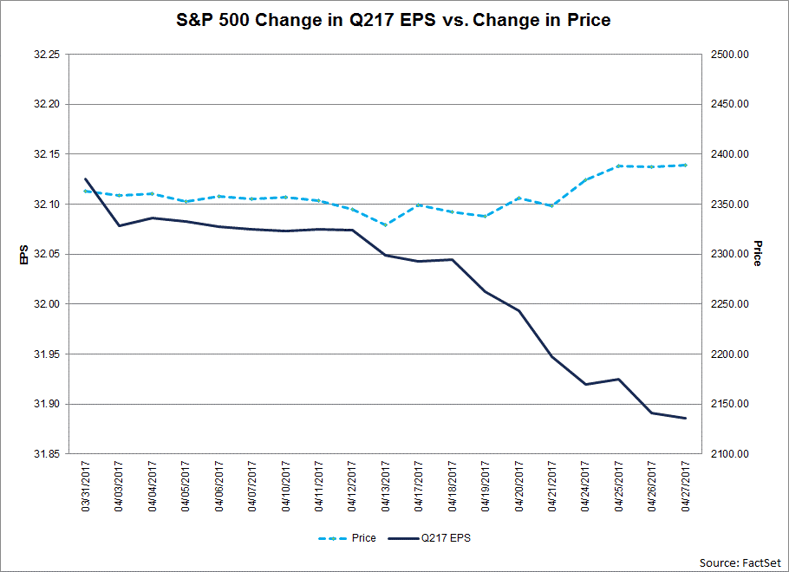

During the month of April, analysts lowered earnings estimates for companies in the S&P 500 for the second quarter. The Q2 bottom-up EPS estimate (which is an aggregation of the EPS estimates for all the companies in the index) dropped by 0.7% (to $31.89 from $32.12) during this period. How significant is a 0.7% decline in the bottom-up EPS estimate during the first month of a quarter? How does this decrease compare to recent quarters?

During the past year (four quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 1.5%. During the past five years (20 quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 2.3%. During the past 10 years, (40 quarters), the average decline in the bottom-up EPS estimate during the first month of a quarter has been 2.5%. Thus, the decline in the bottom-up EPS estimate recorded during the first month of the second quarter was smaller than the one-year, five-year, and 10-year averages.

In fact, this marks the smallest decline in the bottom-up EPS estimate for the index for the first month of the quarter since Q2 2014 (-0.2%).

Sector Level

At the sector level, eight sectors recorded a decline in their bottom-up EPS during the first month of the quarter smaller than the five-year average and 10-year average for that sector. One sector that stands out from the pack in terms of below average cuts to estimates is the Materials sector. This sector recorded a decrease in the bottom-up EPS estimate of 1.0% (to $5.00 from $5.05) during the first month of the second quarter. This 1.0% decrease is much smaller than the average decline of 8.0% over the past five years and the average decline of 9.0% over the past ten years in the bottom-up EPS estimate for this sector during the first month of the quarter.

As the bottom-up EPS estimate for the index declined during the first month of the quarter, the value of the S&P 500 increased during this same period. From March 31 through April 28, the value of the index increased by 1.1% (to 2388.77 from 2238.83). Assuming the closing price of the index for today is above 2238.83, this will mark the thirteenth time in the past 20 quarters in which the bottom-up EPS estimate decreased during the first month of the quarter while the value of the index increased over this same period.