Marc Flory, Senior Consultant, Dan St. George, Senior Consultant, and Suzy Valdes-Rodriguez, Senior Consultant, contributed to this report.

Earlier this month, Uber agreed to sell its Chinese operations to Didi Chuxing Technologies, a competitor whose success in the region had made it difficult for Uber to find its footing there. After the deal, Uber will become the largest Didi shareholder (18% stake), and the combined company will be worth roughly $36 billion.

With its place in China now settled, Uber is seeking to improve its market share in other parts of the world and making moves that will augment its fleet with cutting edge technologies.

Driving Innovation

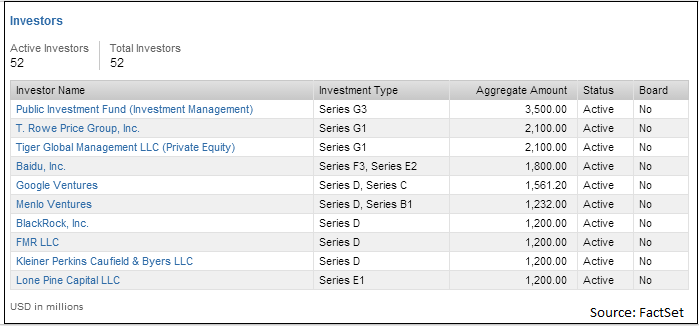

According to Uber’s finance head, Gautam Gupta, the company lost at least $1.27 billion in the first half of 2016, putting it on pace to greatly surpass the more-than-$2 billion in reported losses from 2015. Uber seems to be focused on expanding its customer base as it investigates self-driving car technology, relying on active investors to keep it afloat in the meantime.

Following its deal with Didi in China, Uber acquired driverless technology developer OTTO on August 18. The move will help Uber keep pace with Tesla and Google's autonomous car efforts and adds OTTO’s 90 developers to its team, giving the company one of the strongest autonomous engineering forces in the market.

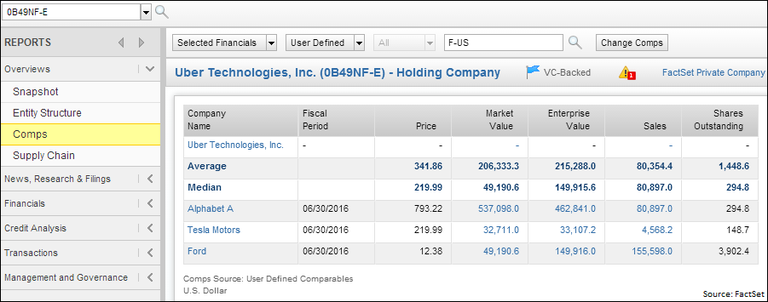

In addition to its deal with OTTO, Uber also launched its first self-driving fleet in August. The autonomous cars launched in Pittsburgh, making Uber the very first company to introduce a self-driving automobile to the commercial market. At the same time, Google, Tesla, and Ford have also boasted plans to offer their own autonomous models.

Related: US Elections, China Concern at Camp Kotok

In fact, Ford hopes to challenge Uber’s business plan directly with an autonomous ride-sharing service of its own. The intensifying competition is changing the landscape of the automotive and technology fields as other companies try to up the ante, and the race to innovate will certainly affect the value of all companies involved.

Suppliers Along for the Ride

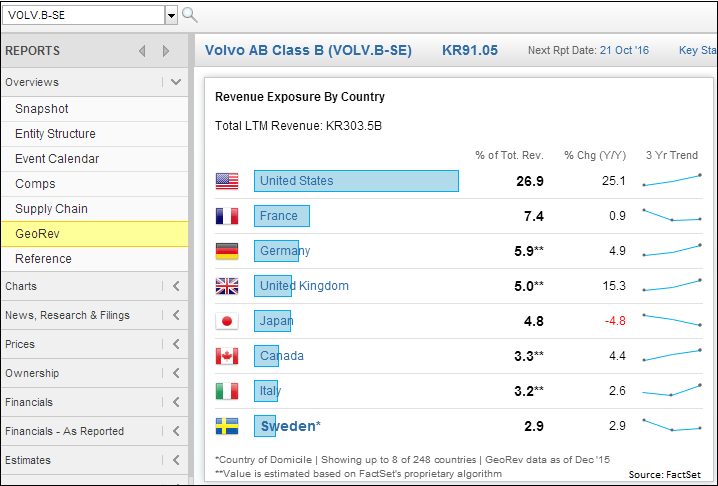

Right now, Uber's self-driving fleet in Pittsburgh consists of a handful of modified Volvo XC90 sport utility vehicles, with plans for up to 100 by the end of the year. But partnering with Volvo is only the beginning for Uber.

