Frequently associated with the rise of smartphones, social media, and “selfies,” the millennial generation’s reliance on technology and access to information has changed the way the world works, and the wealth management industry is not immune to their influence.

In a recent survey of over 1,000 high net worth individuals, FactSet and Scorpio Partnership took a look at the wealth management preferences of HNWIs by generation. The findings identify those under the age of 35 (millennials) as an information-hungry group that wants more accountability, communication, social responsibility, and innovation from their wealth managers.

What Millennials Want from a Wealth Manager

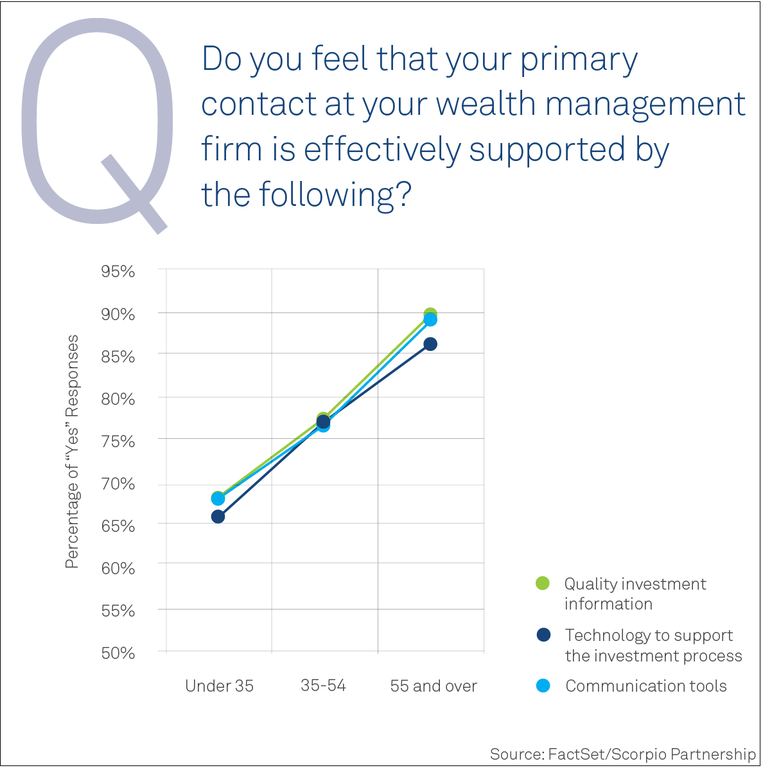

According to our survey, 90% of HNW baby boomers (those ages 55-74) believe wealth managers are effectively supported by quality investment information, communications tools, and investment technologies. However, that belief dropped by more than 20% for respondents under the age of 35.

While the majority of millennials still felt their wealth management contacts were well supported, the drop-off between generations indicates a misalignment in expectations and shows that firms can better serve this younger set of HNWIs. Focusing on improving information delivery and the frequency of communications are two ways advisors can meet the needs of this generation.

Our survey showed that across the board, HNWIs are beginning to favor digital communications over traditional methods and want more frequent interactions from wealth management firms. But millennials, in particular, voiced a need for a much more aggressive information delivery cycle, especially when it came to their portfolio’s risk exposure. Thirty percent of respondents under 35 said they want updates on risk profiles weekly, with 16% preferring daily updates.

