Each year, David Kotok, well-known head of the Sarasota, Florida-based Cumberland Advisors, invites 50 or so well-known economists, investors, and journalists to join him for a little fishing in Grand Lake Stream, Maine. The point of the weekend isn’t so much the fish, however, as the conversation. Kotok has curated the list of attendees not to engender groupthink, but rather to represent a broad range of backgrounds and opinions on economics and markets, from every corner of the political and economic spectrum.

The weekend has been referred to as a “mini-Davos,” which is probably apt. Somehow, this year, I was lucky enough to be included.

Formal debates and informal discussions dominated the 90 or so hours I was there, spilling out onto the lakes on flotillas of six or eight folks, vigorously arguing over everything from China’s commodity demand to the nuclear triad.

There’s really only one strict rule at Camp Kotok: the Chatham House Rule. Originated in the 1920s in London, the Chatham House Rule simply states that while the information from the event is fair game, the identities and affiliations of the participants are confidential. Obviously, individuals can reveal their own attendance or explicitly state something as “on the record.” That this event includes reporters makes this rule a matter of sublime trust.

Here were my take-aways from the event.

While participants came from varying parts of the political spectrum, I heard little direct support for either candidate. Instead, what I came away with was a concern that from an economic perspective, both parties seem to be heading towards record deficit spending without much real sense of how to pay for it. There was a substantial sense of longing for a time when politicians engaged in intellectual debate and ultimately came to compromise solutions for the benefit of the country – a nostalgia I feel myself.

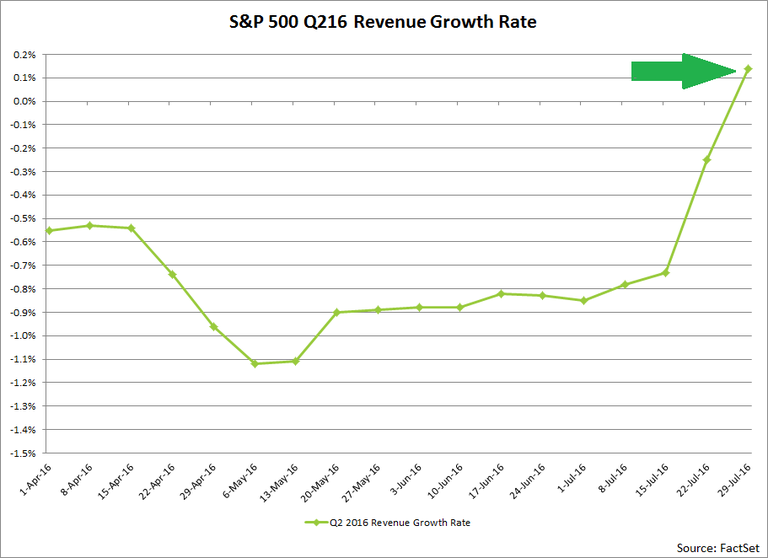

Related: S&P Now Reporting Revenue Growth for Q2

For investors, that all really translates into volatility, one way or another. I’ve been writing all year about how 2016 is a year of fear and uncertainty, and despite the VIX sitting at historic lows, I think that’s still the emotional state of the market. The S&P 500 closed July up over 3.7%, at all-time highs, and yet, I haven’t talked to a single investor who felt good about the state of the market going into the election.

I was surprised how many conversations turned back to China, given that the news from China has actually been quite tame over the past few months. The assembled group expressed overwhelming skepticism about the validity of the official Chinese economic numbers and that the current actual, real economic situation in China is concerning. The common themes included inflated credit quality (implying the need for large write-downs) and unproductive growth estimates (essentially “manufactured” growth through non-productive spending). A straw poll around the dinner table suggested real productive GDP growth in the 3-4% range, roughly half of the official numbers.

A second topic of conversation turned to the MSCI deliberations around the inclusion of China’s local “A-Share” market in major indexes. MSCI rejected including A-shares in their core emerging markets indexes back in June, citing the need to improve access. I’vewritten quite a bit about China A-Shares before, and was surprised at the diversity of opinions on the topic at Camp Kotok. If there was a consensus, it could best be summed up as “MSCI made the right call in delaying,” but there was concern that MSCI would be forced to bow to pressure from major fund managers before the A-Share market was truly ready.

