By Nikita Pillai | December 21, 2016

Fabio Fais, Southern Europe Analytics Consultant, contributed to this report.

As 2016 comes to a wrap, there’s no doubt that political surprise and the ensuing economic uncertainty have arisen as two overarching themes of the year that caused global markets to grapple with concerns of volatility, risk, and exposure. While this year has already seen markets stirred up by the Brexit vote in June and more recently President Elect Donald Trump’s ascent to the White House, political surprises may be far from over as Italian citizens gear up to vote in a referendum that could significantly change the course of the country’s governance as we know it.

The country’s impending referendum will see citizens head to the polls on December 4 to approve or reject a package of constitutional reforms put forward by Prime Minister Matteo Renzi to address “institutional paralysis.” Renzi’s proposed reforms include reducing the powers of the Senate and Italy’s regional governments, making the Chamber of Deputies the primary legislative body –effectively terminating the perfect bicameralism that came of Italy’s 1948 constitution following the fall of Benito Mussolini’s dictatorship.For a country that has seen 65 governments since the end of World War II, Renzi believes constitutional reform is crucial to ensuring stability and allowing for effective governance.

Those in support of passing Renzi’s reforms point to increased legislative efficiency, political stability, and investor confidence. By recentralizing power, the reform also hopes to address issues of corruption entrenched in Italy’s regional governments that have long been considered a driving force behind the country’s alarming government debt – 158% of GDP in 2015 per the Organization for Economic Co-operation and Development.

Local businesses, investors, and pro-reform European governments fear that a “no” vote could not only unnerve markets and end the premiership of Matteo Renzi but also be a harbinger of the euro’s collapse. Those opposed to the reforms are concerned they may pose a threat to democracy by weakening the Senate’s role and placing significant power in the hands of the governing party.

In addition to the immediate changes on the ballot, passage of the reforms could set the stage for further disruption during Italy’s 2018 election. Advocating Italy’s abandonment of the euro is the anti-establishment Five Star Movement (MFS), running just a few points behind Renzi’s Democratic Party in opinion polls ahead of Italy’s general elections in 2018. Should Renzi’s reforms be in place in a scenario where the MFS emerges as the governing party, the party would have unprecedented power in governing the country, with limited oversight from a weaker Senate.

Based on the prevailing notion that a “No” vote could create a more challenging situation for Italy than a “Yes” vote, we constructed a stress test with a “No” vote victory being classified as the “stressed” situation.

In deciding on the factor shocks in this model, we assessed the movement in European markets in the heat of the Debt Crisis in 2011. This time saw the spreads for all PIIGS (Portugal, Italy, Ireland, Greece, Spain) widen deeply due to a substantial sell-off of their government bonds and the classic flight-to-quality to economically stronger core EU countries of the likes of Germany, France, Netherlands, and Belgium. As a result of the mass sell-off in the PIIGS and concerns of increased volatility, the euro depreciated against the US dollar and Japanese yen–safe haven currencies. Mario Draghi and the European Central Bank (ECB) then brought in quantitative easing as a means to bolster the regional economy at any cost.

Evaluating the factor shocks in this time period specific to the Italian economy, we set up comparable factor shocks for each stress test component in the model based on the assumption that the impact of a “No” vote will have far from as marked an impact on European economies systemically as the Debt Crisis of 2011 or Brexit.

Event-Weighted Stress Test: We chose to run this model as an Event-Weighted stress test so that periods that have changes similar to the shock amounts we decided on for the factors above are weighted higher than non-similar periods.

Risk Model History Limit: We specified a risk model history limit so the model will only feel back for factor correlations until the start of 2010 – just before the brink of the European Debt Crisis of 2011.

Horizon: We set the period over which the shock happens as one week for the purpose of this model.

Universe: Our tested universe was 30% Equity [Euro STOXX 600] and 70% FI [25% BAML Euro Government, 25% BAML Pan-Europe Government, 20% BAML EMU Corporate Index]. This universe does not contain inflation linked bonds.