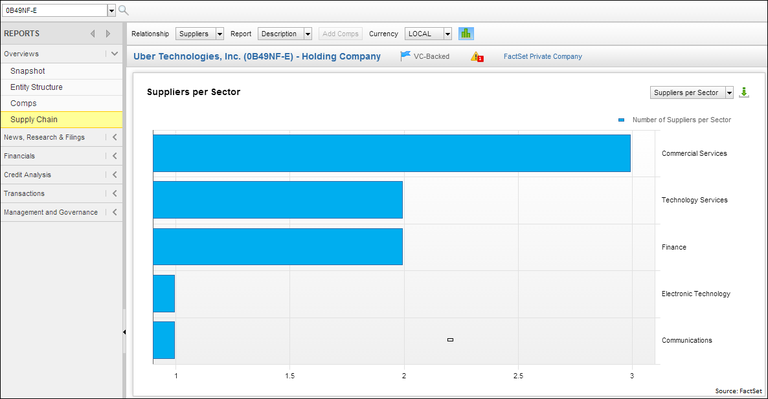

As we mentioned, the company reached an agreement this year to buy OTTO, a startup with roots developing technology that lets big-rig trucks steer themselves so drivers can rest. Though only a third of Uber’s reported suppliers are in a technology-related sector today, the company’s push into the autonomous transportation market could encourage other tech companies to partner for a piece of the profit.

How will Uber’s ongoing investment in this type of technology impact Volvo? The European car company hasn’t seen a jump in sales yet, but a partnership like this is unprecedented.

Since Uber has no plans to manufacture its own cars, it will be interesting to see which auto company will be next to strike a deal with Uber. Will the companies look to outsource costs, increasing their geographic revenue exposure? How will oil be impacted if the competitively low prices of the autonomous ride-share program make consumers want to drive less?

A lot of questions arise with the launch of this exciting innovation, and we can be sure that self-driving cars will not be Uber’s last advance in this field. Based on the company’s recent activity, we can expect more acquisition deals, more partners and customers in its supply chain, and bigger impacts to companies, like Volvo, that Uber is taking along for the ride.

What’s Around the Corner for Uber?

So how does the continued push into automation influence Uber and the transportation industry?

The amount of Uber drivers has grown significantly as the company has focused on attracting talent with advantages like schedule flexibility and opportunities for additional income. Although there will always be a need for human drivers to handle difficult roads and unique situations, the impact of driverless cars will extend far beyond the 600,000 Uber drivers in the United States and close to 1.5 million around the world.

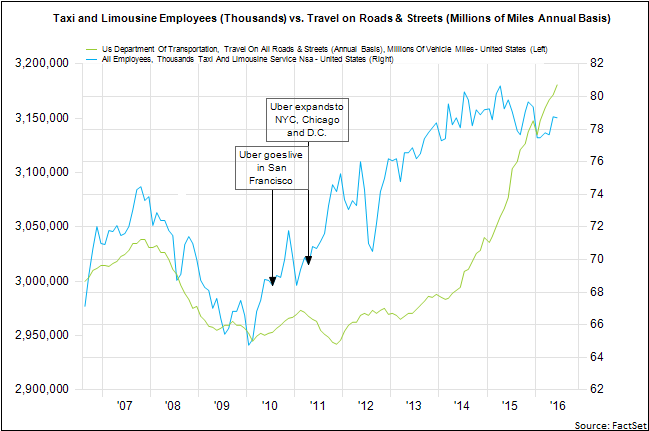

Uber has already proven to have a significant impact on the transportation market. In New York City competition from Uber is thought to have driven cab medallions to half their cost. Uber launches have also driven spikes in the number of employees in the Taxi and Limousine industry for the respective region.

In addition to the potential effects on labor markets and the cost of travel, if the driverless revolution decreases demand for vehicles, there could also be a reduction in demand for automobile related services (repair, dealerships, etc.).

Historically, technical innovations have prompted (sometimes disruptive) evolution of the job market. Where there were once farming jobs, the industrial revolution created a workforce of mechanics and engineers to services the machines of the agriculture industry. Likewise the development of the telephone resulted in jobs for switchboard operators.

While it’s easy to be concerned about the impact that vehicular automation may have on the labor market, driverless cars will also need to be programmed, serviced, and maintained.