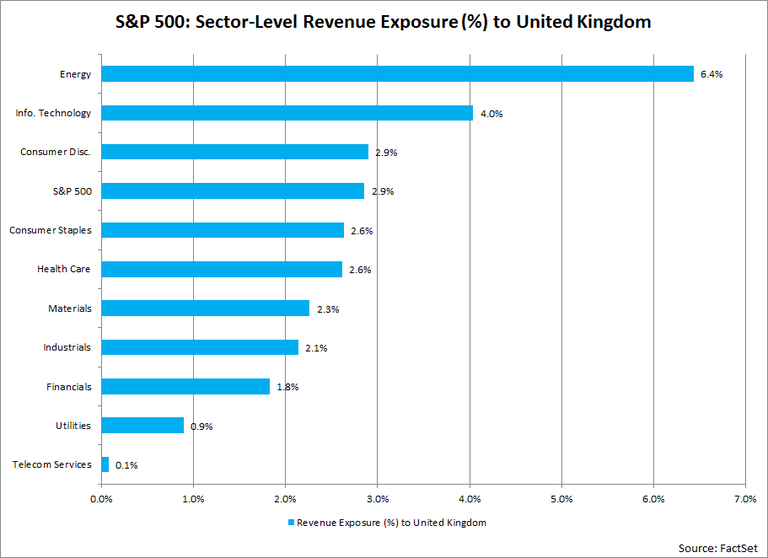

One of the only formal, on-the-record debates of the weekend was about the impact of Brexit on the US, British, and global economies. I was again surprised at the actual variance of opinion in the group; while many echoed what I believe is the global consensus that the Brexit will be bad for Great Britain and the EU, several folks mounted strong defenses of the decision. There was a general consensus, however, that the net impact for most US investors would be fairly small to non-existent.

By far the biggest concern in the group was the impact of Brexit on the future of the EU and the euro. Cascading de-globalization (a Scottish split from England, Grexit, and subsequent withdrawals) would have a significant destabilizing effect on the region and create a deep and extended drag on the growth there. Many participants pointed to the surprising strength of nationalist and populist political movements throughout the region as evidence that such a breakup may be in the cards. That these movements cross traditional political boundaries (right-leaning in Austria, Finland, Hungary, Latvia, left-leaning in Spain and Greece) was seen as an even stronger sign that change was far from over.

It’s perhaps no surprise that, given the host’s known prowess in the fixed income market, many of the economists and investors attending had strong backgrounds and opinions about the fixed income markets. While there was much debate, there was little consensus that I heard about the specifics of the yield curve, defaults, or long-term interest rate targets.

Related: The Hunt for Alpha in Fixed Income

There was, however, a concern about the fundamental structure of the fixed income market, in particular around ETFs. I participated in several long debates about the relative merits of indexing bonds in the first place, and then whether ETFs were the right vehicle.

As Chief Fixed Income Strategist for Janney Montgomery Scott, Guy LeBas put it in his own summary of the discussion, “Essentially, the inflows and outflows of high yield ETFs have become the elastic variable in the high yield markets, absorbing and giving off supply. Traditionally, that role had been reserved for dealers that traded in and supported the high yield markets.”

Related: July ETF Flows: Full Speed Ahead

This increased focus on the role of high-yield ETFs not just as buckets but as market participants was refreshing, honestly, as I’ve been arguing for quite some time that in times of crisis, the ETFs themselves become the price discovery vehicle for less liquid underlying markets.

Perhaps the most interesting discussions I participated in at Camp Kotok were around Bitcoin. While there wasn’t a strong proponent of Bitcoin arguing for its eventual dominance as a global currency, there was a surprising level of interest about the “bitcoin experiment” and in particular about the use of blockchain systems in broader financial markets, whether inter-bank transaction systems or equity markets. There was considerable discussion of what a digital currency even is in a true economic sense, with a broad consensus that it was far closer to a precious metal than a true currency: something given value by collective agreement, but unlikely to be used as a direct medium of exchange. Given how easily I see Bitcoin and blockchain written off in the financial press on most days, it was refreshing to hear the depth of consideration being given to the topic.

Reading over my own summary of this incredible, heady weekend of discussion and debate, the key thing that jumps out at me is the overwhelming lack of consensus on key topics. As mentioned at the beginning of this piece, that’s in part due to David Kotok’s brilliant design. But it’s also an interesting commentary on the state of the world when we have Donald Trump as the GOP nominee, Great Britain exiting the Euro, China decelerating (and fudging the numbers), and trillions of dollars in bonds yielding negative interest.

This isn’t 1970, 1980, 1990, or 2000; we decidedly haven’t seen this movie before. That makes predicting the direction of the economy and the markets more challenging, more interesting, and ultimately more important than at any time in the past.

AI Fear and Insurance Stocks Revisited

Stay ahead with FactSet’s weekly insights on the latest insurance industry updates, trends, events, and market developments.

Capturing Megatrends: A Data-Driven Approach to Thematic Investing

Explore how data-driven thematic investing captures megatrends like AI and demographic shifts. Learn how to identify quality...

U.S. ETF Monthly Summary: February 2026

Explore U.S. ETF trends with FactSet's monthly summary. Get flow stats by asset class and sector, ETF launches, and this month a...

U.S. Mergers & Acquisitions Monthly Review: January 2026

Explore FactSet's U.S. Mergers & Acquisitions Monthly Review. Gain deep insights into market trends and expert analysis to inform...

The information contained in this article is not investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.