According to the The Forum for Sustainable and Responsible Investment, over 16% of money managed in the United States is done so in a socially responsible way. Further, from 2012 to 2014, there has been a 76% growth rate in the number of assets managed by socially responsible investing and a 36% increase in the number of Economic, Social, and Governance (ESG) mutual funds.

With the increased flow of funds into socially responsible investing, investors need better ways to understand and interpret their ESG exposures. In this article, we’ll review a method by which you can interpret ESG exposures within an attribution framework.

Related: Wealth Managers Take On the "Connected Generation"

Do ESG Strategies Outperform Broad Indices?

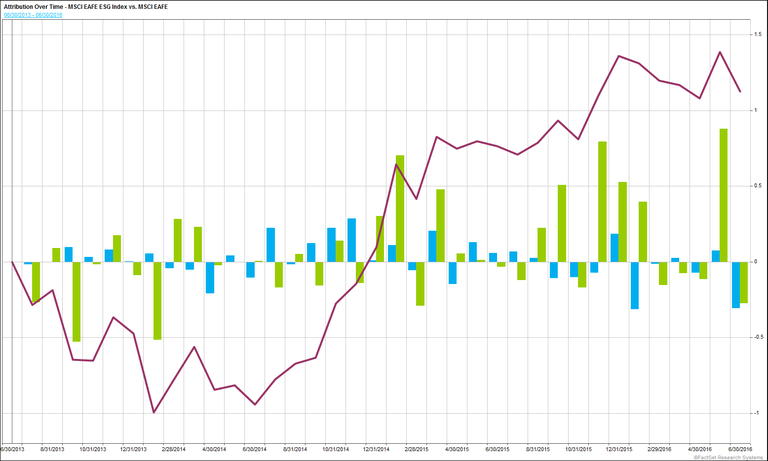

A performance attribution report can help to answer the question with a traditional allocation vs. selection breakdown. When we analyze the MSCI EAFE ESG Index against the MSCI EAFE for the past three years (ending 6/30/2016), we see that the ESG index outperformed by over 100 basis points.

Diving deeper, we can see that this effect was driven predominantly by security selection effect. One might think that the avoidance of certain sectors would be the chief source of outperformance, but in reality, the companies with higher ESG scores simply performed better than their broad counterparts.

Security selection added 91bps, while allocation only added 18bps during the three-year period analyzed.

Many investors are favoring ESG strategies for a variety of reasons, long-term performance being one of them. Assuming that your goal is to invest in ESG companies, you might ask:

Where Am I Taking the Biggest Benchmark-Relative ESG Bets?

MSCI rates issuers on three pillars: Environment, Social and Governance. The values range from 0-10 with higher scores ranking higher in the peer group.

We propose that these ESG scores can be decomposed in the same attribution framework for which we evaluate performance. This would allow us to split out our active ESG bets into ESG Allocation and ESG Selection effects.

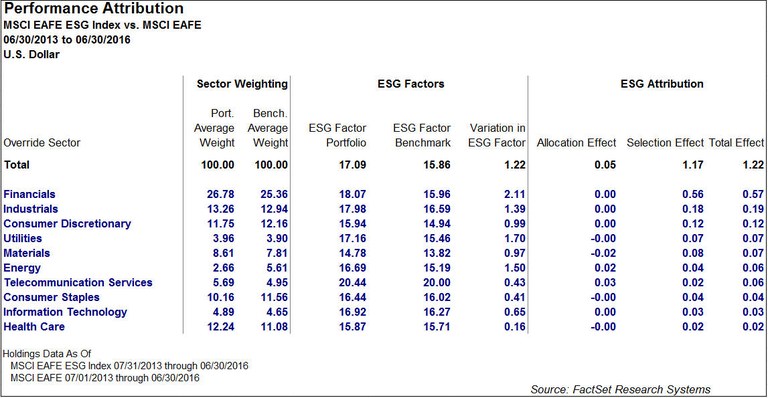

Continuing with our above example of the MSCI EAFE ESG vs. the MSCI EAFE, we can see that the ESG index had a score that was 122 basis points higher than the index. This is not surprising given the index objective.

In an ESG attribution framework, we then see that ESG security selection positively impacted our score across all 10 sectors. Looking at Energy in particular, the ESG Index underweighted Energy. This is a positive ESG allocation decision, as Energy has one of the lower ESG benchmark scores overall. The overall impact of ESG allocation is insignificant, only contributing five basis points to the ESG variance. As seen earlier, differences are almost entirely due to stock selection within this sector.

Related: Active Management and Understanding Analyst Forecasts

We propose that this analysis will be even more insightful when applied to investor portfolios that are taking many complicated, and often contradictory, bets. Without an understanding of the sources of active ESG bets that may exist in a portfolio, a portfolio manager may not be able to develop a repeatable strategy that adds value over time. Even for an investor that is not focused explicitly on ESG exposures, a framework such as this could be a valuable tool in understanding exposure to a factor that is clearly gaining popularity within the market.