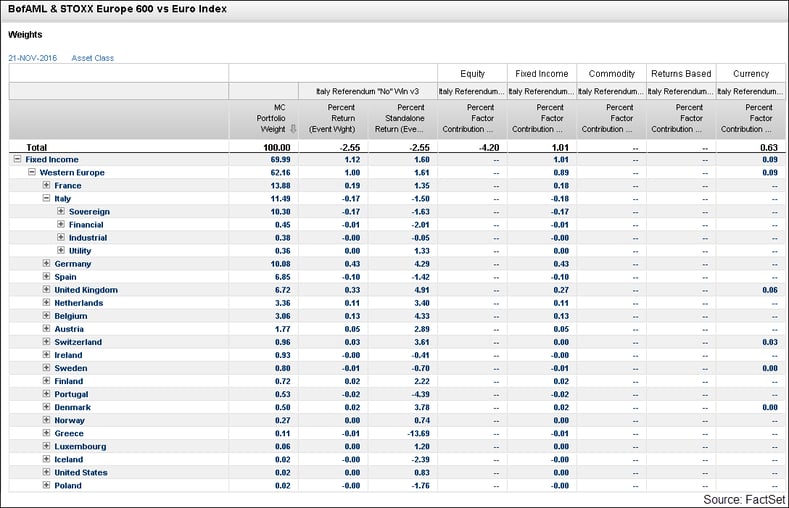

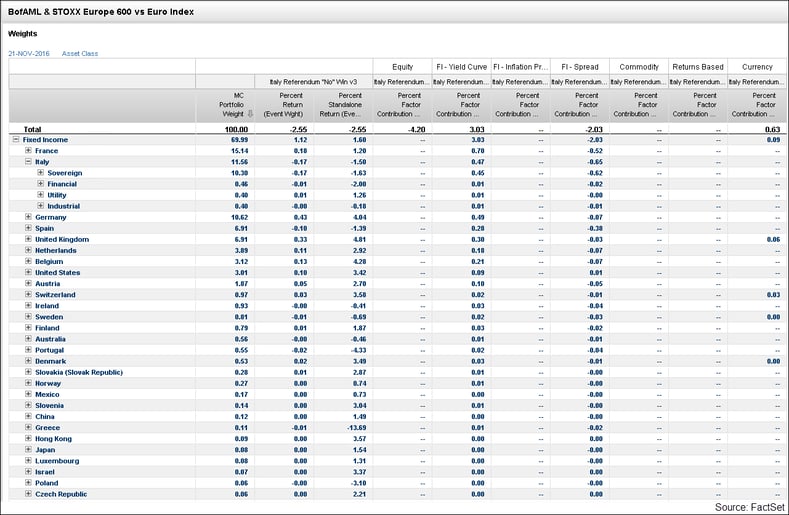

Overall, the portfolio loses 2.55%, mainly due to a drop in equity of 4.20% but is offset by a net gain on the fixed income front – a result of a gain on fixed income yield curves of 3.03% and a drop of 2.03% due to widened spreads.

Further analyzing the fixed income front, the PIIGS suffer the most as a result of a “No” vote primarily due to an increase in spreads. The EU core countries, on the other hand, gain, likely due to expected flight-to-quality behavior.

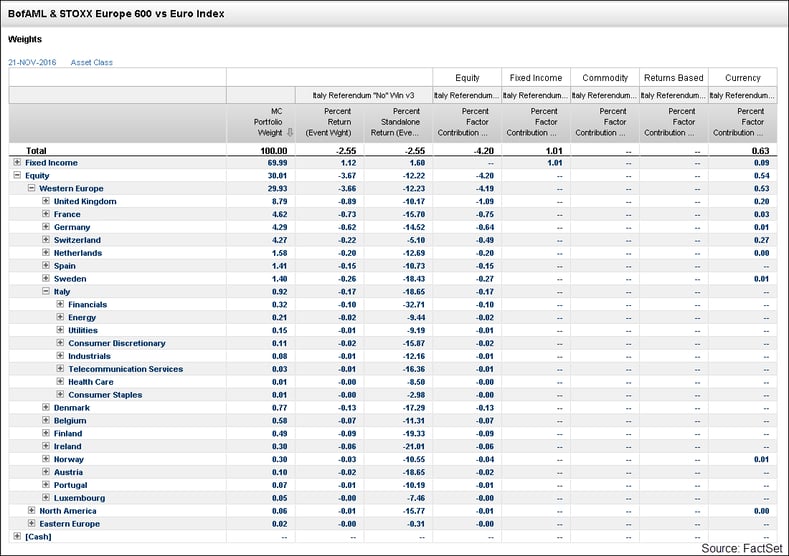

On the equity side, Italy’s weight is just residual on the Euro STOXX 600, and so due to correlations, the drop is limited. By looking at Standalone % Return however, Italy is in the top quartile of losing countries. Further filtering down to GICS sector groups on a country level, it can be seen that the Financials sector is indeed expected to be the top driver of Italy's drop in the aftermath of a “No” vote.

The results of the stress test suggest that a “No” vote will likely place a strain on some of Europe’s currently weakest economies (PIIGS) and result in a panic selling on equity markets in the immediate aftermath of the vote. Based on the assumptions and factor correlations of this model though, a “No” vote scenario is unlikely to fuel a systemic crash across European economies. The economic impact of a “No” vote is likely to be more concentrated on Italy alone.

PM Renzi’s resignation may not necessarily be the catastrophe that investors and European governments fear, as Italy could assemble a technocratic caretaker government, as it has in the past. The options markets supports this narrative, as the 30-day implied volatility of the FTSE MIB rose significantly last week, while the same measure on the Euro STOXX 50 fell– creating a difference between the two measures that is the widest it has been in almost two years. The divergence between the two measures implies that markets do not see the referendum as a black swan event that could cause systemic financial instability across the Eurozone.

With general elections also around the corner for France, Italy and the European Central Bank’s response to the December 4 referendum results will be instrumental to setting the tone for investor confidence in the Eurozone for the years to come.

Stress Test Your Portfolio Using 1990 and 2003 Middle East Conflict Scenarios

Explore how to leverage two FactSet hypothetical scenarios based on historical Middle East conflicts and stress test your...

Geopolitical Risk Scenarios: Stress Testing Investment Strategies Amid the War in Iran

Stay ahead of evolving markets with a stress testing module from FactSet. Use it as your starting point and build in your...

By Kristina Bratanova-Cvetanova | Risk, Performance, and Reporting

Portfolio Scenario Analysis and Stress Testing in Tariff Conditions

We added two base thematic stress tests for clients to run their specific assumptions and evaluate their investment strategies...

By Kristina Bratanova-Cvetanova | Risk, Performance, and Reporting

Post-Storm Analysis: How Weather Events Affect Investable Indices and Sectors

Learn how major weather events impact investors and explore how this FactSet historical analysis provides a basis for...

By Kristina Bratanova-Cvetanova | Risk, Performance, and Reporting

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.