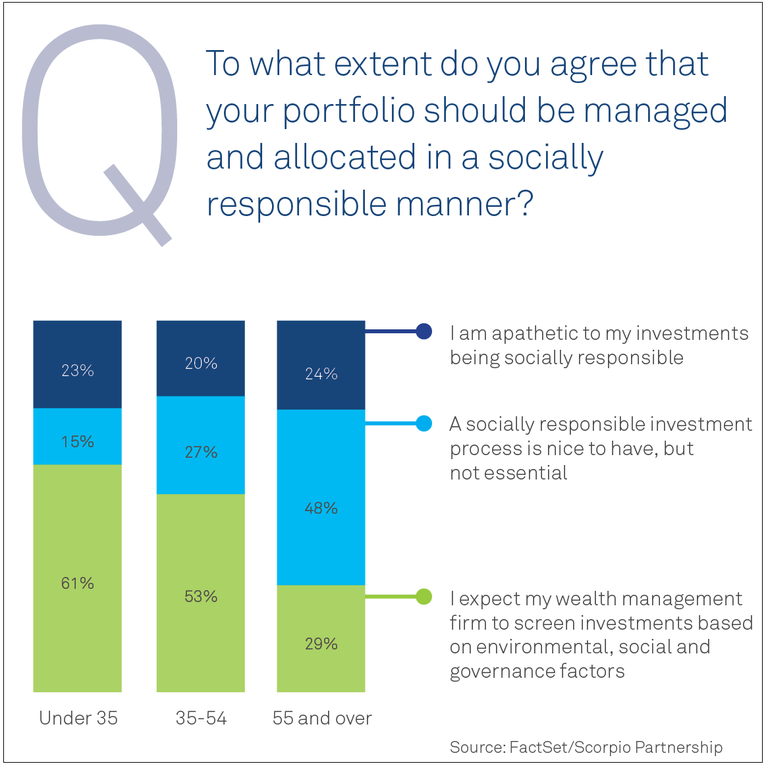

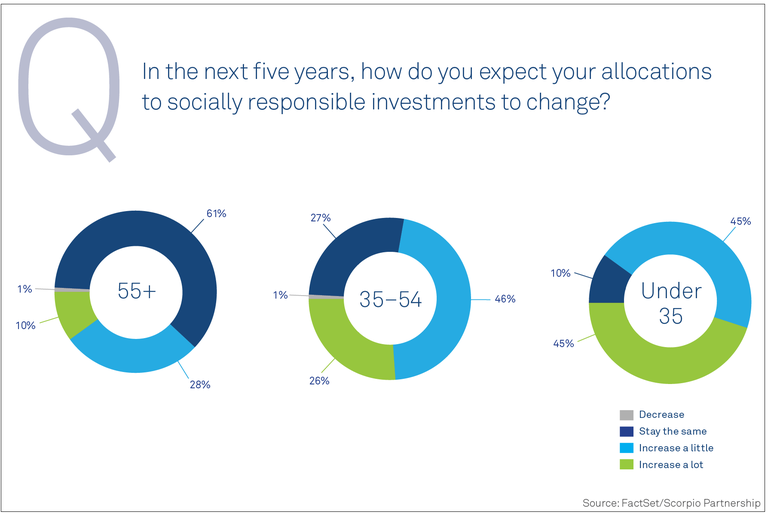

Socially responsible investing (SRI) also revealed itself as a hot button issue for millennial HNWIs. Sixty-one percent of respondents under 35 said they wanted evidence that their wealth managers are screening investments based on environmental, social, and governance (ESG) factors. A whopping 90% of millennials said they want to grow their allocations to responsible investments in the next five years, with half planning substantial portfolio redistributions to support it.

Inclinations for SRI were also high in the 35-54 age group. Fifty-three percent of Generation X respondents said they wanted wealth managers to screen for ESG issues, suggesting that millennials are a bellwether for changing preferences on the issue.

Our full research dives further into the preferences of the millennial HNW, but these two trends are representative of the millennial generation’s predilection to constant connectivity and global mindedness.

Why Millennials Matter

As a growing segment of the HNW community containing some of the wealthiest individuals in the world, millennials are a crucial segment of the wealth management client base. The group’s unique ideals and expectations represent an opportunity for wealth managers to bring their industry into the digital age and broaden their appeal in the process.

As illustrated in the SRI statistics above, our findings suggest a correlation between millennial preferences and those of HNWIs in the 35-54 age range. Wealth management firms that appeal to HNW millennials can potentially win the business of Generation X HNWIs as well.

Related: Four Emerging HNWI Expectations Wealth Managers Must Meet

Millennials Reward Strong Brands with Loyalty

An even more compelling reason to align wealth management practices with millennial preferences is the high level of brand loyalty displayed by the group. More than half of millennials say they are extremely loyal or quite loyal to their favorite brands, and our survey demonstrated that a third of HNWIs under the age of 35 considered “strong brand” a critical quality in the selection of a wealth manager, more than any other characteristic.

Overall, FactSet and Scorpio Partnership’s research shows that the wealth management industry requires an urgent reconfiguration of client engagement strategies, technology solutions, and cultural beliefs to more effectively support the changing preferences of HNWIs. As it relates to millennials, updates that favor connectivity, transparency, and social responsibility provide wealth managers with an opportunity to win loyal customers with considerable influence on their community.