As of Friday, more than 90% of the companies in the S&P 500 have reported earnings for the second quarter. Of these companies, 73% have reported actual EPS above the mean EPS estimate, which is above the five-year average of 68%. In aggregate, earnings have exceeded expectations by 6.1%, which is also above the five-year average of 4.1%. Due to these upside surprises, the earnings growth rate for the S&P 500 has improved to 10.2% today from 6.4% on June 30.

Given the stronger performance of companies relative to analyst EPS estimates and the improvement in the growth rate over the past few weeks, how has the market responded to upside EPS surprises during the Q2 earnings season?

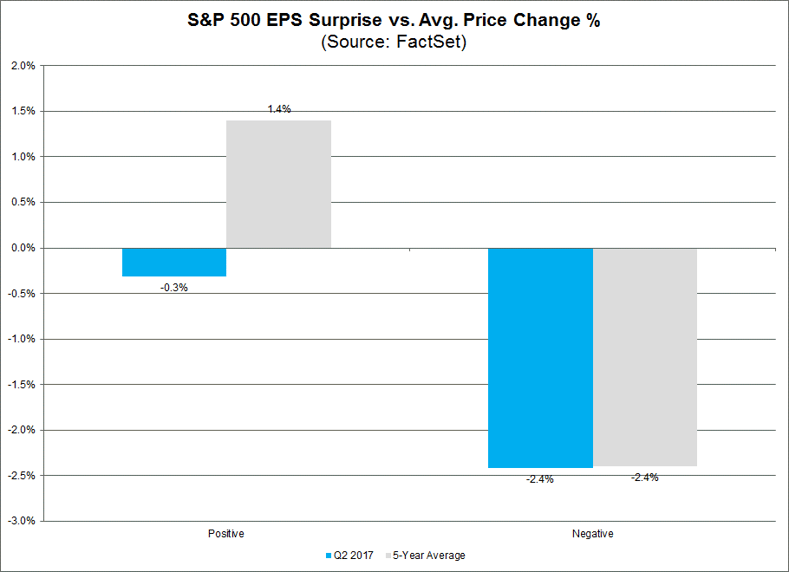

Companies in the S&P 500 that reported positive earnings surprises for Q2 have seen a decrease in price of 0.3% on average from two days before the company reported actual results through two days after the company reported actual results. Over the past five years, companies in the S&P 500 that have reported positive earnings surprises have witnessed a 1.4% increase in price on average during this four-day window.

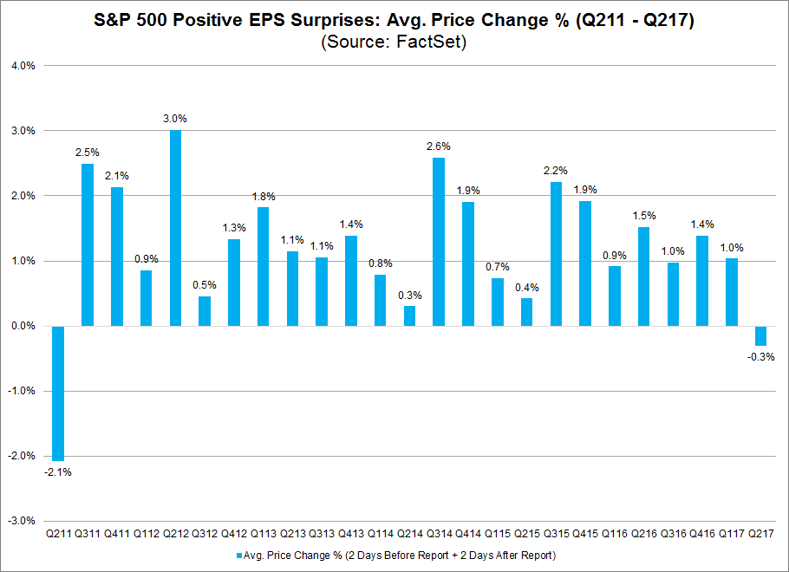

If the final percentage for the quarter is -0.3%, it will mark the first time since Q2 2011 (-2.1%) in which S&P 500 companies that reported positive earnings surprises recorded an average price decline over this 4-day window.

Of the 331 S&P 500 companies that have reported positive earnings surprises for Q2, 159 (or 48%) recorded a decline in price over this period. The average price decline of these 159 companies over this four-day window was -4.0%. Nine of these 159 companies witnessed a double-digit decline in price, led by Pioneer Natural Resources (-16%). After the closing bell on August 1, Pioneer Natural Resources reported actual (adjusted) EPS of $0.21, compared to the mean EPS estimate of $0.10. However, from July 28 through August 3, the price of the stock fell to $135.12 from $161.41.

Why is the market punishing companies (on average) that have reported positive earnings surprises? It is likely not due to forward EPS guidance or analyst revisions to EPS estimates for the third quarter. To date, fewer S&P 500 companies have issued negative EPS guidance and more S&P 500 companies have issued positive EPS guidance for Q3 2017 than average. In aggregate, analysts made smaller cuts than average to third quarter EPS estimates during the month of July.

Author’s Note: The Earnings Insight report will not be published on August 18 or August 25. The next edition of the report will be published on September 1.