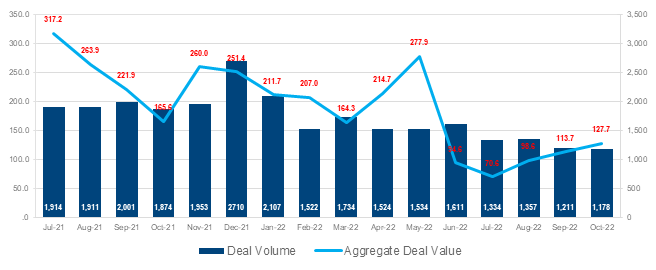

U.S. M&A deal activity decreased in October, going down 2.7% with 1,178 announcements compared to 1,211 in September. However, aggregate M&A spending increased. In October, 12.3% more was spent on deals compared to September.

In terms of M&A deal activity (volume) over the past three months, no sector saw an increase in deals relative to the same three-month period one year ago. Thus, all 21 sectors tracked by FactSet saw a decrease in M&A deal activity over the past three months, relative to the same three-month period one year ago. The five sectors that witnessed the largest declines in M&A deal volume (relative to the same three-month period one year ago) were: Finance (627 vs. 1281), Technology Services (751 vs. 1136), Commercial Services (512 vs. 676), Producer Manufacturing (175 vs. 298) and Retail Trade (113 vs. 221).

Topping the list of the largest deals announced in October are: The Kroger Co. entering an agreement to acquire Albertsons Cos., Inc. for $18.2 billion; Blackstone. Inc.'s agreement to acquire a 55% majority stake in the business and assets related to the Climate Technologies segment of Emerson Electric Co. for $11.75 billion; A private group led by Cameco Corp and Brookfield Renewable Partners agreeing to acquire Westinghouse Electric Co. LLC from Brookfield Business Partners LP for $7.9 billion; RWE Renewables Americas LLC, a subsidiary of RWE AG, signing a purchase agreement to acquire Con Edison Clean Energy Businesses, Inc. from Consolidated Edison, Inc. for an enterprise value of $6.8 billion; Regal Rexnord Corp.'s deal to acquire Altra Industrial Motion Corp. for $4 billion.

The US Mergers & Acquisitions Market Index

Deal Activity by Sector

Insight/2022/11.2022/11.21.2022_Flashwire/target-sector.png?width=935&height=504&name=target-sector.png)

Top U.S Deals Scorecard YTD

Insight/2022/11.2022/11.21.2022_Flashwire/top-us-deals-scorecard-2.png?width=790&height=1023&name=top-us-deals-scorecard-2.png)

This blog post is for informational purposes only. The information contained in this blog post is not legal, tax, or investment advice. FactSet does not endorse or recommend any investments and assumes no liability for any consequence relating directly or indirectly to any action or inaction taken based on the information contained in this article.