In the past few years we have seen an explosion in the amount of information generated and transmitted through the internet, underlined by the often-cited statistic that 90% of all the world’s data has been created since 2011.

The instinctive reaction of the wealth management industry would be to assume the more data, the better. After all, holistic insight is the lifeblood of good investment decisions.

But the risks of a volume-driven approach also need exploring. Information overload is one worrying possibility for the wealth management industry, with clients struggling to find the time to process the quantity of content communicated to them. In a worst case scenario, the result is decision paralysis and possible misallocation of assets.

So what can wealth management firms do to avoid overloading high net worth investors (HNWI)? Here are three principles to follow to promote better information consumption.

1) Presentation is Everything

The wealth management industry is hardly renowned for its straight-talking style. Wealth managers need to ask themselves whether the way they are communicating important content drives or dissuades client understanding.

When asked to specify where the CEO of their wealth manager should focus innovation efforts, the number one priority—selected by 83% of HNWIs—was investment information.

Our recent research surveying over 1,000 wealthy investors demonstrates that HNWIs struggle to engage with investor insight as it is currently conveyed to them. When asked to specify where the CEO of their wealth manager should focus innovation efforts, the number one priority—selected by 83% of HNWIs—was investment information.

To respond effectively, wealth managers should adapt investor interfaces to be more interactive. Giving clients access to analytical tools to interact with portfolio data, for example, would facilitate better understanding of performance. Executive summaries of key insights could help land important messages with more impact. Firms will also need to re-double efforts to relay content using more client-friendly language and tone.

2) Better Insight, Rather Than More

An obvious pitfall while developing a refreshed communication strategy would be simply sharing more, rather than more useful, information with clients. Wealth managers need to focus on conveying the insights that HNWIs really need to know.

For example, at the portfolio composition stage, many want reassurance that their money is secure. Similarly, investors profess concerns about suitability of investment ideas, which requires more clarity on how recommendations are formulated and why they are right for their profiles.

Advisors must also learn to communicate on areas of the investment process that are currently less important to them—but fundamental to clients.

Advisors must also learn to communicate on areas of the investment process that are currently less important to them—but fundamental to clients. Socially responsible investing (SRI), for example, is now seen as an essential element of portfolio construction. According to our research, more than two thirds of HNW respondents say their SRI allocations will increase in the next five years.

3) Increase the Frequency of Updates, in Bite Sizes

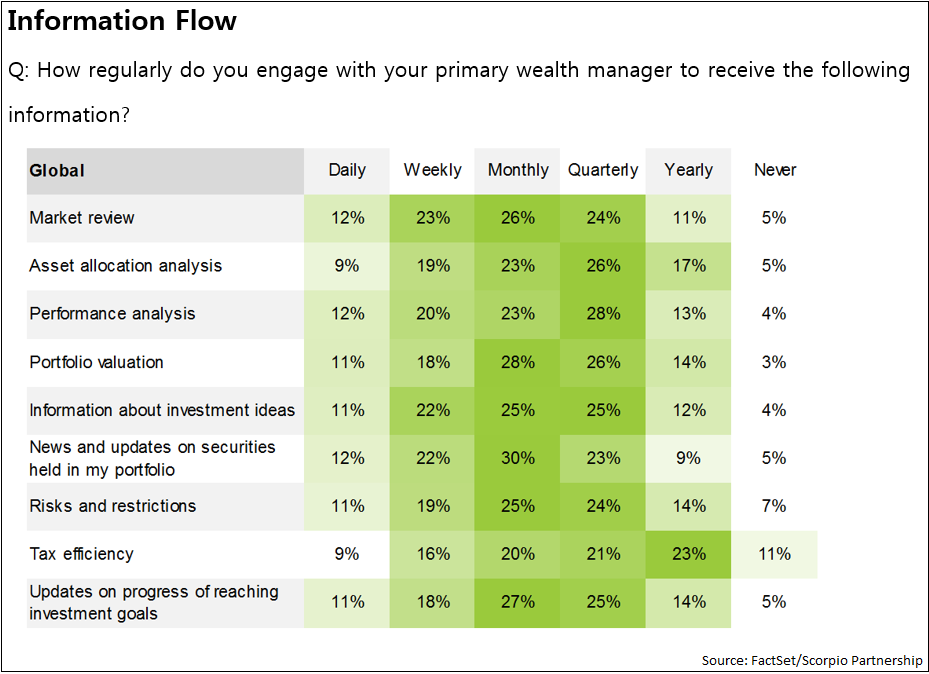

High net worth clients are keen to absorb information about investment performance. However, the current communication cycle between advisors and investors tends to be unstructured, resulting in a protracted flow of insight. Most data sources—from performance analysis to market reviews—are shared only on a monthly basis or less frequently.

This ad hoc approach poses risks. Wealth managers may end up sharing too much data simultaneously, resulting in information fatigue. Without support in prioritizing sources, investors could gloss over or miss essential updates entirely.

To promote better engagement, advisors need to adapt their strategies to give access to performance data at the time of clients’ choosing. This means capturing investors’ channel preferences in advance and communicating information as it is generated. Bite-size updates would promote better awareness of content, while push notifications and reminders could prompt investors to examine key insight more regularly, such as news on portfolio securities or progress with investment goals.

Given the wealth management industry’s voracious appetite for data, access to more holistic insights should yield good investment outcomes in the longer-run. But there are risks that HNWIs will step back from the process in response to being overloaded. To reap the client engagement benefits offered by the information revolution, advisors will need to shift mindsets from focusing on volume to prioritizing making core content more digestible and aligned with client expectations.